Are you tired of the 9-to-5 grind? Do you feel like you’re stuck in a loop, working for the weekend and counting down the days until a traditional retirement that feels a lifetime away? If so, you’re not alone. A growing number of people are rejecting this timeline and embracing a new philosophy: the FIRE Movement (Financial Independence, Retire Early).

This isn’t a get-rich-quick scheme or a lottery dream. It’s a concrete, actionable plan built on simple math and disciplined habits. The financial independence retire early meaning is all about one thing: options. It’s about reclaiming your time—your most valuable asset—to live life on your own terms, not someone else’s.

But what is the FIRE movement, really? How do you go from a regular paycheck to a lifetime of freedom?

This ultimate guide will provide you with actionable FIRE movement strategies. We will explore everything from the core concepts to the detailed investment plans, the different “flavors” of FIRE, and the common pitfalls to avoid. This is your comprehensive blueprint for achieving FIRE in your 30s, 40s, or 50s. Let’s get started.

(Disclaimer: This guide provides comprehensive information on FIRE strategies for educational purposes. I am not a financial advisor, and this content should not be considered financial advice. Please consult with a certified financial planner (CFP) to discuss your personal financial situation and early retirement goals.)

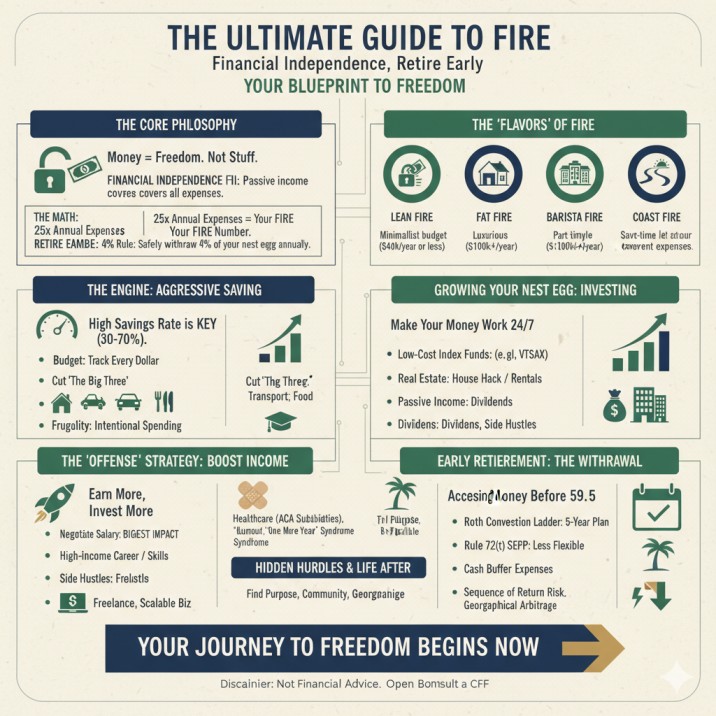

The Core Philosophy – What is the FIRE Movement Explained?

At its heart, the FIRE movement is a lifestyle choice. It’s a complete shift in your relationship with money. Instead of seeing money as just a way to buy things, you see it as a tool to buy your freedom.

Breaking Down “Financial Independence” vs. “Retire Early”

These two parts of the acronym are related, but not identical.

- Financial Independence (FI): This is the core goal. The financial independence definition is simple: you reach a point where your assets (like investments, real estate, etc.) generate enough passive income to cover all your living expenses. You no longer need to work for money. If your annual expenses are $40,000, you are financially independent when your investments provide $40,000 a year.

- Retire Early (RE): This is what you do with your financial independence. For many, this means leaving the traditional workforce decades ahead of schedule. But “retire” doesn’t have to mean sitting on a beach (unless you want to!). It can mean starting a passion project, working part-time on something you love (barista FIRE lifestyle), volunteering, or traveling the world. The key is that working becomes optional.

The Simple Math Behind FIRE: The 25x Rule and the 4% Rule

This is where the dream becomes a concrete number. The FIRE community uses a simple guideline to figure out how much money is needed to become financially independent.

- The 25x Rule: This is how you find your “FIRE number.” You take your annual living expenses and multiply them by 25.

- Formula: Your FIRE Number = Annual Expenses x 25

- Example: If you spend $50,000 a year, your FIRE number is $50,000 x 25 = $1,250,000. This is your FIRE savings goal.

- The 4% Rule: This is the other side of the same coin, and it answers the question, “How much can I spend in retirement?” The 4 percent rule for early retirement, based on a famous study from Trinity University, suggests that you can safely withdraw 4% of your invested nest egg in your first year of retirement (and adjust that amount for inflation each following year) with a very high probability of your money lasting for at least 30 years.

Understanding the 25x rule for retirement is a game-changer. It turns a vague goal (“I want to retire early”) into a specific target ($1,250,000).

Why the FIRE Movement is Gaining Popularity

The FIRE movement isn’t just for high-income earners. It’s for anyone who values time more than status symbols. The dissatisfaction with traditional careers, corporate burnout, and a deep desire for time freedom are fueling this movement. People are realizing they don’t want to trade the best 40 years of their lives for a brief retirement in their late 60s.

What’s Your Flavor? The Different Types of FIRE

FIRE is not a one-size-fits-all plan. Your journey depends on your desired lifestyle, your income, and your tolerance for frugality. Here are the most common paths.

Lean FIRE: The Path of Extreme Frugality

Lean FIRE is for the minimalists. This path involves living on a very small budget, often $40,000 a year or less.

- Goal: Reach FI with the smallest possible nest egg. If you can learn how to live on $25,000 a year, your FIRE number is only $625,000 ($25,000 x 25).

- Who is it for? People who genuinely enjoy a simple, minimalist lifestyle and find joy in experiences rather than possessions. The lean FIRE lifestyle explained is one of low consumption and high personal freedom.

- Strategy: Requires extreme frugality without deprivation, focusing on mastering needs vs. wants.

Fat FIRE: Retiring with a Luxurious Lifestyle

On the opposite end of the spectrum is Fat FIRE. This is for those who want to retire early without sacrificing material comforts.

- Goal: Maintain a high-spending lifestyle in retirement (e.g., $100,000+ per year). This means a FIRE number of $2.5 million or much more.

- Who is it for? Typically FIRE movement for high-income earners (like doctors, lawyers, or tech executives) who can save massive amounts of money quickly.

- Strategy: Focuses heavily on maximizing income and aggressive investing, as frugal living alone won’t be enough. Fat FIRE lifestyle examples include frequent international travel, expensive hobbies, and nice homes.

Barista FIRE: The Best of Both Worlds?

Barista FIRE is a popular middle ground. It’s for people who want to leave their high-stress 9-to-5 but don’t mind working part-time in a low-stress job they enjoy.

- Goal: Save enough to cover most of your expenses, but not all. You then work part-time (like at a coffee shop, hence the name) to cover the gap or, more commonly, to get early retirement healthcare insurance solutions.

- Who is it for? Anyone who enjoys social interaction from work but hates the corporate grind. The barista FIRE lifestyle benefits include easing into retirement and solving the healthcare puzzle.

Coast FIRE: Letting Compound Interest Do the Work

Coast FIRE is perhaps the most relaxed approach. You reach Coast FIRE when you have saved enough in your retirement accounts that, without saving another penny, your nest egg will grow (thanks to compound interest) to your full FIRE number by your traditional retirement age.

- Goal: Save aggressively early on. Once you hit your Coast FIRE number, you’re “coasting.” You only need to work to cover your current living expenses, not to save for retirement.

- Who is it for? Young people who want to take their foot off the gas. How to reach Coast FIRE in your 30s is a common goal, allowing you to switch to a passion-driven, lower-paying career without worrying about your retirement.

The Engine of FIRE – Aggressive Saving Strategies

You cannot reach FIRE by saving 10% of your income. The movement is built on one core principle: aggressive saving.

Why Your Savings Rate is the Most Important Metric

Forget “what’s the best stock?” The single most important factor in your FIRE journey is your savings rate—the percentage of your after-tax income that you save and invest.

This metric combines both offense (earning) and defense (spending). The importance of a high savings rate is that it simultaneously does two things:

- It builds your investment portfolio faster.

- It trains you to live on less, which lowers your FIRE number.

Someone saving 10% of their income will take about 51 years to reach FI. Someone with a 50% savings rate can achieve FIRE in about 17 years. This is the simple math to retire early.

How to Create a FIRE Budget That Actually Works

You can’t manage what you don’t measure. A budget is your roadmap.

- Track Everything: For 1-3 months, use a tool or a spreadsheet for tracking expenses to find savings. You must know where every single dollar is going.

- Identify the “Big Three”: The fastest way to increase your savings rate is to cut your biggest expenses: cutting the big three: housing, transport, and food.

- Housing: Can you “house hack” (rent out rooms), move to a lower-cost-of-living area, or avoid buying “too much house”?

- Transportation: Can you drive a used car, use public transit, or bike to work? The car payment is a FIRE killer.

- Food: This is a major leak. Stop eating out, learn to cook, and plan your meals.

- Adopt a System: Many in the FIRE community use zero-based budgeting for FIRE, where every dollar is given a “job” (spending, saving, investing) at the beginning of the month.

Practical Frugal Living Tips for FIRE Achievers

This isn’t about being cheap; it’s about being intentional. Frugality is the muscle you build to reach FI.

- Mind the Gaps (The “Latte Factor”): Small, recurring purchases do add up.

- Use the Library: Free books, movies, and even passes to local attractions.

- Learn DIY Skills: Basic car maintenance, home repairs, and cooking will save you thousands.

- Embrace “Secondhand First”: For clothes, furniture, and even cars.

- Optimize Your Bills: Call your insurance, cell phone, and internet providers annually to ask for a better rate.

The goal is to find frugality without deprivation. Spend lavishly on the things you love, and cut ruthlessly on the things you don’t.

Growing Your Nest Egg – Smart Investing for FIRE

You cannot save your way to financial independence. You must invest. Your money needs to be working for you, 24/7, through the power of compound interest. These are the investing strategies for financial independence that the FIRE community relies on.

The FIRE Community’s Favorite Tool: Low-Cost Index Funds

The overwhelming majority of FIRE followers are not day traders. They are passive, long-term investors.

- What are they? A low-cost index fund is a mutual fund or ETF (Exchange Traded Fund) that holds all the stocks in a particular index (like the S\&P 500).

- Why are they so popular?

- Diversification: You instantly own a tiny piece of hundreds or thousands of companies.

- Low Fees: This is critical. Funds like VTSAX and a three-fund portfolio (a simple mix of US stocks, international stocks, and bonds) have “expense ratios” that are incredibly low. High fees will destroy your returns.

- Proven Performance: The long-term buy and hold strategy in broad market index funds has historically been one of the most reliable ways to build wealth.

For most people, building a simple investment portfolio for FIRE with 2-3 low-cost index funds is the only strategy they will ever need.

Real Estate Investing for Financial Independence

Another popular path is real estate investing for financial independence. This can be more hands-on, but it has unique benefits.

- House Hacking: This is a fantastic FIRE strategy for beginners. You buy a small multi-family property (like a duplex or triplex), live in one unit, and rent out the others. The rent from your tenants can cover your entire mortgage, allowing you to live for free. This is the ultimate way of house hacking to eliminate housing costs.

- Rental Properties: The classic approach. You buy properties and use rental properties for passive income. This provides steady cash flow and property appreciation over time. It’s a key part of many Fat FIRE strategies.

Building Passive Income Streams for FIRE

Financial independence is all about passive income. The goal is to have your passive income exceed your expenses.

- Dividend Stocks: Some investors prefer building a portfolio of dividend stocks for early retirement. These are shares in established companies that pay out a portion of their profits (dividends) to shareholders.

- Side Hustles: While not “passive” at first, side hustles to reach financial independence faster are crucial. You can use this extra income to pay off debt or buy more assets. The goal is to find scalable side businesses that can eventually run without your direct involvement.

Increasing Your Income – The “Offense” Strategy

There is a limit to how much you can cut, but there is no limit to how much you can earn. Playing “offense” (earning more) is just as important as playing “defense” (spending less).

Optimizing Your 9-to-5 for Maximum Income

Your primary job is your most powerful wealth-building tool.

- Negotiate Your Salary: This is the most underrated FIRE skill. Negotiating salary for FIRE can mean a 10% raise, which is 10% more you can invest, year after year. A single negotiation can be worth hundreds of thousands of dollars over your career.

- Choose a High-Income Career Path: If you are young, consider fields known for high earning potential. This is a common path for those aiming for Fat FIRE.

- Focus on Skills: Invest in yourself. Get certifications, learn to code, or master public speaking. Skills that make you more valuable are a direct investment in your FIRE journey.

The Best Side Hustles to Accelerate Your FIRE Journey

Extra income, dedicated 100% to investments, can shave years off your FIRE timeline.

- Turn a Skill into Income: Are you a great writer, designer, or coder? Freelancing is one of the best side hustles for FIRE.

- Scalable Businesses: Think about creating something you can sell multiple times—an e-book, an online course, or a software tool.

- Low-Effort Gigs: Even simple things like food delivery or pet sitting can add a few hundred dollars a month directly to your investment account.

The “Retire Early” Part – Execution and Withdrawal

You’ve saved your money. You’ve hit your number. Now what? This is where you need advanced strategies for safely accessing and living off your nest egg, especially if you’re retiring decades before 59.5.

Managing the Dreaded Sequence of Return Risk

This is one of the biggest risks of the FIRE movement. Sequence of return risk explained is simple: a major market crash (like 2008 or 2020) in the first few years of your retirement can permanently cripple your portfolio, even if the long-term returns are good.

Why? Because you are withdrawing money from a portfolio that has just lost significant value, locking in those losses.

- How to Fight It:

- Flexible Withdrawal Strategies: The 4% rule is a guideline, not a law. In a down market, you might need to withdraw only 3% or 3.5%.

- Cash Buffer: Many early retirees keep a cash buffer for early retirement (1-3 years of living expenses in cash or short-term bonds) so they don’t have to sell stocks when the market is down.

The 5-Year Retirement Puzzle: Accessing Your Money Before 59.5

This is the most common technical question people have. “My money is in a 401(k) and an IRA. How do I get it without paying a 10% penalty?”

You have two primary tools:

- The Roth Conversion Ladder: This is the most popular method. The Roth conversion ladder explained is a 5-year plan.

- Year 1: You “convert” a year’s worth of expenses from your Traditional IRA/401(k) to a Roth IRA. You pay income tax on this conversion now.

- Year 2: You do it again.

- …

- Year 6: The money you converted in Year 1 has now “aged” for 5 years. You can withdraw that specific amount (the principal) tax-free and penalty-free.

- You continue this “ladder” every year, giving you a pipeline of tax-free money.

- Rule 72(t) – SEPP: The Rule 72(t) for penalty-free withdrawals (Substantially Equal Periodic Payments) is an IRS rule that lets you take distributions from your retirement accounts early. The catch? You must take a specific, calculated amount every year for at least 5 years or until you turn 59.5, whichever is longer. It’s much less flexible, and you should only use it with direct guidance from the IRS and a financial professional.

The Hidden Hurdles – Challenges and Risks of FIRE

The question “is FIRE movement realistic” is a valid one. It’s not all spreadsheets and passive income. There are serious challenges to consider.

The Biggest Problem: Healthcare for Early Retirees

In the U.S., this is the number one obstacle. When you leave your job, you lose your employer-subsidized health insurance.

- ACA Marketplace: Your primary option will likely be the ACA marketplace for FIRE. Because your taxable income in retirement will be low (from strategic Roth conversions), you will likely qualify for significant subsidies, making plans affordable.

- Health Share Ministries: A less common option, these are not insurance but groups that share medical bills. Use caution and do extensive research.

- Fat FIRE / Barista FIRE: Fat FIRE advocates simply budget $20,000+ a year for insurance. Barista FIRE advocates get a part-time job specifically for the health benefits.

The Psychological Toll: Burnout and “One More Year” Syndrome

Burnout from chasing FIRE is real. Living on an extreme 70% savings rate can be isolating and exhausting. You have to find a balance.

An even more common issue is “one more year” syndrome. You hit your FIRE number, but you’re afraid to pull the trigger. “What if I didn’t save enough? I’ll just work one more year…” This fear can trap people in the jobs they hate for years after they’ve already won the game.

FIRE Movement Mistakes to Avoid at All Costs

- Forgetting about Inflation: Your $1 million nest egg will be worth much less in 20 years. Your plan must account for inflation (the 4% rule does).

- Lifestyle Inflation: This is the silent killer. As your income grows, your spending grows with it. You must break this cycle and direct all new income to investments.

- Not Having a Post-FIRE Plan: Retiring from a bad job is not enough. You need something to retire to. This is crucial for finding purpose after FIRE.

- Telling Your Boss/Coworkers: A FIRE movement mistake to avoid is telling people at work. It can lead to resentment, being passed over for promotions, or being first on the layoff list.

- How to Convince Your Partner About FIRE: Trying to do this alone when your partner isn’t on board is a recipe for disaster. This must be a team effort, focusing on shared goals and values, not just deprivation.

Life After FIRE – Finding Purpose and Happiness

You did it. You’re free. What now? The transition can be harder than people think.

Building a Fulfilling Post-Retirement Life

Many early retirees report a “dip” in happiness after the initial celebration wears off. Your job gave you a social circle, a status, and a structure. Now, you have to build that yourself.

Your plan for what to do after retiring early is just as important as your financial plan.

- Finding Purpose After FIRE: What gets you out of bed? For many, it’s volunteering and travel in early retirement. For others, it’s mastering a new skill, spending time with family, or starting a passion business that doesn’t need to make a profit.

- Building Community: You must actively build a social network outside of work.

Geographical Arbitrage: Retiring Better for Less

One advanced strategy for FIRE is geographical arbitrage.

- What is it? Earning money in a high-cost-of-living area (like New York or San Francisco) and then moving to a low-cost-of-living area to retire.

- Examples:

- Moving from California to the Midwest.

- Moving to one of the best countries for early retirement, like Portugal, Mexico, or Malaysia, where your $40,000-a-year withdrawal gives you a high-end lifestyle.

This strategy can dramatically shorten your timeline or upgrade your retirement lifestyle for the same amount of money.

Frequently Asked Questions (FAQ) about FIRE Strategies

1. What is a “good” savings rate for FIRE?

While any savings rate is good, most in the FIRE community aim for 30% at a minimum. A 50% savings rate is often the standard goal, as it allows you to retire in under 20 years. Aggressive savers aim for 70% or more.

2. Is the 4% rule safe for a 50-year retirement?

The 4 percent rule for early retirement was originally tested on 30-year retirement periods. For a 50+ year retirement, many experts suggest a more conservative safe withdrawal rate (SWR), such as 3.5% or even 3.25%, to be extra safe against sequence of return risk.

3. Can you achieve FIRE on a low income?

Yes, but it is much harder and requires a commitment to Lean FIRE. You must master frugality and focus on cutting the big three expenses (housing, transport, food). House hacking to eliminate housing costs becomes one of the most powerful strategies.

4. What are the best index funds for FIRE?

The most common recommendations are broad-market, low-cost funds. A three-fund portfolio is very popular:

- A US Total Stock Market Index Fund (like VTSAX).

- An International Total Stock Market Index Fund (like VTIAX).

- A Total Bond Market Index Fund (as you get closer to retirement).

5. How does debt fit into the FIRE movement?

Most FIRE followers aim to be completely debt-free, especially high-interest debt like credit cards. The one exception is often a low-interest mortgage, which some consider “good debt” as the property appreciates.

6. What is the FIRE movement for families?

It’s absolutely possible, but kids add expenses. The FIRE movement for families involves strategic saving for college (like 529 plans), teaching kids about money early, and often leaning towards Coast FIRE or Barista FIRE for more flexibility.

7. How do I calculate my FIRE number?

Track your actual annual spending for a year. Do not guess. Once you have that number, multiply it by 25. That is your baseline FIRE number. If you plan to spend more in retirement (e.g., travel), adjust your annual spending number up before multiplying.

8. What are the main risks of the FIRE movement?

The biggest risks are: 1) A market crash early in retirement (sequence of return risk), 2) Unexpectedly high inflation, 3) A major health event (this is the big one in the US), and 4) Psychological burnout or lack of purpose post-FIRE.

9. Do I need a financial advisor for FIRE?

While the FIRE philosophy is simple, the execution (like tax optimization and withdrawal strategies) is complex. It’s highly recommended to consult with a fee-only financial planner who understands FIRE principles, at least once or twice, to validate your plan.

10. What is the FIRE movement in the UK?

The FIRE movement UK is very similar, but the tools are different. Instead of 401(k)s and IRAs, practitioners use ISAs (Individual Savings Accounts) and SIPPs (Self-Invested Personal Pensions) to grow their money tax-efficiently.

11. How do I access my 401(k) to retire early?

You never want to just “cash it out” and pay the 10% penalty. You use a Roth conversion ladder (planned over 5+ years) or Rule 72(t) (SEPP), as explained in Part 6 of this guide.

12. What’s the easiest way to start the FIRE movement today?

Step 1: Calculate your savings rate. Step 2: Track your spending for 30 days. Step 3: Open a low-cost brokerage account (like Vanguard, Fidelity, or Schwab) and set up an automatic monthly investment into a total market index fund. Start, even if it’s just $100.

Your Journey Starts Now

The Financial Independence, Retire Early movement is not a magic solution. It is a powerful, intentional, and disciplined path to a life of freedom. It’s about designing a life you don’t need to vacation from.

It will require you to challenge consumer culture, learn new skills, and be deliberate with your money in a way you never have before. But the reward is the ultimate prize: your time.

You don’t have to wait until you’re 65 to live your life. You can start building your freedom today. Your first step? Find out where your money is going. Calculate your savings rate. And take one small, actionable FIRE movement step toward the life you truly want to live.