Feeling overwhelmed by your finances? You’re not alone. Millions of people feel trapped in a cycle of debt, living paycheck to paycheck, and wondering if they’ll ever get ahead. The good news is that financial freedom isn’t a secret reserved for the wealthy. It’s a goal you can achieve with the right knowledge and a clear plan.

This is not your basic “skip the latte” advice. This is an advanced-level guide designed to give you the concrete personal finance tips for debt management and savings that actually move the needle. We will dive deep into three critical pillars of financial health:

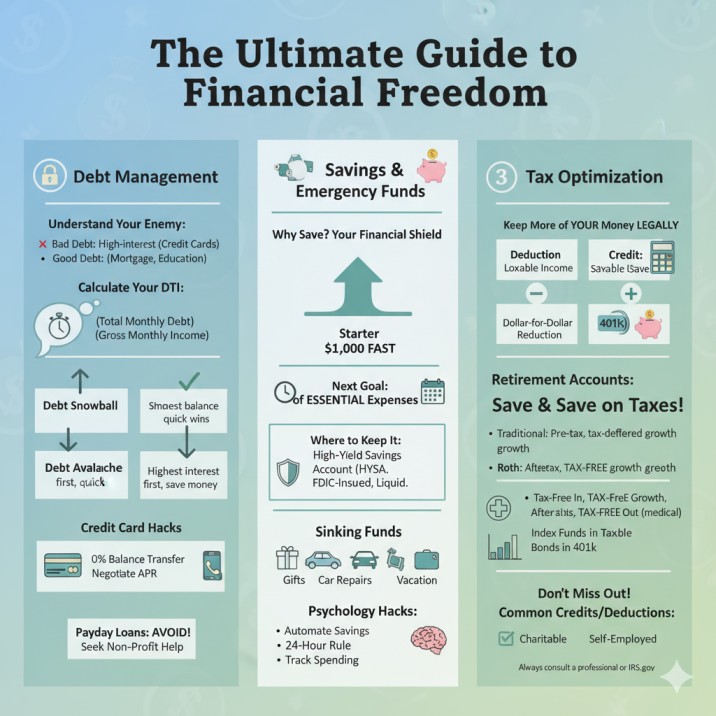

- Debt Management: We’ll explore powerful strategies for paying off loans, from credit cards to student debt, so you can finally break free.

- Savings & Emergency Funds: You’ll learn how to build an emergency fund quickly and develop the psychological habits to make saving second nature.

- Tax Optimization: We’ll uncover tax optimization strategies for individuals that legally let you keep more of your hard-earned money.

By the time you finish this guide, you will have a clear blueprint to tackle your debt, build your savings, and grow your wealth. Let’s begin the journey to achieve financial independence.

Your Blueprint for Debt Freedom: Advanced Debt Management Strategies

Before you can build wealth, you need to stop the leaks. High-interest debt is the biggest leak in most financial boats. Getting rid of it must be your first priority.

First, Understand Your Enemy: Good Debt vs. Bad Debt Explanation

Not all debt is created equal. Understanding the difference is the first step in financial planning for debt reduction.

- Bad Debt: This is typically high-interest, non-appreciating debt. Think credit card debt, payday loans, and high-interest personal loans. This debt costs you money every month and provides no long-term value. This is the debt we must attack aggressively.

- Good Debt: This is debt that (in theory) helps you build wealth or increase your income potential. Examples include a sensible mortgage (building equity in a home), a federal student loan (investing in your education), or a business loan. The interest rates are usually much lower.

Your focus should be on eliminating bad debt first. Once that’s gone, you can develop strategies for paying off collection accounts or other lingering issues.

The Critical First Step: How to Calculate Your Debt-to-Income Ratio

You can’t win the game if you don’t know the score. Your Debt-to-Income ratio (DTI) is the most important number for lenders. It’s the percentage of your gross monthly income that goes toward paying your monthly debt payments.

How to Calculate DTI:

(Total Monthly Debt Payments) / (Gross Monthly Income) = DTI

For example, if your monthly debts (mortgage, car loan, credit card minimums) are \$1,500 and your gross monthly income is \$4,500, your DTI is 33%.

Lenders want to see a DTI below 43% (and ideally below 36%). A high DTI is a major red flag and a sign you are over-leveraged. You can find helpful calculators and worksheets at official consumer resources like the Consumer Financial Protection Bureau (CFPB).

Choosing Your Weapon: The Debt Snowball Method vs. The Debt Avalanche Method

These are the two most effective tips for managing multiple debts.

- Understanding the Debt Snowball Method: You list all your debts from the smallest balance to the largest, regardless of the interest rate. You make minimum payments on everything except the smallest debt. You throw every extra dollar at that smallest debt until it’s gone. Then, you take the money you were paying on that debt and “roll it” onto the next-smallest debt.

- Why it works: This is all about the psychology of paying off debt. Getting that first quick win gives you a powerful motivational boost to keep going.

- Best Debt Avalanche Method Steps: You list your debts from the highest interest rate to the lowest. You make minimum payments on everything except the debt with the highest APR. You attack that one with all your extra cash. Once it’s gone, you move to the next-highest interest rate.

- Why it works: This is the mathematically optimal choice. You will pay less interest overall and get out of debt faster because you are eliminating the most expensive debt first.

Which is better? The one you will actually stick with. If you need quick wins to stay motivated, use the Snowball. If you are driven by numbers and want the fastest way to pay off \$10,000 debt, use the Avalanche.

How to Pay Off Credit Card Debt Fast

High-interest credit card debt is a financial emergency. Here are some advanced personal loan consolidation strategies and tips to tackle it.

- Use a Zero-Interest Balance Transfer: If you have good credit, a zero-interest balance transfer cards guide is your best friend. You transfer your high-interest balances to a new card that charges 0% APR for a promotional period (usually 12-21 months). This stops the interest from bleeding you dry and allows 100% of your payment to go toward the principal. Warning: You MUST have a plan to pay it off before the promo period ends, or the interest will come back with a vengeance.

- Negotiating with Creditors for Lower Payments: Yes, you can do this. Call your credit card company and ask for a lower interest rate. If you have a good payment history, they will often lower it to keep you as a customer. Simply say, “I am a long-time customer trying to pay down my balance, but my interest rate is making it difficult. Can you lower my APR to help me?”

What About Debt Consolidation? A Look at the Pros and Cons

You see the ads all the time. But is debt consolidation a good idea? It depends.

- What is a debt consolidation loan? It’s a new, single loan (usually a personal loan) that you use to pay off all your other smaller debts. You are left with just one monthly payment, often at a lower interest rate.

- Debt Management Plan Pros and Cons:

- Pros: Simplifies your bills to one payment. Can lower your total interest rate. Gives you a fixed end date for your debt.

- Cons: You need good credit to qualify for a low rate. It doesn’t solve the spending habits that got you into debt. If you run up your credit cards again, you’ll be in an even worse position.

A debt management plan (DMP) from a non-profit credit counseling agency is another option. They negotiate with your creditors for you and you make one payment to the agency.

Debt Settlement: The “Nuclear” Option

This is not the same as consolidation. Debt settlement is when a company (or you) negotiates with your creditors to let you pay a lump sum that is less than what you actually owe.

This is an alternative to bankruptcy, but it has severe consequences. It will crater your credit score, the forgiven debt may be considered taxable income, and there is no guarantee it will work. Only consider this if you are in extreme financial hardship and cannot make your minimum payments.

How to Tackle Payday Loan Debt

Payday loans are a trap designed to keep you in debt forever with triple-digit interest rates. To escape the payday loan debt cycle:

- Stop the Bleeding: You must stop taking out new loans to pay off old ones.

- Build a Budget: Create a bare-bones zero-based budget to see where every dollar is going.

- Contact the Lender: Call them and say you cannot pay. Ask for an extended payment plan. Some states require them to offer this.

- Explore Alternatives: Can you get a small loan from a credit union, ask your employer for an advance, or borrow from family (with a written agreement)?

- Get Help: Contact a non-profit credit counselor immediately. They are experts at dealing with these predatory lenders.

The ultimate goal is living debt-free strategies. It takes focus and sacrifice, but the peace of mind you’ll gain is priceless.

Building Your Financial Fortress: Savings and Emergency Funds

Once you have a handle on your debt (or at least a solid plan), you must shift your focus to building a financial safety net. This is how you stop living paycheck to paycheck and start building wealth.

The “Why”: The Importance of an Emergency Savings Fund

An emergency fund is your personal insurance policy against life. It’s not an investment; it’s a buffer. When the car breaks down, the roof leaks, or you face a sudden job loss, this fund is what prevents you from sliding right back into debt. Without it, you are always one bad day away from a financial crisis.

How to Build an Emergency Fund Quickly (Even on a Low Income)

Don’t be intimidated by the final goal. Start small.

- Your First Goal: How to Save \$1,000 Fast. This is your “starter” emergency fund. Do whatever it takes to get this first \$1,000. Sell things you don’t need. Pick up a side hustle. Cut all non-essential spending.

- Automate It: The automatic savings plan setup is the most powerful trick. Set up an automatic transfer from your checking account to your savings account for the day after you get paid. Even if it’s just \$25 a week, you’ll be building savings without thinking about it. This is the core of the pay yourself first budgeting method.

How Much Emergency Fund is Enough? The 3 to 6 Months of Expenses Rule

Once you have your \$1,000 starter fund, your next goal is to build it up to cover 3 to 6 months of your essential living expenses.

- What are essential expenses? This is your rent/mortgage, utilities, food, transportation, and insurance. It’s not vacations, new clothes, or dining out.

- Who needs 3 months? People with stable, dual-income households and high job security.

- Who needs 6 months? People who are self-employed, work on commission, have a single income, or have dependents.

Where to Keep Your Emergency Fund: The High-Yield Savings Account

Your emergency fund needs to be liquid (easy to access) but not too easy.

- Do NOT keep it in your regular checking account. It’s too tempting to spend.

- Do NOT invest it in the stock market. It could lose value right when you need it.

- The perfect place is a High-Yield Savings Account (HYSA). These are typically online-only banks that pay 10-20 times more interest than a traditional brick-and-mortar bank. Your money is safe (FDIC-insured) and growing, but it still takes 1-2 days to transfer, which is the perfect “friction” to stop impulsive spending.

Beyond Emergencies: Using Sinking Funds for Beginners

This is one of the best personal finance apps for budgeting techniques, even if you just use envelopes or separate savings accounts.

A sinking fund is a mini-savings account for a specific, planned future expense. This is how you avoid “surprise” bills that drain your emergency fund.

- What are sinking funds used for?

- Annual car insurance

- Holiday gifts / Christmas

- Car repairs and maintenance

- Annual subscriptions

- How to save for a vacation without debt

- A down payment on a car

Example: You know you’ll spend \$600 on holiday gifts in December. You create a “Holiday” sinking fund and automatically save \$50 a month all year. When December comes, the money is already there. No stress, no debt.

The Psychology of Saving Money and Overcoming Bad Habits

Saving is more about behavior than math. If you struggle to save, it’s likely due to a few psychological triggers.

- Identify Your Triggers: Do you spend when you’re bored, stressed, or sad? Do you spend to “keep up” with friends or social media?

- Create Friction: Make spending harder. Unfollow “influencer” accounts. Unsubscribe from marketing emails. Delete your saved credit card info from websites.

- Use the 24-Hour Rule: For any non-essential purchase over \$50, wait 24 hours. The urge to stop impulsive spending will often pass.

- Reframe Your Mindset: Stop viewing saving as a sacrifice. Start viewing it as buying your future freedom. Every dollar you save is a dollar that works for you, not for a credit card company.

Practical Savings Strategies: How to Save Money Daily

- Track Your Expenses to Save More: You can’t change what you don’t measure. Use an app or a notebook for one month. You’ll be shocked at where your money is going.

- How to Reduce Monthly Subscriptions: Do a “subscription audit.” Cancel any streaming services, apps, or memberships you don’t use regularly.

- Saving Money on Groceries Tips: Plan your meals for the week, make a list based on that plan, and stick to it. Never shop hungry.

- Try Money-Saving Challenges: A “no-spend” weekend or a “pantry challenge” (only eating what you already have) can be a fun way to reset your habits.

What to Do After Building Your Emergency Fund?

Congratulations! You are now financially secure. The next step is to start building wealth. Any extra money you have after your emergency fund is full and your high-interest debt is gone should be directed toward investing. This is when you start saving for retirement while paying debt (like your mortgage) and other long-term goals.

Keeping More of Your Money: A Guide to Tax Optimization

You’ve mastered debt and built your savings. Now it’s time for the most advanced step: tax optimization. This isn’t about evasion; it’s about legally using the tax code to your advantage.

The Basics: Understanding Tax Deductions vs. Tax Credits

These two terms are not interchangeable.

- Tax Deduction: This lowers your taxable income. If you are in the 22% tax bracket, a \$1,000 deduction saves you \$220.

- Tax Credit: This is a dollar-for-dollar reduction of your tax bill. A \$1,000 tax credit saves you \$1,000.

Credits are always more valuable than deductions. A guide to understanding your tax bracket is essential, but just know that credits are your best friend.

How to Lower Your Taxable Income Legally Using Retirement Accounts

This is the easiest and most powerful strategy. You get a tax break today just for saving for your future.

- Maximizing Your 401(k) Contributions: If your employer offers a 401(k), this is your #1 tool. Money you contribute to a Traditional 401(k) is pre-tax. This means if you earn \$60,000 and contribute \$6,000, the government only taxes you as if you earned \$54,000. At a minimum, contribute enough to get your full employer match—it’s 100% free money.

- Traditional vs. Roth IRA Tax Advantages: If you don’t have a 401(k) or want to save more, you can use an Individual Retirement Arrangement (IRA).

- Traditional IRA: You get a tax deduction now (if you meet income limits). Your money grows tax-deferred. You pay ordinary income tax on all withdrawals in retirement.

- Roth IRA: You contribute after-tax dollars (no deduction today). Your money grows 100% tax-free. You pay zero taxes on your withdrawals in retirement.

Which is better? A simple rule of thumb: If you believe you’re in a higher tax bracket now than you will be in retirement, use a Traditional IRA/401(k). If you believe you’re in a lower tax bracket now, a Roth is the clear winner.

The “Triple Tax Advantage”: How to Use an HSA for Tax Savings

A Health Savings Account (HSA) is the most powerful tax-advantaged account in existence, but you must have a High-Deductible Health Plan (HDHP) to qualify.

It is “triple-tax-advantaged”:

- Tax-Free In: Contributions are tax-deductible (like a Traditional IRA).

- Tax-Free Growth: The money can be invested and grows 100% tax-free (like a Roth IRA).

- Tax-Free Out: You can withdraw the money 100% tax-free for any qualified medical expense, forever.

Many wealthy individuals use an HSA as a secret retirement account. They pay for current medical expenses out-of-pocket, let their HSA funds grow and compound for decades, and then reimburse themselves in retirement, tax-free.

Tax-Efficient Investing Strategies

This is an advanced concept called asset location. It’s not what you own, but where you own it.

- Tax-Advantaged Accounts (401k, IRA): Place your tax-inefficient investments here. This includes corporate bonds (which generate taxable interest), REITs, and actively managed funds that have high turnover.

- Taxable Brokerage Account: Place your tax-efficient investments here. This includes buy-and-hold index funds (which generate few capital gains), individual stocks, and municipal bonds (which are often tax-free).

This strategy minimizes your annual tax drag, letting your investments compound faster.

Don’t Miss These: Common Tax Write-Offs and Credits

Every year, people leave money on the table. Don’t be one of them.

- Charitable Donations Tax Deduction Rules: You can deduct cash and non-cash (like clothes and furniture) donations if you itemize.

- Maximizing Education Tax Credits: The American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit can be worth thousands.

- Common Tax Write-Offs for Self-Employed: If you have a side hustle, you can deduct a portion of your home office, internet, phone bill, mileage, and supplies.

Common Tax Filing Mistakes to Avoid

Finally, don’t let a simple error cost you.

- Filing with the wrong status (e.g., “Single” when you qualify for “Head of Household”).

- Math errors.

- Forgetting to sign and date your return.

- Entering incorrect bank account numbers for your refund.

- Filing late when you owe money (the penalty is steep).

Using tax software or consulting a professional can help you avoid these year-end tax planning tips and pitfalls. For the most trustworthy and up-to-date information, always refer directly to the Internal Revenue Service (IRS) website.

Conclusion: Your Journey to Financial Independence

We’ve covered a massive amount of ground. From the strategies for paying off student loans to the psychology of saving money and the nuances of tax-efficient investing, you now have the tools.

The path to financial freedom from debt is not a sprint; it’s a marathon. It’s built on a series of small, consistent, and intentional choices.

Don’t let this guide overwhelm you. Pick one thing to do today.

- Maybe it’s calculating your DTI.

- Maybe it’s setting up a \$25 automatic transfer to a new high-yield savings account.

- Maybe it’s just making a list of your debts to decide between the Snowball or Avalanche method.

Your financial future is not written in stone. It is written in the daily habits you build, starting right now. You can do this.

Frequently Asked Questions About Debt, Savings, and Taxes

1. What is the fastest way to pay off \$10,000 in credit card debt?

The fastest way is the “Avalanche” method (paying off the highest-interest card first) combined with “brute force.” This means ruthlessly cutting expenses, taking on a side hustle, and putting every single extra dollar toward the debt. A 0% balance transfer can also accelerate it by stopping interest.

2. Should I save for retirement while paying off debt?

It depends on the debt’s interest rate. Most experts agree you should always contribute enough to your 401(k) to get the employer match (it’s free money). After that, focus on any debt with an interest rate over 6-7% (like credit cards). Once that’s gone, you can split your extra money between paying off lower-interest-rate debt (like student loans) and increasing your retirement savings.

3. What’s the difference between an emergency fund and a sinking fund?

An emergency fund is for unknown, unplanned life events (e.g., job loss, medical emergency). A sinking fund is for known, planned future expenses (e.g., new tires, holiday gifts, vacation). You expect to spend your sinking fund; you hope to never touch your emergency fund.

4. I have a low income. How can I possibly build an emergency fund?

Start incredibly small. The goal is building the habit. Set up an automatic transfer of just \$5 or \$10 per paycheck. Combine this with creative ways to save money daily, like packing your lunch or canceling one subscription. It will build slowly, but it will build.

5. Is a high-yield savings account (HYSA) safe?

Yes. As long as the bank is FDIC-insured (for banks) or NCUA-insured (for credit unions), your money is protected up to \$250,000. HYSAs are one of the best tools for building an emergency fund.

6. What’s the “pay yourself first” budgeting method?

It’s a simple but powerful shift in thinking. Instead of paying all your bills and “saving what’s left,” you treat your savings as your first and most important bill. The day you get paid, you automatically move money to your savings/investment accounts first. Then, you live on the rest.

7. I’m self-employed. What’s the most important tax tip for me?

Pay your estimated quarterly taxes! When you’re a W-2 employee, taxes are taken out of every paycheck. When you’re self-employed, you are responsible for paying those taxes to the IRS four times a year. Failing to do so can result in a massive, unexpected tax bill and penalties.

8. What’s the difference between a Traditional 401(k) and a Roth 401(k)?

It’s the same as the IRA difference. Traditional 401(k): You contribute pre-tax money, which lowers your taxable income today. Your money grows tax-deferred, and you pay taxes on withdrawals in retirement. Roth 401(k): You contribute after-tax money. Your money grows completely tax-free, and you pay zero taxes on withdrawals in retirement.

9. Can I really just call my credit card company and ask for a lower interest rate?

Yes, and it works more often than you’d think, especially if you have a history of on-time payments. The worst they can say is “no.” The best they can say is “yes,” which could save you hundreds or thousands of dollars.

10. What is tax-loss harvesting?

What is tax-loss harvesting? It’s an advanced investing strategy. If you have investments in a taxable brokerage account that have lost value, you can sell them to “harvest” that loss. You can then use that loss to offset any capital gains you may have, and even offset up to \$3,000 of your regular income, lowering your tax bill. You must be careful to avoid the “wash sale” rule.

11. Is medical debt different from other debt?

Yes. Getting out of medical debt can be complex. It’s often subject to billing errors, so always ask for an itemized bill. It is also more negotiable than other debts. Many hospitals will offer significant discounts for paying in cash or will set up long-term, 0% interest payment plans if you just ask.

12. How do I start creating a zero-based budget?

A zero-based budget is where your income minus your expenses equals zero. You give every single dollar a “job.” Start by listing all your income for the month. Then, list all your “must-have” expenses (rent, utilities, food). Next, list your “wants” (dining out, entertainment). Finally, assign the rest to your financial goals (debt-payoff, savings). If you have money left, assign it. If you’re in the red, you must cut from your “wants” until you’re at zero.