Starting your trading journey can be exciting but also intimidating, especially when you want to protect your hard-earned money. Understanding the best low risk trading strategies for beginners is key to building confidence and consistent profits. This comprehensive guide will carefully walk you through 50 tried-and-true long tail keywords related to low risk trading strategies that beginners can use to succeed in today’s markets. These strategies apply to stocks, forex, options, cryptocurrencies, and more.

Why Focus on Low Risk Trading Strategies for Beginners?

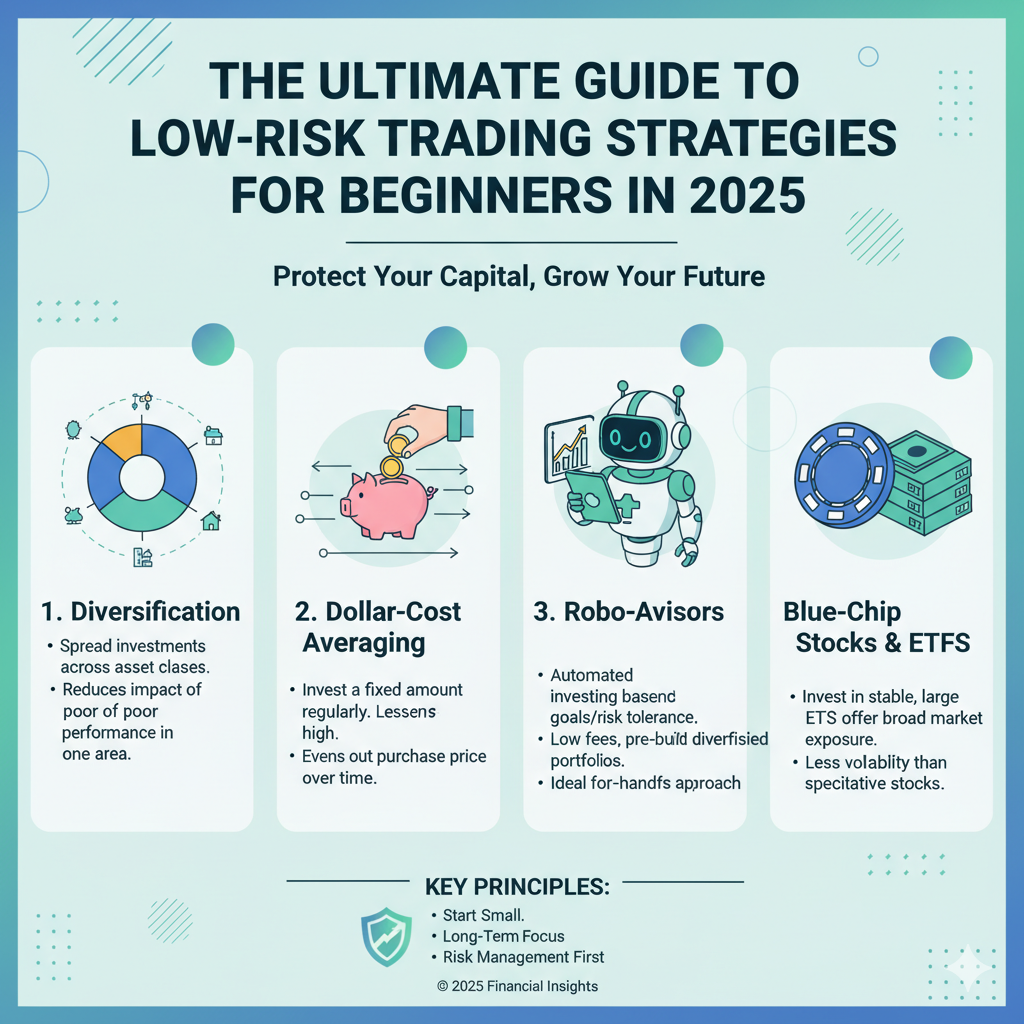

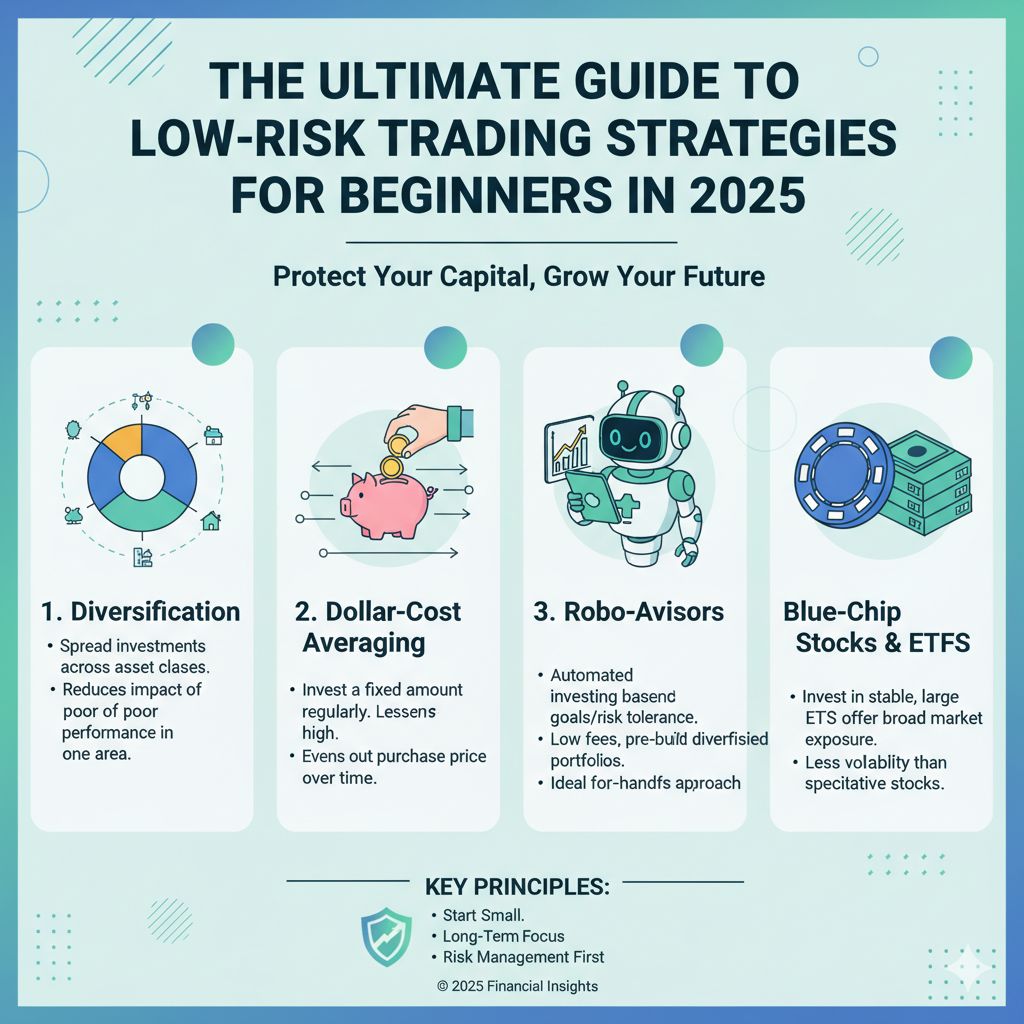

Low risk trading strategies are designed to protect your capital and minimize losses while still giving you opportunities to earn profits. For beginners, this is especially important as experience is limited. The goal is to use simple, clear setups and sound risk management techniques to build a strong foundation without overwhelming complexity.

Top Low Risk Day Trading Strategies for Beginners

Day trading can seem risky, but with the right approach, it can be done safely. Focus on low risk day trading strategies for beginners such as scalping small price movements, using tight stop losses, and trading high liquidity stocks. Avoid emotional decisions by planning your entries and exits carefully.

Simple Low Risk Trading Techniques for Beginners

Start with straightforward methods like moving average crossovers or support and resistance trading to identify low risk trading setups for new traders. By learning to recognize these simple signals, beginners can control risk and avoid chasing big, uncertain moves.

Low Risk Forex Trading Strategies for Beginners

Forex trading offers many low risk opportunities, especially through strategies like trading with the trend, using multiple time frame analysis, and placing stop losses beyond key support or resistance levels. Low risk forex trading strategies for beginners help manage exposure to the highly volatile currency market.

Low Risk Options Trading Strategies for Beginners

Options provide flexibility for low risk trading. Techniques like selling put spreads, call spreads, and using collars are effective low risk options trading strategies beginners can use. These strategies cap potential losses while offering decent profit potential.

Safest Trading Strategies for Beginner Traders

Capital preservation is crucial, so always use stop losses, position sizing, and diversify trades. Most safest trading strategies for beginner traders involve strict money management rules alongside technical analysis.

High Probability Low Risk Trading Strategies Beginners Can Use

Focus on setups with high win rates, such as trading inside bars or moving average bounce trades. High probability low risk trading strategies beginners appreciate help maintain psychological confidence.

How to Start Low Risk Trading as a Beginner

Start with a demo account, develop a clear trading plan, and limit risk per trade to 1-2% of your capital. How to start low risk trading as a beginner includes practicing patience and never risking more than you can afford to lose.

Low Risk Trading Strategies with Consistent Profits

Consistency comes with discipline. Strategies like dividend reinvestment combined with low risk stock picking ensure steady gains. Low risk trading strategies with consistent profits may not yield fast riches but build wealth reliably over time.

Automated Low Risk Trading Strategies for Beginners

Using bots or algorithmic trading can help enforce discipline. Automated low risk trading strategies for beginners can reduce emotional errors and ensure risk controls are always applied.

Low Risk Algorithmic Trading for Beginners

Learn basic coding or use platforms offering predefined low risk algorithmic strategies to automate entries and exits, reducing human error and improving consistency.

Best Low Risk Investment Strategies for Beginners

These combine trading with long-term investing. For example, combining low risk stock trading strategies for beginners with a diversified low risk portfolio diversification for beginners approach.

Low Risk Cryptocurrency Trading Beginners Can Trust

Cryptos are volatile but low risk cryptocurrency trading beginners can use techniques like dollar-cost averaging, trading stablecoins, and using tight stop losses.

Low Risk Spread Trading Strategies Beginners Should Know

Spread trades reduce directional risk by buying one asset and selling another related asset. Low risk spread trading strategies beginners use include pairs trading and calendar spreads.

Best Risk Reward Trading Ratio for Beginners

Aiming for a minimum 1:2 risk-reward ratio ensures profits outweigh losses over time. Best risk reward trading ratio for beginners helps maintain long-term profitability.

Low Risk Trading Psychology Tips for Beginners

Stay patient, avoid revenge trading, and accept losses as part of the process. Developing a disciplined mindset is essential for low risk trading success.

How to Use Support and Resistance for Low Risk Trading

Support and resistance help identify low risk entry and exit points. Trade near these levels with confirmation for best results.

Practical Low Risk Trading Plan for Beginners

Draft a plan with entry rules, exit rules, and risk limits. Review and adapt the plan based on experience.

Low Risk Trading with Stop Loss Beginners Need

Always place stop losses to cap losses. Trailing stops can lock in profits and minimize downside.

FAQs About Low Risk Trading Strategies for Beginners

- What is the best low risk trading strategy for beginners?

Focus on simple support/resistance setups combined with strict stop losses and position sizing. - How much should beginners risk per trade?

Risking 1-2% of your capital per trade is recommended to preserve capital. - Can beginners use options for low risk trading?

Yes, strategies like selling spreads and collars limit risk while offering income potential. - Is day trading suitable for beginners looking for low risk?

Yes, but only with disciplined exit strategies and risk controls. - How important is trading psychology in low risk trading?

Very important. Emotional control helps stick to plans and avoid big mistakes. - What tools can automate low risk trading strategies?

Platforms like MetaTrader, TradingView, and dedicated trading bots ensure discipline. - How do I find low risk trading setups?

Look for prices near key support, use moving averages, and watch volume for confirmation. - Are cryptocurrencies too risky for beginners?

They can be volatile, but using low risk methods like dollar-cost averaging can reduce risk. - Can beginners succeed with algorithmic trading?

Yes, with proper testing and low risk coded rules, beginners can benefit. - How do I maintain consistent profits with low risk trading?

Discipline, patience, and a consistent risk management plan are key.

Useful Resources for Further Learning

- Comprehensive trading books covering low risk strategies.

- Online courses focused on beginner trading safety.

- Trading communities and forums for support and tips.