Welcome to the world of investing! If you’ve ever felt that your savings account isn’t quite cutting it, or if terms like “stocks,” “ETFs,” and “401(k)” sound like a foreign language, you’re in the right place. This guide is designed to be your plain-English map, taking you from a curious beginner to a confident investor.

Investing can feel intimidating. The truth is, the financial world often uses complicated jargon to explain simple ideas. Our goal here is to strip all that away. We’re going to explain what you really need to know to start building wealth, protecting your future, and making your money work for you.

This isn’t about “get rich quick” schemes. This is about building real, sustainable, long-term wealth. We will cover the three biggest pillars of modern investing: stocks, ETFs, and the special accounts that help you save for retirement.

The First Step – Understanding the “Why” and “How” of Investing

Before you put a single dollar into the market, it’s crucial to understand the foundation. Why invest at all? And how do you prepare?

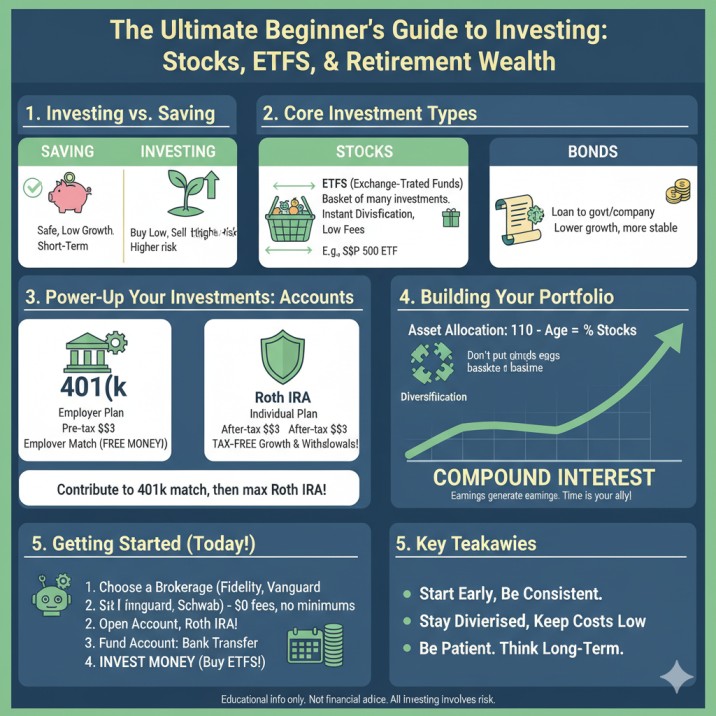

Investing vs. Saving: What’s the Big Difference?

Think of saving as putting money in a safe place, like a high-yield savings account. It’s secure, it’s easily accessible, and it’s perfect for your emergency fund or short-term goals (like a vacation or a down payment). The problem? It barely grows.

Investing, on the other hand, is the act of buying assets that have the potential to grow in value over time. You are taking on more risk, but in exchange, you get the potential for much higher returns. The main goal of investing is to outpace inflation—the slow increase in the price of goods—and grow your purchasing power significantly over the long haul.

What is Your Risk Tolerance for Beginners?

This is maybe the most important question you’ll answer. Risk tolerance is simply how much you can emotionally and financially handle the ups and downs of the market.

- Are you someone who would panic and sell everything if your account dropped 20%? You might have a low risk tolerance.

- Are you someone who understands that markets dip and sees it as a buying opportunity? You might have a high risk tolerance.

Your age, financial goals, and personality all play a role. The golden rule: Never invest money you’ll need in the next five years.

Setting Financial Goals Before You Start Investing

You wouldn’t start a road trip without a destination. The same goes for investing. Your goals determine your strategy.

- Short-Term Goal (Less than 5 years): Buying a car. Investment strategy: Not recommended. Keep this in cash/savings.

- Mid-Term Goal (5-10 years): Saving for a house down payment. Investment strategy: A “conservative” mix, maybe with more stable investments like bonds.

- Long-Term Goal (10+ years): Retirement. Investment strategy: This is where you can take on more risk (like stocks and ETFs) because you have time to ride out the market’s cycles.

Deep Dive on Stocks – Your Guide to Owning a Piece of a Company

When people talk about “investing,” they’re usually thinking about stocks.

What Are Stocks and How Do They Work?

A stock (also called “equity” or a “share”) represents a tiny piece of ownership in a public company. When you buy one share of Apple ($AAPL), you are, in a very small way, an owner of Apple.

Companies sell shares to the public to raise money (called “capital”) to fund their operations, expand, develop new products, and grow. These shares are then traded on a stock market, like the New York Stock Exchange (NYSE) or the NASDAQ.

How Do You Make Money from Stocks?

There are two primary ways:

- Capital Gains: This is the most common. You buy a stock for $100 per share. Five years later, the company has done well, and other investors are willing to pay $180 for that share. You sell it and make an $80 profit (or “capital gain”).

- Dividends: Some companies, often large and stable ones, share a portion of their profits with their shareholders. This payment is called a dividend. It’s often paid out every three months (quarterly) and can be a great source of income. You get paid just for owning the stock.

Understanding the Different Types of Stocks

Not all stocks are the same. They are often grouped by size, style, or type.

- Common Stock vs. Preferred Stock: As a beginner, you’ll almost always be buying common stock. This gives you voting rights (like voting for the board of directors) and the potential to grow. Preferred stock is different; it usually doesn’t have voting rights but often pays a fixed dividend, making it act a bit more like a bond.

- Growth Stocks vs. Value Stocks:

- Growth stocks are shares in companies that are expected to grow faster than the average. Think of tech companies that are reinvesting all their profits to expand. They rarely pay dividends.

- Value stocks are shares in companies that seem to be trading for less than they are worth (they’re “on sale”). These are often older, more established companies that may pay a dividend.

- Market Capitalization (Company Size):

- Large-Cap: These are the giants—Microsoft, Amazon, Johnson & Johnson. They are generally considered safer, more stable investments.

- Mid-Cap: Companies in the middle. They offer a mix of stability and growth potential.

- Small-Cap: Smaller, younger companies with high growth potential, but also much higher risk.

What Are the Risks of Buying Individual Stocks?

When you buy a single stock, your success is tied 100% to that one company. If that company has a bad product launch, a major scandal, or just gets out-competed, the value of your stock can fall dramatically.

This is why diversification (which we’ll cover next) is so important. Most experts agree that beginners should not try to “pick” individual stocks. It’s incredibly difficult, even for professionals.

ETFs Explained – The Beginner’s Best Friend for Investing

If buying individual stocks is risky and hard, what’s the alternative? For most people, the answer is Exchange-Traded Funds (ETFs).

What is an ETF (Exchange-Traded Fund)?

An ETF is a bundle of investments sold as a single “share” on the stock exchange.

Think of it like a basket of fruit. Instead of going to the store and trying to pick the single best apple (a stock), you can buy a pre-made “fruit basket” (an ETF). This basket might contain 500 different fruits—apples, oranges, bananas (representing hundreds of different stocks).

If one apple (one stock) turns out to be bad, it doesn’t really matter. You’re protected by the 499 other good pieces of fruit in your basket. This is instant diversification.

How Do ETFs Work for Beginners?

When you buy one share of an ETF, you are buying a tiny piece of all the stocks or assets inside that fund.

The most popular type of ETF is an index fund ETF. An index is just a list that measures a part of the market. The most famous is the S&P 500, which is a list of the 500 largest U.S. companies.

When you buy a best S&P 500 ETF for beginners (like $VOO or $IVV), you are instantly buying a small piece of all 500 of those top companies. You are betting on the success of the entire U.S. economy, not just one company.

ETFs vs. Mutual Funds: Key Differences

You’ll often hear ETFs and mutual funds mentioned together. They are very similar (both are baskets of stocks), but have one key difference:

- ETFs trade on the stock exchange all day long, just like a stock. Their price changes minute by minute.

- Mutual Funds are priced only once per day, after the market closes.

Generally, ETFs have become more popular for beginners because they are often cheaper (have lower fees), are easier to buy and sell, and can be more tax-efficient.

Why are ETFs Great for Building a Portfolio?

- Instant Diversification: As mentioned, you spread your risk across hundreds or even thousands of companies.

- Very Low Cost: Most index ETFs have incredibly low fees, known as an expense ratio. A 0.03% expense ratio means you pay just $0.30 per year for every $1,000 you have invested. This is a huge deal, as high fees can destroy your long-term returns.

- Simplicity: You can how to build an ETF portfolio with just 1-3 funds. A popular “three-fund portfolio” might include:

- A U.S. Total Stock Market ETF

- An International Total Stock Market ETF

- A Total Bond Market ETF

How to Choose the Right ETF for Your Portfolio

When comparing ETFs, look at two main things:

- What does it hold? Does it track the S&P 500? The total stock market? A specific industry (a “sector ETF”)? As a beginner, sticking to broad market index funds is the safest bet.

- What is the expense ratio? Lower is always better. For broad index funds, you should look for fees under 0.10%.

Retirement Accounts – Your Super-Powered Investing Tools

Now we know what to invest in (stocks and ETFs). But where should you hold them?

You can just open a standard brokerage account. But the government provides special “tax-advantaged” accounts to encourage you to save for retirement. These accounts are like special shields that protect your investments from taxes, letting them grow much, much faster.

The two main types are the 401(k) and the IRA.

Understanding 401(k) Basics

A 401(k) is a retirement plan offered by an employer.

- How it works: You contribute money directly from your paycheck (before taxes are taken out).

- The benefit: This lowers your taxable income for the year. For example, if you make $60,000 and contribute $5,000 to your 401(k), the government only taxes you as if you made $55,000.

- The investments: Inside your 401(k), you choose from a limited menu of investments, which are usually mutual funds and ETFs.

- The rules: You can’t touch this money until you’re 59 ½ without paying a penalty.

The Most Important Thing: What is a 401(k) Employer Match?

This is free money. Do not ignore this.

Many employers will match your contributions up to a certain percentage. A common match is “50% of contributions up to 6% of your salary.”

- In English: If you make $60,000 and contribute 6% ($3,600), your employer will add an extra $1,800 (50% of your $3,600) to your account. For free.

- This is a 100% risk-free return on your money.

- Rule #1 of investing: Before you do anything else, contribute at least enough to your 401(k) to get the full employer match.

Understanding IRA (Individual Retirement Account) Basics

An IRA is a retirement account that you open yourself. It’s not tied to an employer. This makes it one of the best retirement accounts for self-employed individuals or anyone who wants more investment choices than their 401(k) offers.

There are two main types: Traditional and Roth.

Traditional IRA vs. Roth IRA Explained: The Key Difference

This is all about when you pay taxes.

Traditional IRA:

- Taxes: You get a tax break today. Your contributions are often tax-deductible (like a 401(k)), lowering your taxable income this year.

- Growth: Your investments grow tax-deferred.

- Withdrawals: When you retire and pull the money out, you pay regular income taxes on all of it.

- Who it’s for: People who think they are in a higher tax bracket today than they will be in retirement.

Roth IRA:

- Taxes: You get no tax break today. You contribute with after-tax dollars (money that’s already been taxed in your paycheck).

- Growth: Your investments grow 100%… TAX-FREE.

- Withdrawals: When you retire, you pay… ZERO. NOTHING. All of it—your original contributions and all the growth—is 100% tax-free.

- Who it’s for: People who think they are in a lower tax bracket today than they will be in retirement (this is true for most young people!).

Many financial experts believe the Roth IRA is one of the most powerful wealth-building tools ever created, especially for those investing for retirement in your 20s or 30s.

How to Open an IRA for Beginners

- Choose a “brokerage” (we’ll cover this in Part 6).

- Select “Open a New Account” and choose “Roth IRA” or “Traditional IRA.”

- Fund the account by transferring money from your bank.

- Crucial Step: You must invest the money! Just having cash in the IRA does nothing. You use that cash to buy the stocks or ETFs you’ve chosen.

Building Your First Portfolio – Putting It All Together

You’ve got your accounts open. Now… what do you actually buy? How do you build a “portfolio”?

What is Asset Allocation for Beginners?

Asset allocation is the fancy term for deciding how to divide your money between different types of assets—mainly stocks and bonds.

- Stocks (like your S&P 500 ETF) are your growth engine. They are high-risk, high-reward.

- Bonds are essentially loans you give to a government or company. They are your safety engine. They have low growth but are much more stable and provide ballast when the stock market is crashing.

A common rule of thumb for your stock percentage is “110 minus your age.”

- If you’re 30, you’d have 80% in stocks and 20% in bonds.

- If you’re 60, you’d have 50% in stocks and 50% in bonds.

This is a simple starting point, and you should adjust it based on your personal risk tolerance.

What is Diversification in Investing?

We’ve touched on this, but it’s worth its own section. Diversification is the principle of not putting all your eggs in one basket.

- Buying one stock (Tesla) is not diversified.

- Buying one ETF (S&P 500) is very diversified across the U.S.

- Building a portfolio with a U.S. ETF, an International ETF, and a Bond ETF is globally diversified across different asset classes. This is the goal.

Dollar-Cost Averaging vs. Lump Sum Investing

You have $5,000 to invest. What do you do?

- Lump Sum: Invest all $5,000 today. Statistically, this wins out about two-thirds of the time because the market generally goes up.

- Dollar-Cost Averaging (DCA): Invest $1,000 every month for five months. This is a powerful psychological tool. If the market drops, you’re happy because you get to “buy on sale” next month. If the market goes up, you’re happy because your first investment is already making money.

For beginners, dollar-cost averaging is a fantastic, stress-free strategy. It builds the vital habit of investing consistently, which is the true secret to success.

The Power of Compound Interest Explained

Albert Einstein supposedly called compound interest the “eighth wonder of the world.”

Here’s why: Compound interest is when your earnings start generating their own earnings.

- Year 1: You invest $1,000. It earns 10% ($100). Your total is $1,100.

- Year 2: You earn 10% on the new total. 10% of $1,100 is $110. Your total is $1,210.

- Year 3: You earn 10% on $1,210, which is $121.

Your money starts to snowball, growing faster and faster on its own. The two most important ingredients for compounding are reinvesting your earnings (like dividends) and TIME. The earlier you start, the more powerful this effect becomes.

How to Start Investing Today – The Practical Steps

You’re ready. Here is the literal, step-by-step process.

How to Choose an Online Brokerage Account

A brokerage is simply the company that gives you access to the stock market. Think of it as the store where you go to buy your stocks and ETFs.

For beginners, you want to look for three things:

- $0 Commissions: You should not pay a fee to buy or sell stocks and ETFs.

- No Account Minimums: You want to be able to start investing with $100 or even less.

- Easy to Use: A good website and mobile app are key.

Some of the best brokerage accounts for beginners in the U.S. include Fidelity, Vanguard, and Charles Schwab. They are all highly trusted, low-cost, and perfect for long-term investors.

What is a Robo-Advisor and Is It Right for Me?

A robo-advisor is an automated investing service. You sign up, answer a questionnaire about your goals and risk tolerance, and the robo-advisor does everything else.

- It builds a diversified ETF portfolio for you.

- It automatically rebalances your account.

- It reinvests your dividends.

This is a “set it and forget it” solution. The downside? They charge a small management fee (usually around 0.25% per year) for this service.

- Choose a Robo-Advisor if: You are terrified of an “empty” account and don’t trust yourself to pick the right ETFs.

- Choose a Brokerage if: You are willing to do 10 minutes of research to buy a single S&P 500 ETF and save on the management fee.

Final Thoughts: Your Journey Has Just Begun

Investing is not as complicated as it seems. It boils down to a few simple, powerful ideas:

- Spend less than you earn.

- Invest the difference consistently.

- Use low-cost, diversified index fund ETFs.

- Use tax-advantaged accounts like a 401(k) and a Roth IRA.

- Be patient and let compound interest do the heavy lifting for decades.

The hardest part is starting. The best time to invest was 20 years ago. The second best time is today.

Frequently Asked Questions (FAQ) About Investing Basics

1. How much money do I need to start investing?

You can start with as little as $1. Many brokerages now offer “fractional shares,” which means you can buy a piece of a share. You don’t need $400 to buy one share of an S&P 500 ETF; you can buy $10 worth.

2. Is investing in stocks the same as gambling?

No. Gambling is a bet on a random, short-term outcome with a high chance of losing everything. Investing is the long-term ownership of productive assets (companies) that generate real profits and value. The “house” (the economy) is structured to grow over time.

3. What’s the difference between an ETF and an index fund?

An index fund is a strategy (passively tracking a market list like the S&P 500). An ETF is a structure (a fund that trades on an exchange). You can have an index fund ETF (most common) or an index fund mutual fund. For beginners, they are often used to mean the same thing: a low-cost fund that tracks the market.

4. What should I invest in first: my 401(k) or a Roth IRA?

The standard advice is:

- Contribute to your 401(k) up to the employer match. (This is free money!)

- Fully fund your Roth IRA (up to the annual limit).

- If you still have money to invest, go back and put more into your 401(k).

5. How are stocks and ETFs taxed?

In a regular (taxable) brokerage account:

- Dividends: Taxed as income in the year you receive them.

- Capital Gains: If you sell an investment for a profit after holding it for less than one year, it’s a “short-term gain” and taxed at your regular income rate. If you hold it for more than one year, it’s a “long-term gain” and taxed at a much lower, more favorable rate. This is why long-term investing is so powerful.

- (In a Roth IRA, you pay no taxes on any of this!)

6. What’s the best S&P 500 ETF for beginners?

You can’t go wrong with any of the major ones, as they all do the same thing. Look for the one with the lowest expense ratio. Popular options include $VOO (Vanguard), $IVV (iShares/BlackRock), and $FXAIX (Fidelity’s mutual fund version).

7. Can I lose all my money investing in stocks?

If you invest all your money in a single stock, yes, that company could go bankrupt and your investment could go to $0. If you invest in a broad market ETF (like an S&P 500 fund), the only way to lose all your money is if all 500 of the biggest companies in America go bankrupt simultaneously. If that happens, money will be the least of our problems.

8. What does “rebalancing” a portfolio mean?

Imagine you want a 80% stock / 20% bond portfolio. If stocks have a great year, your portfolio might “drift” to be 90% stocks / 10% bonds. This is now riskier than you intended. Rebalancing is the act of selling some stocks and buying some bonds to get back to your 80/20 target.

9. What is an “expense ratio”?

This is the small annual fee charged by an ETF or mutual fund, expressed as a percentage of your investment. A 0.03% expense ratio is excellent. A 1.00% expense ratio is very high and should be avoided, as it will significantly eat into your long-term returns.

10. What is a “dividend yield”?

This is the total annual dividend payment from a stock or fund, expressed as a percentage of the stock’s current price. A $100 stock that pays $2 in dividends per year has a dividend yield of 2%.

11. How often should I check my investments?

As little as possible! For long-term investors, checking your portfolio every day will only cause stress and tempt you to make emotional decisions (like selling during a panic). A good plan is to check in once every 3-6 months just to make sure your contributions are going in correctly and to see if you need to rebalance.

12. Where can I learn more?

For trustworthy, official information, the U.S. Securities and Exchange Commission’s investor education site, Investor.gov, is an excellent resource. For financial definitions and in-depth articles, many people turn to sites like Investopedia.

Disclaimer: This article is for educational and informational purposes only. It is not intended as financial or investment advice. All investing involves risk. You should consult with a qualified financial professional before making any investment decisions.