Investing is no longer just about the bottom line. A massive shift is underway, and by 2026, it will be the new standard. We’ve moved from asking “How much money can I make?” to “How can my money make a difference and grow?” This is the core of sustainable and ethical investing.

If you’re wondering what is the future of ESG investing, you’re in the right place. This isn’t a fleeting trend; it’s a fundamental re-evaluation of value. We’re seeing a new generation of investors, particularly Gen Z trends in sustainable investing, who demand transparency and impact from their portfolios. They understand that a company poisoning a river or exploiting its workers isn’t just bad ethics—it’s a bad long-term investment.

The ethical investing forecast 2026 points to a market that’s more sophisticated, more regulated, and more focused on real-world outcomes. The old idea that you had to sacrifice profit for principles is one of the biggest myths in finance. Today, the data suggests the opposite.

This comprehensive guide will explore the top sustainable investing trends 2026. We’ll move beyond the buzzwords to give you actionable insights. We will dive deep into the best ESG funds, the explosive growth of green bonds, and the critical impact on returns, using real case studies to show you what works and what doesn’t. We will also cover the most important emerging themes in responsible investing to help you build a resilient, profitable, and principled portfolio for 2026 and beyond.

Beyond Negative Screening: The New Face of Responsible Investing

Not long ago, “ethical investing” just meant not investing in certain things. This was called Socially Responsible Investing (SRI), and it focused on “negative screening”—avoiding stocks in tobacco, weapons, or gambling.

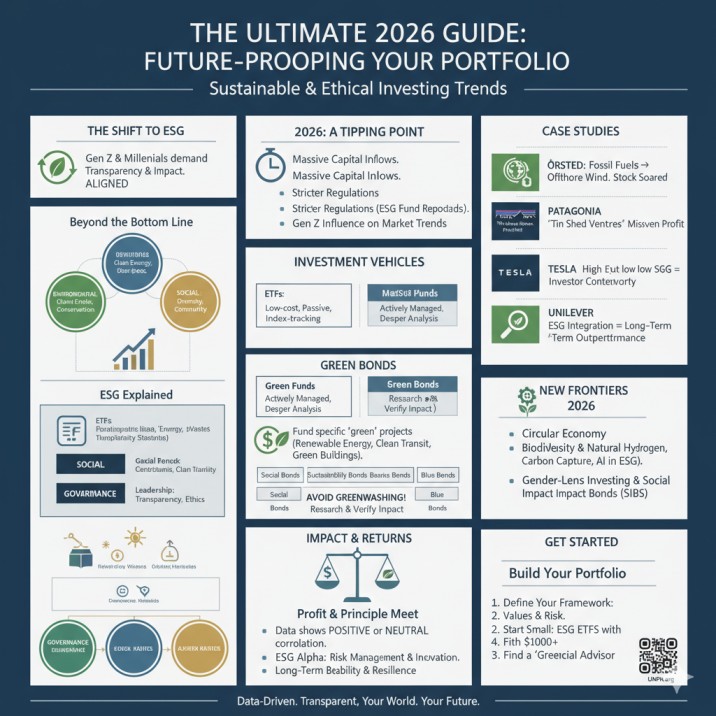

It was a good start, but the conversation has evolved. Today, we focus on ESG integration strategies for 2026 portfolios. ESG stands for Environmental, Social, and Governance. It’s a “positive screening” framework that looks for companies that are actively doing good and are well-managed.

- Environmental: How does a company manage its energy use, waste, pollution, and natural resource conservation?

- Social: How does it treat its employees, suppliers, and customers? Does it promote diversity and inclusion?

- Governance: How is the company run? Is its leadership transparent? Is executive pay fair? How does it treat shareholder rights?

This shift is crucial. We’re not just avoiding the “bad” companies; we’re actively seeking out the “good” ones that are set to lead the future.

Why 2026 is a Tipping Point for Sustainable Finance

Several factors are coming together to make 2026 a landmark year. First, the future of sustainable finance report 2026 projections all point to massive capital inflows. Second, regulation is catching up. Governments worldwide are introducing new rules, like the ESG fund reporting standards 2026, to crack down on false claims and create a level playing field. This increasing impact of regulation on ESG funds 2026 means more transparency and trust for investors like you.

The Gen Z Influence: How New Investors are Shaping Markets

We cannot overstate the impact of younger investors. The ethical investing for millennials 2026 guide is already standard, but Gen Z is taking it further. They see their investments as an extension of their values. They are digital-native, demand proof, and are fueling the growth of sustainable investing platforms and robo-advisors. This demographic shift is forcing asset managers to offer genuinely impactful products.

The Rise of “Impact” as a Core Metric

There’s a growing conversation about what is impact investing vs ESG. While ESG investing often focuses on reducing risk by picking good companies, impact investing actively seeks to create a specific, positive, and measurable social or environmental outcome alongside a financial return. Think: investing in a fund that builds affordable housing or finances clean water projects. In 2026, the lines will blur as more investors demand to know how to measure the impact of your investments in clear, simple terms.

Deep Dive: Unpacking ESG Funds in 2026

For most retail investors, the easiest way to invest sustainably is through ESG-focused funds. But what are they, really?

What Are ESG Funds and How Do They Really Work?

An ESG fund is a mutual fund or exchange-traded fund (ETF) that selects its investments based on those Environmental, Social, and Governance criteria.

The understanding ESG screening process for funds is key. A fund manager might:

- Exclude: Automatically remove industries like tobacco or controversial weapons.

- Integrate: Analyze the main ESG factors for every company, weighing, for example, Microsoft’s water use (E) against its data privacy policies (S) and board structure (G). This is what is ESG integration in asset management.

- Invest for Impact: Specifically choose companies whose core business model is solving a problem, like a solar panel manufacturer.

The global ESG fund flow trends 2026 show a clear preference for funds that can prove their integration strategy is more than just marketing.

ESG Mutual Funds vs ETFs 2026 Comparison: Which is Right for You?

Choosing between a mutual fund and an ETF depends on your investing style.

- ESG ETFs (Exchange-Traded Funds): These trade like stocks. They are often passive, meaning they track an index (like the “S&P 500 ESG Index”). This makes them great low-cost ESG index funds for beginners.

- ESG Mutual Funds: These are often actively managed, meaning a portfolio manager is picking stocks they believe will outperform. They might offer deeper ESG analysis but usually come with higher fees.

Your choice in the ESG mutual funds vs ETFs 2026 comparison depends on whether you prefer a low-cost, set-it-and-forget-it approach or are willing to pay more for expert management.

Finding the Best ESG Funds for Long-Term Growth 2026

Not all ESG funds are created equal. When researching, look for high-growth ESG funds to watch in 2026 and top-rated thematic ESG funds 2026 (funds that focus on one idea, like “clean energy” or “gender equality”).

When you’re evaluating ESG fund performance metrics, look beyond just the last year’s return. Check its holdings (what does it actually own?), its expense ratio (how much does it cost?), and its official ESG rating from sources like MSCI or Morningstar.

The Greenwashing Trap: How to Avoid Greenwashing in ESG Funds

This is one of the biggest risks of investing in ESG funds. What is greenwashing and how to spot it? Greenwashing is when a fund or company claims to be sustainable but its underlying practices (or investments) don’t back it up.

The lack of standardized ESG data has made this a huge problem. However, new regulations are helping. To protect yourself, always read the fund’s prospectus. If an “ESG” fund’s top 10 holdings look suspiciously like a standard S&P 500 fund, dig deeper. This is why avoiding greenwashing in ESG funds is a critical investor skill for 2026.

Green Bonds: Financing the Future

If ESG funds are about who you invest in, green bonds are about what you invest in.

Investing in Green Bonds for Retail Investors: A 2026 Guide

So, what are green bonds and how do they work? A green bond is a fixed-income investment (a loan) where the money raised is specifically earmarked for projects with positive environmental benefits.

When you buy a green bond, you are lending money to a corporation or government (like a city or state) for a set period. In return, you get regular interest payments (coupons). The key difference is that your money must be used for a qualified “green” project, suchas:

- Building a wind farm or solar park.

- Financing public transit like electric trains.

- Developing sustainable water management systems.

- Constructing energy-efficient “green” buildings.

In the past, these were mostly for big institutions. But now, investing in green bonds for retail investors is easier than ever through bond funds and ETFs.

Green Bond Market Growth Forecast 2026: What’s Driving Demand?

The green bond market growth forecast 2026 is astronomical. Why? The world needs trillions of dollars to finance the transition to a low-carbon economy. How do green bonds finance renewable energy? By providing the upfront cash needed to build massive projects.

Governments are using them to meet climate goals, and corporations like Apple and Google are using corporate green bonds examples 2026 to fund their own sustainability targets. This market is a core part of the future of the green bond market post-2025.

Green Bonds vs Social Bonds vs Sustainability Bonds: Understanding the Labels

You’ll see a few different “use-of-proceeds” bonds. The green bonds vs social bonds vs sustainability bonds debate is just about an asset’s primary goal:

- Green Bonds: Fund environmental projects.

- Social Bonds: Fund social projects, like affordable housing or public health. (e.g., social impact bonds (SIBs) explained 2026).

- Sustainability Bonds: A hybrid that funds both green and social projects.

- Blue Bonds: A newer, exciting trend. The rise of blue bonds for ocean conservation shows how niche and targeted these products are becoming.

How to Verify the Impact of Green Bond Projects

This is the most important part. How do you know your money is really building a wind farm?

- Green Bond Frameworks for Issuers: Before issuing the bond, the company publishes a “framework” explaining what projects qualify and how they will be managed.

- Green Bond Certification Process Explained: Issuers often get a “second-party opinion” from an independent verifier (like the Climate Bonds Initiative) to confirm the framework is solid.

- Impact Reporting for Green Bond Investors: This is the key. The issuer must provide regular reports (usually annually) that detail how the money was spent and, ideally, the impact it had (e.g., “megawatts of clean energy generated” or “tonnes of CO2 avoided”).

Risks Associated with Green Bond Investments: Are Green Bonds a Good Investment Right Now?

It’s important to remember that a green bond is still a bond. The main risks associated with green bond investments are the same as any bond:

- Interest Rate Risk: If interest rates go up, the value of your existing (lower-rate) bond may go down.

- Credit Risk: The risk that the issuer (the company or government) defaults on its payments. Can I lose money in green bonds? Yes, if the issuer goes bankrupt, just like with any other bond.

The “green” label doesn’t make it risk-free. However, tax advantages of municipal green bonds (issued by cities or states) can make them very attractive, as the interest is often free from federal tax. Always assess the credit-worthiness of the issuer, not just the “green-ness” of the project.

The Big Question: Impact on Returns

This is the question that stops most investors: Does sustainable investing hurt returns? For decades, the myth of sacrificing returns for ethics was the biggest barrier to entry.

Let’s be clear: the data no longer supports this myth.

The Financial Performance of ESG Portfolios 2026: What the Data Says

Overwhelmingly, the academic studies on ESG and financial performance show a positive or neutral correlation. Very few studies show a consistent negative impact.

In many cases, the financial performance of ESG portfolios 2026 is expected to be stronger than traditional ones. Why? Because companies that score high on ESG metrics are often:

- More Efficient: They use less energy and create less waste, saving money.

- Less Risky: They have better relationships with regulators, fewer (expensive) scandals, and higher employee retention.

- More Innovative: They are focused on the products and services of the future, not the past.

The ESG investing vs traditional investing performance debate is largely settled. You no longer have to choose between doing good and doing well.

Evidence of ESG Alpha Generation: How ESG Factors Impact Stock Prices

“Alpha” is the investing term for returns that are above the market average. There is growing evidence of ESG alpha generation.

Here’s how ESG factors impact stock prices: A company with strong governance (G) is less likely to have a sudden accounting scandal that tanks its stock. A company with good social practices (S) attracts better talent and has more loyal customers. A company focused on the environment (E) is avoiding future carbon taxes and regulatory fines.

This isn’t magic; it’s risk management. Good ESG is simply good business. The correlation between ESG scores and profitability is becoming a core metric for smart analysts.

Analyzing the “ESG Premium” in 2026: Are Ethical Investments More Expensive?

This is a common question. Are ethical investments more expensive?

Sometimes, yes. An actively managed ESG mutual fund might have a higher expense ratio than a simple S&P 500 ETF. However, the rise of low-cost ESG index funds for beginners has made this almost a non-issue. You can now build a sustainable portfolio for the same price as a traditional one.

The “ESG premium” is less about fees and more about whether high-ESG-scoring stocks are becoming “overvalued” because everyone wants them. While this is a risk to watch, the long-term financial benefits of sustainable investing—like lower volatility and resilience during downturns—are often seen as worth it.

Long-Term Financial Benefits of Sustainable Investing

Looking ahead, the risk-adjusted returns of ethical portfolios are the real prize. These portfolios may offer more stability. By screening out companies with high-risk practices, you are essentially trimming the fat from your portfolio and insulating yourself from “headline risk.”

As we move toward 2026, sustainable investing performance benchmarks 2026 are becoming more common, allowing for a truer comparison. And consistently, they are showing that ESG investing positive returns proof is not an anomaly; it’s the new norm.

Case Studies in Action: Where Principles and Profit Meet

Theory is great, but let’s look at real-world successful sustainable investing case studies 2026.

Case Study: The Ørsted Green Energy Transition Case Study

One of the best companies with high ESG ratings that perform well is Ørsted, a Danish power company. A decade ago, it was one of Europe’s most fossil-fuel-intensive utilities.

Then, it made a radical decision. It sold off all its oil and gas assets and went all-in on offshore wind energy. The Ørsted green energy transition case study is now a textbook example of ESG integration. The result? It became a global leader in clean energy and its stock price soared, delivering massive returns to investors who believed in its new vision.

Case Study: Patagonia Impact Investing Model Explained

Patagonia is famous for its “Don’t Buy This Jacket” ad. But its impact goes deeper. The Patagonia impact investing model explained through its “Tin Shed Ventures” fund shows how impact investing generates financial returns.

They invest in start-ups that are solving environmental problems, from regenerative organic food to water-saving technologies. They prove that you can build a highly profitable business because of your mission, not in spite of it. This is a model many are trying to copy.

Case Study: How Tesla’s ESG Controversy Affects Investors

ESG isn’t always simple. The how Tesla’s ESG controversy affects investors case is a perfect example. Tesla is undeniably good for the “E” (Environment) by accelerating the world’s transition to electric vehicles.

However, it has faced serious criticism on the “S” (Social) for reports of poor factory conditions and the “G” (Governance) for its unconventional board and CEO behavior. This is why some ESG funds don’t hold Tesla. It’s a powerful lesson that you have to look at the whole picture. This also serves as one of the examples of failed ESG strategies for funds that only looked at the “E.”

Case Study: Unilever’s ESG Integration and Market Performance

The ESG integration case study Unilever is a classic. For years, Unilever (which owns brands like Dove and Ben & Jerry’s) has been a leader in linking its corporate strategy to sustainability goals. They have been transparent in their impact reporting and have consistently argued that this focus drives growth and customer loyalty.

While not every strategy is perfect, Unilever has shown that a giant, global consumer-goods company can embed sustainability into its DNA and outperform its peers over the long term. It’s a key example we learn from, just as we learn from lessons from green bond project failures to make the market stronger.

Top Sustainable Investment Opportunities 2026: Beyond Mainstream ESG

As the market matures, exciting new themes are emerging. These are the top sustainable investment opportunities 2026 that are on the cutting edge.

Circular Economy Investing Opportunities 2026

The old model was “take-make-waste.” The circular economy investing opportunities 2026 focus on a new model: “reduce-reuse-recycle.” This means investing in companies that design waste out of their products, companies that specialize in recycling and reprocessing, or businesses built on a “rental” or “sharing” model.

Investing in Biodiversity and Natural Capital

This is one of the most critical new frontiers. For too long, we’ve ignored the value of nature. Investing in biodiversity and natural capital means funding projects or companies involved in reforestation, sustainable agriculture (investing in sustainable agriculture 2026), or protecting ocean health. This is linked to the rise of blue bonds for ocean conservation.

Investing in Clean Technology Innovation 2026

This goes beyond just solar and wind. Investing in clean technology innovation 2026 includes areas like:

- Green hydrogen

- Carbon capture and storage

- Battery technology and grid-scale storage

- Role of AI in ESG data analysis (to better find and rank companies)

Gender-Lens Investing Funds 2026 and Social Impact Bonds (SIBs)

The “S” in ESG is getting its due. Gender-lens investing funds 2026 direct capital to companies that promote gender equality in their leadership and supply chains. At the same time, social impact bonds (SIBs) explained 2026 are gaining traction as a way to fund specific social programs, like reducing homelessness, where investors are paid based on the program’s success. Other areas to watch include community development financial institutions (CDFIs) investing and ethical investing in emerging markets 2026.

Building a Sustainable Investment Portfolio 2026: A Step-by-Step Guide

Ready to get started? Building a sustainable investment portfolio 2026 is easier than you think.

Creating a Personal Ethical Investing Framework

First, define what matters to you. This is your sustainable investing checklist for beginners.

- What are your non-negotiables? (e.g., “I will not invest in fossil fuels, period.”)

- What impact do you want to have? (e.g., “I want to support clean energy” or “I want to promote diversity.”)

- What is your risk tolerance? (Are you a conservative investor or an aggressive one?)

Creating a personal ethical investing framework before you invest will be your North Star.

How to Start Ethical Investing with $1000

You don’t need to be wealthy. If you’re wondering how to start ethical investing with $1000 (or even less), the answer is simple: ESG ETFs.

You can open an account with a brokerage or use sustainable investing platforms and robo-advisors (like Stash, Aspiration, or Betterment). These platforms are designed for beginners and allow you to buy fractional shares of low-cost ESG funds, so even how to start impact investing with little money is possible.

Finding a Financial Advisor for Ethical Investing

If you want more personalized help, look for a “green” or “SRI” advisor. When finding a financial advisor for ethical investing, ask them two questions:

- “How do you integrate ESG and sustainable investing into your practice?”

- “How will you help me avoid greenwashing?”

A good advisor will be ableto help you align your personal framework with a sound financial plan. This process also enables shareholder activism for sustainability 2026, as advisors can vote on your behalf at company meetings.

Conclusion: The Future is Profitable and Principled

The how will ethical investing evolve by 2026 question is clear: it will simply become investing. The separation between “sustainable” and “traditional” finance is disappearing.

The sustainable investing trends 2026 show a market that is more transparent, data-driven, and impact-focused than ever before. From high-growth ESG funds and a booming green bond market to new frontiers like biodiversity, the opportunities are vast.

We’ve moved past the myth of sacrificing returns for ethics. We now have clear ESG investing positive returns proof. The future of sustainable finance is one where your portfolio can be a powerful engine for building the world you want to live in, all while securing your own financial future. The only question left is: are you ready to be a part of it?

For more information on sustainable principles, you can visit authoritative sources like the UN Principles for Responsible Investment (UNPRI) or the Global Reporting Initiative (GRI) for corporate standards.

Frequently Asked Questions (FAQ) About Sustainable Investing in 2026

1. Is sustainable investing really profitable?

Yes. Overwhelmingly, academic studies on ESG and financial performance show that companies with high sustainability ratings often meet or exceed the performance of their non-ESG peers. This is because they typically manage risk better, are more innovative, and have more loyal customers. The long-term financial benefits of sustainable investing are well-documented.

2. How do I know if a fund is truly ethical?

This is the challenge of greenwashing. To know how to avoid greenwashing in investments, you must look “under the hood.” Don’t just trust the name. Read the fund’s prospectus, look at its top 10 holdings, and check its ESG score on independent platforms like Morningstar or MSCI. Look for funds that offer clear impact reporting.

3. What is the difference between ESG and SRI?

SRI (Socially Responsible Investing) is the older-style, typically based on “negative screening” (e.g., excluding tobacco or weapons). ESG (Environmental, Social, Governance) is a more modern, data-driven approach. It uses “positive screening” to find the best companies in each sector based on their environmental, social, and governance practices.

4. Can I lose money in green bonds?

Yes. A green bond is still a bond, and it carries the same risks as traditional bonds. The primary risks are credit risk (the issuer defaults on payments) and interest rate risk (the bond’s value falls if market rates rise). The “green” label refers to the use of proceeds, not to a guarantee of profit or safety.

5. What are the main ESG factors?

- Environmental (E): Carbon emissions, water use, pollution, renewable energy, waste management.

- Social (S): Employee treatment, diversity and inclusion, customer privacy, data security, community relations, supply chain labor standards.

- Governance (G): Executive pay, board diversity, shareholder rights, bribery and corruption, political lobbying.

6. What is impact investing vs ESG?

ESG investing typically involves investing in public companies (stocks and bonds) that have good ESG ratings, with the goal of getting strong, risk-adjusted returns. Impact investing is more targeted. It involves making investments (often private) with the specific, measurable intent to create a positive social or environmental outcome alongside a financial return (e.g., funding a clean-water startup).

7. How much of my portfolio should be sustainable?

This is a personal choice. Some investors start with a small “sleeve” of 10-20% dedicated to ESG. However, because ESG principles are increasingly seen as a core part of risk management, many financial advisors now recommend integrating ESG factors across 100% of your portfolio.

8. Are ethical investments more expensive?

They used to be, but not anymore. While some actively managed mutual funds have high fees, the analyzing the “ESG premium” in 2026 shows that low-cost ESG index funds for beginners (especially ETFs) are now just as cheap as their traditional, non-ESG counterparts.

9. What are the biggest challenges of ethical investing in 2026?

The main challenges are data and definitions. The lack of standardized ESG data means one rating agency might score a company high while another scores it low. The other major challenge is greenwashing, or a company/fund making false or misleading claims about its sustainability. New regulations are actively trying to solve both of these challenges of ethical investing in 2026.

10. How to start impact investing with little money?

While many “pure” impact investments are private and require a lot of money, you can start small. Look for “public equity impact funds” (ETFs or mutual funds) that focus on specific themes like clean energy or gender equality. Platforms like community development financial institutions (CDFIs) also offer ways to invest in your local community with smaller amounts.

11. How will the political backlash against ESG investing affect me?

The political backlash against ESG investing is a real trend, with some politicians claiming it’s a political movement. However, for most long-term investors, this is just “noise.” The core drivers of ESG (risk management, efficiency, innovation, and consumer demand) are powerful economic forces that are independent of politics. Savvy investors focus on the long-term data, not the short-term headlines.

12. What are the 2026 regulations for ESG I should know about?

You don’t need to be a legal expert, but the key trend is transparency. In Europe (with its SFDR rules) and increasingly in the U.S. (with new SEC proposals), regulators are forcing funds to prove their ESG claims. This means more standardized ESG fund reporting standards 2026, which is great news for investors. It makes it easier to compare funds and spot greenwashing.