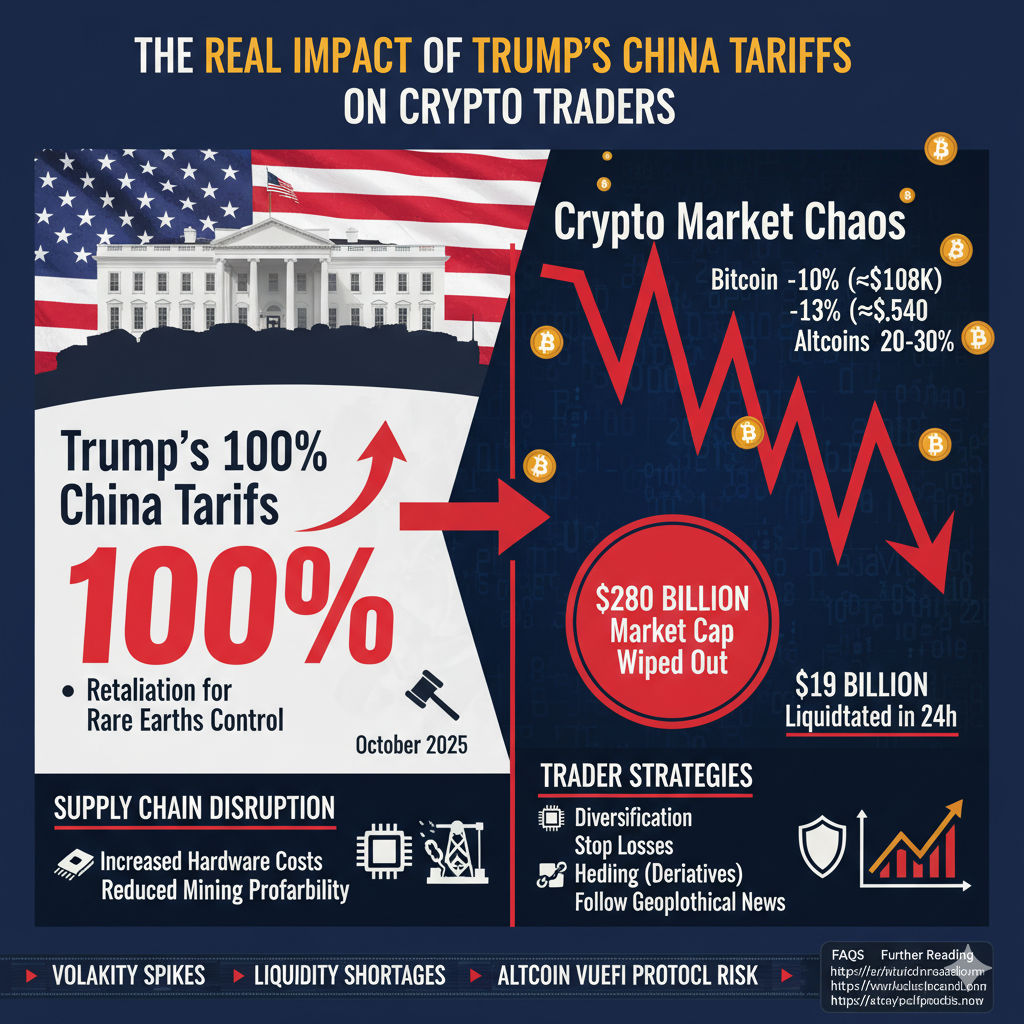

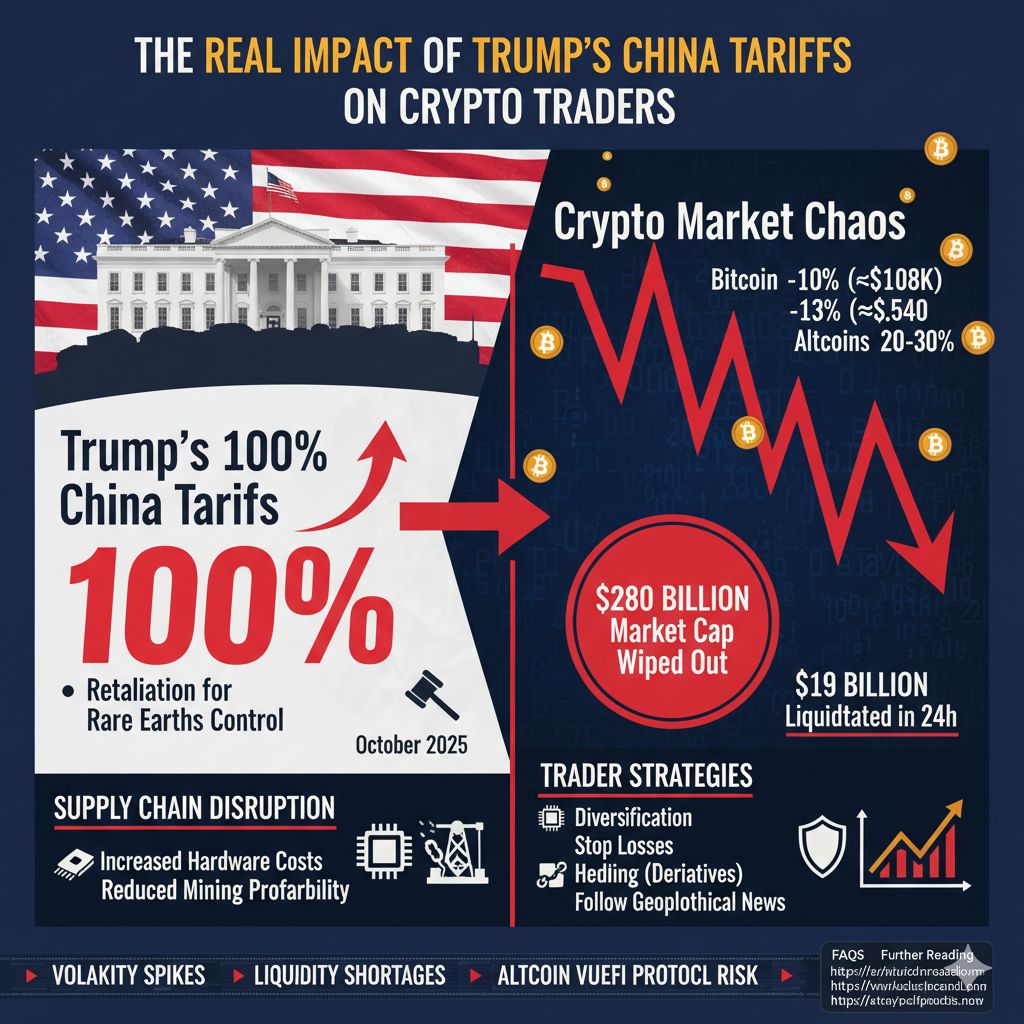

In October 2025, President Donald Trump announced a plan to impose a sweeping 100% tariff increase on imports of Chinese goods, including critical software and technology components. This tariff hike comes as retaliation against China’s recent export controls on rare earth minerals essential for tech manufacturing. The announcement triggered one of the most dramatic crashes in cryptocurrency markets this year, wiping out billions in a matter of hours and setting off widespread trader liquidations. For crypto traders, understanding the Trump 100% China tariff impact on Bitcoin and the broader crypto ecosystem has never been more critical.

How Trump’s 100% China Tariff Changed the Crypto Market Landscape

President Trump’s decision increases existing tariffs on Chinese imports to a combined 130%, giving the US government new tools to counter China’s export restrictions. The market initially reacted with shock as Bitcoin slid over 10% from recent highs, briefly dipping below $108,000, while Ethereum plunged over 13%. Smaller altcoins like XRP and Solana suffered steep losses of 20-30%, illustrating the broad impact of the tariff escalation. The crypto market lost nearly $280 billion in market cap at the peak of panic selling, with over $19 billion liquidated in a single day [1][2][3].

What Crypto Traders Should Know About the Tariff Effects on Bitcoin and Ethereum Prices

Cryptocurrency prices are highly sensitive to geopolitical developments, and Trump’s tariff announcement exemplifies this. The Bitcoin price forecast post China tariffs shows likely continued volatility, as uncertainty around supply chain disruptions and escalating trade tensions linger. Ethereum’s sharp drop highlights how crypto platforms reliant on Chinese tech and software face heightened risk. Traders need to closely monitor these price movements, considering both short-term correction opportunities and potential long-term recovery reinforced by market fundamentals.

Why China’s Export Controls Matter to Crypto Technology and Mining

China’s new restrictions on rare earth minerals, essential for manufacturing semiconductors and mining hardware, severely affect the crypto supply chain. The combined effect of export controls and the 100% tariffs raises the cost of mining equipment, slowing down hardware availability globally. This results in a direct impact on mining profitability and operational efficiency. Understanding impact of tariffs on crypto mining hardware and China tariffs and crypto mining profitability is essential when evaluating investment risk in mining operations [1][2].

How to Trade Crypto During US-China Trade War and Tariff-Induced Volatility

The ongoing fallout from tariff escalations requires traders to adapt strategic approaches. Understanding trading crypto during US-China trade conflict involves focusing on risk diversification, setting stop losses, and exploring hedging with crypto derivatives. Active traders should also watch for liquidation signals and volume spikes triggered by market panic. Trader sentiment can be volatile, making it crucial to follow geopolitical news and tariff updates to time entries and exits effectively.

Altcoin Markets and DeFi Protocols Under Tariff Pressure

While Bitcoin and Ethereum dominate headlines, many altcoins saw the greatest pressure in this tariff episode. Tokens like XRP and Dogecoin dropped over 30%, illustrating high sensitivity to supply-related shocks. Decentralized finance (DeFi) projects, heavily dependent on software imports and innovation cycles, face disruption as well. The tariffs effect on altcoins in 2025 and impact of tariffs on DeFi protocols will continue to shape market dynamics as traders assess which protocols maintain resilience.

Trader Liquidations and Market Volatility Explained

The immediate result of Trump’s tariff announcement was a record-setting $19 billion in liquidations, the largest single-day wipeout recorded. More than 1.6 million trader positions were liquidated in 24 hours, with roughly $7 billion in forced sell-offs occurring in one hour alone. This cascading effect intensified market crashes and widened volatility, highlighting the risks inherent in high-leverage crypto trading. Awareness of liquidation in crypto after Trump tariffs and effective liquidation risk management is critical.

How Tariffs Affect Cryptocurrency Exchange Volumes and Liquidity

With volatility surging, trading volumes initially spiked but quickly gave way to liquidity shortages in various markets. Crypto exchanges experienced heightened volatility in order books, with some facing temporary liquidity stress, which complicated trading executions. Monitoring crypto exchange volume trends amid tariff-induced volatility helps traders gauge market health and fine-tune execution strategies.

Protecting Crypto Investments in an Uncertain Tariff Era

To mitigate tariff-driven risks, investors should consider diversification across assets, including stablecoins and less China-dependent cryptocurrencies. Employing hedging techniques via futures and options can shield portfolios from sudden downturns. Staying informed on how to protect crypto investments from tariffs through careful portfolio management and timely responses remains paramount.

FAQs About Trump’s 100% China Tariffs and Crypto Trading

1. What is the actual tariff rate imposed on Chinese imports?

The US has increased tariffs by 100% on top of existing rates, bringing total tariffs on many Chinese goods to around 130%.

2. How much did Bitcoin and Ethereum prices drop after the tariff announcement?

Bitcoin dropped more than 10%, briefly dipping below $108,000, while Ethereum fell over 13% to around $3,540.

3. Why did the crypto market react so strongly to the tariffs?

The tariffs escalate trade tensions and disrupt technology supply chains crucial to crypto mining and software development, triggering panic selling.

4. What was the scale of liquidations in the crypto market?

Approximately $19 billion in positions were liquidated in 24 hours, with $7 billion wiped out in less than one hour.

5. How do tariffs affect crypto mining profitability?

Tariffs increase the cost of mining hardware imported from China, reducing profit margins for mining operations.

6. Are altcoins more vulnerable to the tariff effects than Bitcoin?

Many altcoins saw sharper percentage losses due to heavier exposure to Chinese technology inputs and lower liquidity.

7. How can traders shield themselves from tariff-related volatility?

Risk management strategies such as stop-loss orders, diversification, and hedging with derivatives are essential.

8. Is there potential for crypto market recovery after tariffs?

Yes. Historical patterns suggest that after initial sell-offs, markets can rally, particularly if trade tensions ease.

Backlinks for Further Reading and Research

- Comprehensive trade and finance insights are available in the OECD Business and Finance Outlook.

- Stay updated on latest crypto market reactions to trade policies via Cointelegraph’s in-depth analysis.

- For practical long-tail SEO keyword strategies linked to tech markets, visit the SEMrush Long-tail Keywords guide.

Conclusion

Trump’s imposition of a 100% tariff increase on Chinese imports simultaneously escalates trade tensions and disrupts global crypto markets. The ensuing market crashes, volatility, and liquidation waves underline the importance for traders to adopt flexible strategies, stay informed on geopolitical developments, and employ strong risk management. Understanding the full scope of tariff impacts from hardware to software supply chains positions traders to navigate the complex, dynamic world of crypto trading in this new era.