For decades, the standard treatments for mental health conditions like depression, PTSD, and anxiety have offered hope to many, but have left millions more behind. Now, we are on the cusp of a paradigm shift in psychiatry, one that involves a class of compounds once relegated to the counterculture: psychedelics. Groundbreaking clinical trials are showing that substances like psilocybin (from magic mushrooms) and MDMA can produce remarkable, lasting benefits when used in a therapeutic setting.

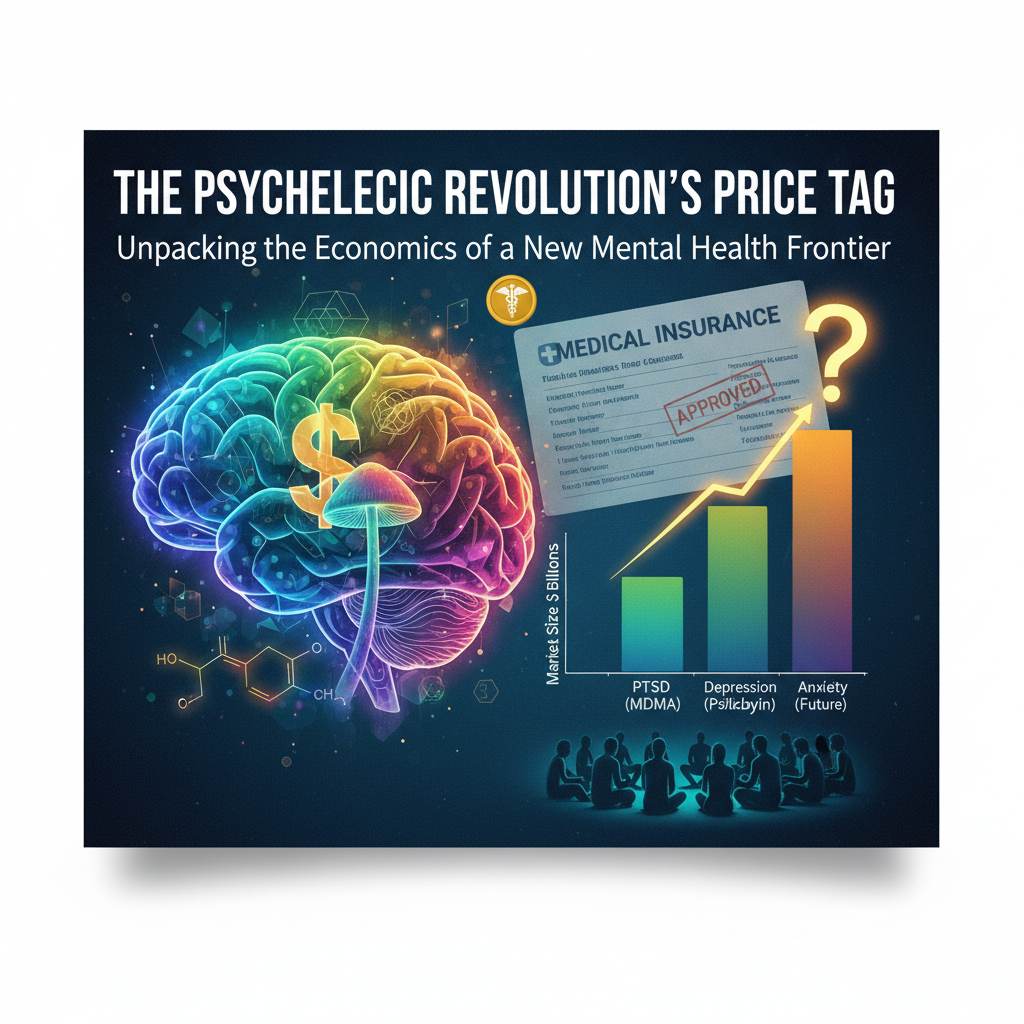

As these treatments move closer to FDA approval, the conversation is shifting from “Do they work?” to a far more complex set of questions: “What is the business of healing?” and “What is the price of a breakthrough?” This isn’t just about medicine; it’s about the emergence of a multi-billion-dollar industry from the ground up.

This analysis will cut through the hype to explore the real economics of regulated psychedelics for mental health treatment. We will dissect the potential market size, explore the business models for a new kind of clinic, navigate the high-stakes investment landscape, and tackle the critical question of who will ultimately pay for these transformative, yet potentially expensive, therapies.

The Multi-Billion Dollar Question: What is the Potential Market Size for Psychedelic Therapies?

Before a single dollar is invested, analysts want to know the size of the prize. The potential market for psychedelic-assisted therapies is staggering, primarily because the conditions they aim to treat are so widespread and costly to society.

A Realistic Market Analysis for Psilocybin and MDMA Treatments

The two leading candidates closest to potential FDA approval are MDMA for Post-Traumatic Stress Disorder (PTSD) and psilocybin for Treatment-Resistant Depression (TRD) and Major Depressive Disorder (MDD).

To create a realistic market forecast, we can’t simply multiply the number of patients by a potential treatment cost. We have to consider factors like patient willingness, therapist availability, regulatory rollout, and insurance coverage. Early projections from market research firms suggest that the annual market for these therapies could reach well into the tens of billions of dollars within the next decade. This is driven by the sheer number of people suffering. For example, millions of adults in the U.S. alone suffer from PTSD, and an even larger number from depression.

Comparing the Addressable Market for Depression, PTSD, and Anxiety

While often grouped together, the target markets for different psychedelic compounds have unique characteristics.

- PTSD (MDMA): The initial target market includes veterans and first responders, a population with high rates of PTSD and often supported by government healthcare systems like the VA. This provides a clear initial pathway for reimbursement and adoption. The broader civilian market is also substantial.

- Depression (Psilocybin): This represents a potentially larger, more diverse market. The focus on Treatment-Resistant Depression is a strategic first step, as these patients have already failed multiple other treatments, creating a clear and urgent medical need that insurers are more likely to recognize.

- Anxiety and Other Indications: Beyond the front-runners, research is underway for using psychedelics to treat Generalized Anxiety Disorder (GAD), substance use disorders, and end-of-life distress. Each of these represents a significant market expansion opportunity.

Long-Term Market Forecast for the Psychedelic Medicine Sector

Looking beyond the first wave of approvals, the long-term market forecast for the psychedelic medicine sector is exceptionally robust. The potential for these therapies to offer a “curative” or long-remission treatment with just a few sessions—as opposed to a lifetime of daily pills—is a disruptive value proposition. If this promise holds true, psychedelics could not only capture a significant share of the existing $240 billion global mental health market but also expand it by bringing in patients who have given up on conventional treatments.

Building the Business: Viable Business Models for Psychedelic-Assisted Therapy Clinics

Psychedelic medicine isn’t just a pill you pick up from the pharmacy. The treatment protocol involves a combination of the drug itself and extensive therapy. This unique model requires a new kind of infrastructure and business strategy.

A Breakdown of the Cost of Delivering Psychedelic Therapy

The price of a full course of psychedelic-assisted therapy will be significant, with early estimates ranging from $10,000 to $15,000. This isn’t just the cost of the drug, which may only be a small fraction. The majority of the cost is for the labor-intensive therapy model:

- Preparatory Sessions: Multiple hours with one or two trained therapists to build trust and prepare the patient.

- Dosing Session: An 6-8 hour session with constant monitoring by two therapists.

- Integration Sessions: Several follow-up therapy sessions to help the patient process the experience and integrate the insights into their life.

The high cost is driven by the need for highly trained professionals, specialized clinical spaces, and significant time commitment per patient.

How Will Psychedelic Therapy Clinics Become Profitable?

The path to profitability for these clinics relies on a few key factors. First is optimizing the use of physical space and therapist time. Second is establishing efficient workflows for patient intake, treatment, and follow-up. Third, and most importantly, is securing insurance reimbursement. A cash-only model will severely limit the patient pool. Profitable ketamine infusion clinics have already provided a partial roadmap, but the psychedelic therapy model is even more time-intensive. Success will depend on creating a scalable system that doesn’t compromise the quality and safety of the therapeutic container.

Exploring Different Psychedelic Therapy Delivery Models

To address cost and scalability, various delivery models are being explored. These include:

- High-End Wellness Centers: Offering a premium, comfortable experience for those who can pay out-of-pocket.

- Hospital and Institutional Partnerships: Integrating psychedelic therapy into existing hospital psychiatric departments.

- Group Therapy Models: Research is exploring the efficacy of conducting parts of the therapy in a group setting to reduce the cost per patient, a model that could be crucial for broader access.

The Investor’s Dilemma: Navigating the Psychedelic Pharmaceutical Investment Landscape

The buzz around psychedelics has created a gold rush atmosphere for investors. However, this is a high-risk, high-reward sector that requires careful navigation.

A Guide to Investing in Psychedelic Biotech Stocks

Investing in this space means betting on the outcome of clinical trials and FDA decisions. The landscape is dominated by biotech companies like COMPASS Pathways (developing psilocybin) and Atai Life Sciences (a holding company with a diverse portfolio). When evaluating these companies, investors should look at:

- The strength of their clinical trial data.

- The size and experience of their management team.

- Their cash position to fund incredibly expensive multi-phase trials.

- Their intellectual property strategy.

As an emerging sector, the stocks are highly volatile and sensitive to news about clinical trial results and regulatory changes.

Analyzing the Patent Strategies of Top Psychedelic Companies

A major point of controversy and a key factor for investors is the patent strategy. Since the basic psychedelic molecules (psilocybin, MDMA) are in the public domain, companies are seeking patents on specific manufacturing processes, new formulations (e.g., a non-hallucinogenic version), and standardized therapy protocols. A strong patent portfolio is seen as crucial for protecting a company’s investment and ensuring a period of market exclusivity to recoup R\&D costs. This is a complex area, as detailed in the FDA’s guidance on psychedelic clinical trial development.

Key Regulatory Hurdles Affecting Psychedelic Investment Returns

The biggest hurdle is, of course, FDA approval. A failed Phase 3 trial can wipe out a company’s value overnight. Beyond that, companies face DEA scheduling. Even after approval, these drugs will be tightly controlled substances, which adds layers of complexity to manufacturing, distribution, and prescription. Navigating this federal and state regulatory maze will be a major operational challenge and a key determinant of success.

The Price of Healing: Will Insurance Cover FDA-Approved Psychedelic Treatments?

For psychedelic therapy to reach the millions who need it, it cannot be a luxury for the wealthy. The single most important economic question is about insurance coverage.

The Economic Case for Health Insurance Coverage of Psychedelic Therapy

Insurers make cold, hard calculations based on cost-effectiveness. The case for covering psychedelic therapy is compelling. While the upfront cost is high, it could be significantly cheaper in the long run than the current standard of care for chronic mental illness. This includes years of therapy, multiple failed antidepressant prescriptions, lost productivity, and costs associated with hospitalization or disability. A treatment that can lead to lasting remission after a few sessions represents a massive potential long-term saving.

[Image of a medical insurance claim form]

A Cost-Benefit Analysis of MDMA Therapy for Veterans with PTSD

Consider the case of a veteran with severe PTSD. The lifetime cost to the healthcare system and society can be enormous. Clinical trials, such as those conducted by the Multidisciplinary Association for Psychedelic Studies (MAPS), have shown that MDMA-assisted therapy can lead to a durable remission of symptoms in a majority of participants. A rigorous cost-benefit analysis of MDMA therapy would almost certainly show that the high upfront cost is a sound investment compared to the alternative of decades of ongoing, and often ineffective, treatment. You can read more about the groundbreaking results on the MAPS website.

Challenges in Getting Insurance Reimbursement for Psychedelic Medicine

Despite the strong economic case, securing reimbursement will be an uphill battle. Insurers are traditionally slow to adopt new, high-cost treatments. They will want to see long-term data on the durability of the effects. There are also logistical challenges in creating new billing codes for a treatment that combines both a drug and a complex therapeutic service. The initial rollout of coverage will likely be slow and may contain restrictive pre-authorization requirements.

The Road Ahead: Future Economic and Regulatory Challenges

The path to a mature psychedelic medicine market is filled with complex challenges that will shape the industry for years to come.

The Debate Over Psychedelic Drug Patents and Intellectual Property

The fight over patents is one of the most contentious issues in the field. Critics argue that companies are trying to “patent the unpatentable” by claiming inventions around naturally occurring molecules and ancient practices. Proponents argue that patents are essential to attract the hundreds of millions of dollars in investment needed to get these drugs through the rigorous FDA approval process. This ethical and legal battle will determine whether the market is dominated by a few large pharmaceutical players or allows for more competition.

How State-Level Legalization Could Impact the Medical Model

While the pharmaceutical industry is pursuing the medical, FDA-regulated path, a parallel movement is happening at the state level (e.g., Oregon and Colorado) to create regulated systems for adult use of psychedelics. These two models could coexist, compete, or clash. The state-level initiatives could potentially offer a lower-cost, more accessible option, but without the rigorous safety standards and insurance coverage of the medical model. The interplay between these two paths will be a major economic storyline to watch.

Frequently Asked Questions (FAQ)

1. How much will psychedelic-assisted therapy actually cost a patient?

Early estimates for a full course of treatment (including therapy) range from $10,000 to $15,000. The final out-of-pocket cost for a patient will depend entirely on the extent of health insurance coverage.

2. Why is the cost of delivering psychedelic therapy so high?

The high cost is not from the drug itself but from the labor-intensive therapeutic model. It requires 15-20+ hours of time from highly trained therapists for preparation, an 8-hour dosing session, and follow-up integration sessions.

3. Is it likely that health insurance will cover psilocybin treatment for depression?

Yes, it is considered likely, but it will take time. Insurers will likely cover it once it’s FDA-approved, especially for Treatment-Resistant Depression, because it may prove more cost-effective in the long run than current treatments.

4. What is the potential market size for psychedelic medicine?

Given the high prevalence of conditions like depression, PTSD, and anxiety, credible market forecasts project the annual market could reach tens of billions of dollars within 5-10 years of FDA approval.

5. What are the biggest risks when investing in psychedelic biotech stocks?

The biggest risks are clinical trial failures and regulatory rejection by the FDA. These are high-risk, high-reward investments where a single negative result can have a devastating impact on a stock’s price.

6. How do psychedelic therapy clinics plan to make money?

Their business model relies on a combination of patient volume, operational efficiency, and, most critically, securing reimbursement contracts with insurance companies to make the treatment accessible beyond wealthy individuals.

7. What is the role of ketamine clinics in the psychedelic industry?

Ketamine clinics, which are already legal and operational, serve as a real-world business model. They provide valuable lessons on clinic management, patient acquisition, and navigating the challenges of offering therapy outside of traditional drug protocols.

8. What are the main regulatory hurdles for psychedelic companies?

The primary hurdles are successfully navigating the multi-phase FDA clinical trial process, gaining final FDA approval, and then dealing with the tight restrictions from the DEA regarding the scheduling and handling of these controlled substances.

9. How do patents work for psychedelic drugs if the molecules are old?

Companies are not patenting the original molecules like psilocybin. Instead, they file patents on novel drug delivery methods, specific manufacturing processes, new synthetic variations of the molecules, and standardized treatment protocols.

10. What is the difference between the medical model and state-level legalization?

The medical model involves FDA approval, prescription by a doctor, and administration in a clinical setting with insurance coverage. State-level legalization (like in Oregon) creates a regulated system for adult access outside the medical framework, typically without insurance coverage.

11. How does the cost-effectiveness of psychedelic therapy compare to antidepressants?

While the upfront cost is much higher, psychedelic therapy could be more cost-effective over a lifetime. It offers the potential for long-term remission after a short course of treatment, potentially eliminating decades of costs from daily antidepressants, therapy, and lost productivity.

12. What is the long-term investment outlook for the psychedelic sector?

The long-term outlook is considered very strong by many analysts, assuming regulatory approvals are granted. The disruptive potential to fundamentally change mental healthcare for tens of millions of people represents a massive and durable investment thesis.