For decades, the story of American manufacturing was one of departure. Factory gates were shuttered, jobs moved overseas in search of lower costs, and the phrase “Made in the USA” became a nostalgic echo of a bygone era. But the global economic tides are turning. A powerful combination of supply chain shocks, geopolitical shifts, and technological advancements is fueling a historic reversal.

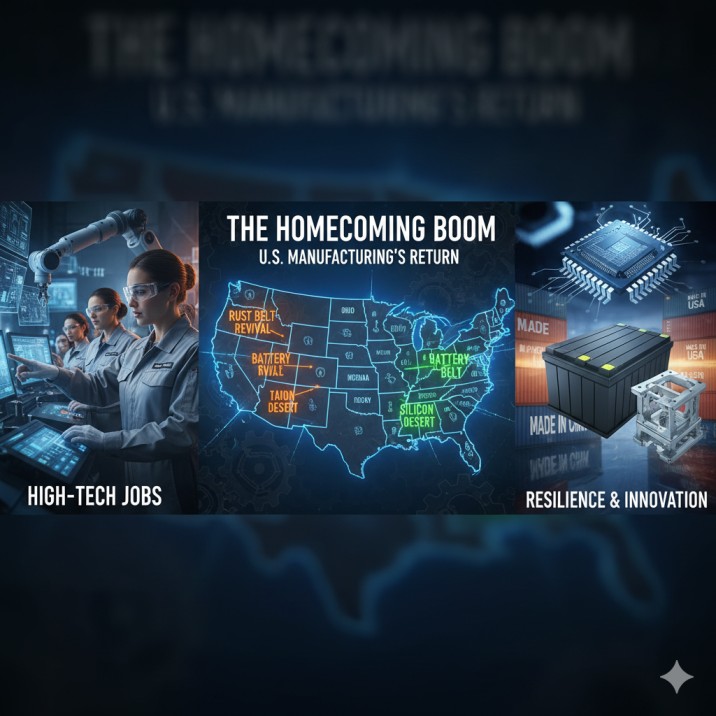

This is the story of deglobalization, and it’s doing more than just changing trade routes—it’s actively reshaping U.S. manufacturing jobs in real-time. We are witnessing the rise of “reshoring” (bringing production back to America) and “friend-shoring” (moving it to allied countries), a trend that is creating a new generation of high-tech, high-skill factory jobs and revitalizing entire regions of the country.

This comprehensive analysis will explore the forces driving this manufacturing renaissance, uncover the new types of jobs being created on the modern factory floor, and pinpoint exactly which states are benefiting most from this homecoming boom. For anyone interested in the future of the American economy, this is a trend you can’t afford to ignore.

The Great Reversal: Understanding the Forces Behind the Shift

The decision to pack up a factory and move it halfway across the world was always a calculated risk. For years, the benefits of cheap labor and production outweighed the downsides. Now, the risk calculation has fundamentally changed.

What is Driving the Trend of Bringing Manufacturing Back to the US?

The reasons for U.S. manufacturing reshoring are multifaceted, creating a perfect storm that is pushing companies to reconsider their global footprint:

- Supply Chain Vulnerability: The COVID-19 pandemic was a brutal wake-up call. It exposed the extreme fragility of long, complex supply chains. Sudden lockdowns overseas led to massive shortages of everything from medical supplies to computer chips, forcing companies to realize that the “just-in-time” global model was also “just-one-crisis-away” from collapse. The impact of supply chain disruptions on offshoring became a painful lesson in risk management.

- Geopolitical Tensions: Rising trade friction and strategic competition, particularly with China, have made relying on a single country for critical components a significant national security and business risk. This has led to a major push to secure supply chains for essential goods.

- Rising Costs Abroad: The massive labor cost advantage that once lured companies overseas is shrinking. Wages in many parts of Asia have risen steadily, while increased shipping and logistics costs have further eroded the financial benefits of offshoring.

- A Push for Innovation: Companies have realized that separating their research and development teams in the U.S. from their manufacturing facilities abroad creates a disconnect that stifles innovation. Bringing production closer to home accelerates the product development cycle.

Reshoring vs. Friend-Shoring: A Simple Explanation of Key Terms

As you read about this trend, you’ll encounter two key terms. The difference between reshoring and friend-shoring is simple but important:

- Reshoring (or Onshoring): This is the process of bringing manufacturing operations that were previously moved overseas back to the United States. A company closing its factory in Vietnam to open a new one in Ohio is a classic example of reshoring.

- Friend-Shoring (or Ally-Shoring): This is the strategy of moving manufacturing operations from geopolitical rivals to countries that are considered friendly and stable allies. For example, a U.S. company might move its supply chain from China to Mexico, Vietnam, or India. While this doesn’t create a job in the U.S. directly, what friend-shoring means for U.S. jobs is a more secure and resilient supply of parts and materials for American factories.

The New Factory Floor: The Types of Manufacturing Jobs Being Created

When people hear “manufacturing jobs are coming back,” they might picture the noisy, repetitive assembly lines of the 20th century. This couldn’t be further from the truth. The factory of today is a clean, quiet, and highly digitized environment.

It’s Not Your Grandfather’s Factory: The Rise of Advanced Manufacturing Roles

The new types of advanced manufacturing jobs in the U.S. are less about manual labor and more about brainpower. These “smart factories” are powered by data, robotics, and artificial intelligence. The role of automation in reshored factories isn’t about replacing all humans; it’s about augmenting human skills. A worker today is more likely to be operating a bank of computers that control robotic arms than they are to be turning a wrench on an assembly line. This shift requires a completely new set of skills.

High-Tech Manufacturing Jobs in Demand for 2025 and Beyond

The career opportunities in U.S. smart factories are expanding rapidly. Some of the most in-demand roles include:

- Robotics Technician: These professionals are responsible for programming, maintaining, and troubleshooting the automated systems and robotic arms that perform repetitive tasks.

- Industrial Data Scientist: Modern factories generate a massive amount of data from sensors on their equipment. Data scientists analyze this information to predict maintenance needs, improve efficiency, and reduce waste.

- Additive Manufacturing Engineer (3D Printing): These engineers use industrial-scale 3D printers to create complex parts and prototypes, revolutionizing the speed of product development.

- EV Battery Technician: With the boom in electric vehicle production, technicians who can build, test, and service advanced battery packs are in extremely high demand.

- Quality Control Systems Manager: This role involves using advanced scanning and imaging technology to ensure every product coming off the line meets exact specifications, a task previously done by human eye.

The Importance of Workforce Training for the US Manufacturing Revival

This shift to high-tech roles has created a significant challenge: the “skills gap.” The jobs are here, but the workforce isn’t always trained for them. This is why workforce development for advanced manufacturing has become a national priority. Community colleges, technical schools, and companies themselves are launching new programs, apprenticeships, and certifications to equip workers with the in-demand skills for modern manufacturing, such as mechatronics, data analytics, and machine learning. A comprehensive overview of these labor needs can be found on the U.S. Bureau of Labor Statistics (BLS) website.

The Winners’ Circle: Which States Are Benefiting Most from Reshoring?

The manufacturing boom isn’t happening everywhere equally. Three distinct regions have emerged as the primary beneficiaries of the reshoring trend, each with its own unique specialization.

The Rust Belt Revival: How Midwestern States Are Attracting New Factories

The states of the traditional “Rust Belt” are leveraging their deep industrial roots to stage a remarkable comeback. The reshoring trends in the American Midwest are centered on the region’s existing infrastructure, skilled labor base, and expertise in heavy industry.

- Ohio, Michigan, and Indiana: This trio is at the forefront of the manufacturing job growth in Ohio and Michigan. They are attracting massive investments in everything from semiconductor manufacturing (Intel’s new mega-fab in Ohio) to electric vehicle production, breathing new life into communities that were hit hard by the first wave of offshoring.

The “Battery Belt”: The Southeast’s Boom in EV and Green Energy Manufacturing

A new manufacturing corridor is rapidly forming across the American Southeast, purpose-built to support the green energy transition. The EV battery plant jobs in the Southeast U.S. are numbered in the tens of thousands, solidifying the region’s new nickname as the “Battery Belt.”

- Georgia, Tennessee, and the Carolinas: These states have used a combination of business-friendly policies and strategic investments to land enormous factories from companies like Hyundai, Ford, and BMW. They are now the epicenter for the production of electric vehicles and the lithium-ion batteries that power them, making them leaders in green energy manufacturing.

The “Silicon Desert”: High-Tech Manufacturing Growth in the Southwest

The arid landscapes of the Southwest are becoming fertile ground for the most technologically advanced manufacturing on the planet. This “Silicon Desert” is the primary destination for the reshoring of semiconductor manufacturing to Arizona and other high-tech industries.

- Arizona and Texas: Driven by a desire to secure the domestic supply of critical microchips, these states have attracted tens of billions of dollars in investment from global giants like Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung. This has led to a surge in high-tech manufacturing job creation in Texas and Arizona, focusing on semiconductors, aerospace, and defense technology. A recent report from the Brookings Institution provides a detailed analysis of these regional shifts.

The Economic Ripple Effect: Benefits and Challenges of Reshoring

The return of manufacturing is about more than just factory jobs. It creates a powerful positive ripple effect throughout the economy, though it’s not without its challenges.

The Tangible Benefits of Bringing Manufacturing Jobs Back to America

The economic benefits of reshoring for local communities are profound. For every new manufacturing job created, several other jobs are supported in the local economy—from construction workers who build the factories to restaurant owners who serve the new employees. This creates stronger, more resilient local tax bases.

Furthermore, how reshoring strengthens U.S. national security is a critical benefit. By producing essential goods like pharmaceuticals, microchips, and defense components at home, the country is less vulnerable to being cut off from critical supplies during a global crisis.

Overcoming the Hurdles: The Challenges of US Manufacturing Reshoring

The transition is not seamless. Companies face significant challenges of bringing manufacturing back to the U.S., including:

- Higher Labor Costs: While the gap is narrowing, labor is still more expensive in the U.S. than in many parts of the world. This is offset by gains in productivity through automation.

- Infrastructure Needs: Many parts of the country need significant upgrades to their roads, ports, and energy grids to support these massive new facilities.

- Regulatory Environment: Navigating the complex web of permits and regulations to build and operate a new factory in the U.S. can be a long and costly process compared to other nations.

Conclusion: The Remaking of the American Economy

The future of manufacturing jobs in the United States is being written right now, and the narrative is one of revitalization and transformation. The great reversal from globalization to reshoring is not a temporary blip; it is a long-term structural shift driven by powerful economic and geopolitical forces.

The jobs coming back are not the jobs that left. They are higher-skilled, higher-paying roles that exist at the intersection of manufacturing and technology. While challenges remain, the trend is clear: specific regions of the country are booming, a new generation of workers is being trained, and the “Made in the USA” label is becoming a symbol not of the past, but of a high-tech, resilient future. The long-term impact of deglobalization on the U.S. economy will be a defining story of this decade.

Frequently Asked Questions (FAQ)

1. Will reshoring make consumer goods like electronics and clothing more expensive?

Initially, some goods may see a modest price increase due to higher labor costs. However, this could be offset by reduced shipping costs, less supply chain disruption, and increased productivity from automation, which could stabilize prices in the long run.

2. What government policies are encouraging reshoring and friend-shoring?

Policies like the CHIPS and Science Act (providing incentives for semiconductor manufacturing) and the Inflation Reduction Act (IRA) (offering tax credits for green energy manufacturing) are major drivers. Tariffs and trade policies also play a role in the financial calculation for companies.

3. Are there enough skilled workers in the U.S. to fill these new high-tech jobs?

Currently, there is a “skills gap,” meaning there are more open jobs than qualified workers. This is why there is a massive nationwide push from companies, community colleges, and governments to fund rapid workforce training and apprenticeship programs.

4. Is reshoring happening in all manufacturing sectors?

The trend is strongest in strategic sectors like semiconductors, electric vehicles, batteries, medical supplies, and other high-value industries. Lower-margin industries like textiles and basic electronics are seeing less reshoring activity.

5. How does automation affect the number of jobs being created?

Automation reduces the number of low-skill, repetitive jobs, but it creates new, higher-skill jobs for technicians, programmers, and data analysts who manage the automated systems. So, while a new factory may employ fewer people than a 1970s factory of the same size, the jobs are typically higher paying.

6. Can small and medium-sized businesses also benefit from reshoring?

Yes. When a large company builds a new factory, it creates a huge demand for local suppliers, from machine parts manufacturers to logistics and maintenance companies, creating significant opportunities for smaller businesses in the area.

7. What is the difference between “near-shoring” and “friend-shoring”?

The terms are closely related. Near-shoring specifically refers to moving operations to a nearby country (like Mexico or Canada for the U.S.). Friend-shoring is a broader term that includes near-shoring but also encompasses moving operations to friendly, allied nations that may be farther away (like Japan or South Korea).

8. How permanent is this reshoring trend likely to be?

While economic conditions can always change, the core drivers (geopolitical risk, supply chain resilience) are long-term structural issues. Most economists believe this is a multi-decade trend, not a short-term reaction.

9. Which specific job skill is most valuable for the future of manufacturing?

While many skills are needed, a background in “mechatronics”—a multidisciplinary field that combines mechanics, electronics, and computing—is extremely valuable as it is the foundation for robotics and smart factory automation.

10. Does reshoring have an environmental impact?

It can have a positive impact. Manufacturing in the U.S. is often subject to stricter environmental regulations than in many other countries. Additionally, shorter supply chains mean less carbon-intensive shipping across oceans.

11. How is this trend affecting the U.S. trade deficit?

By producing more goods domestically, the U.S. will need to import less, which can help to reduce the national trade deficit over time, though this will be a slow and gradual process.

12. Where can I find training for these new manufacturing jobs?

A great place to start is your local community college or technical school, as many are launching “Advanced Manufacturing” or “Mechatronics” certificate and degree programs in partnership with local employers to fill these specific roles.