It’s the paradox of modern success. You have the six-figure salary, the impressive job title, the nice car, and the house in a good neighborhood. From the outside, you’re the definition of “making it.” But inwardly, you’re haunted by a stressful secret: you are a high-income earner with no savings.

You’re not alone. This phenomenon of high earners living paycheck to paycheck is incredibly common. It’s a silent struggle for millions of professionals—doctors, lawyers, tech leaders, and consultants—who, despite earning more than 90% of the population, feel like they are just one bad month away from financial trouble. You’re running on a golden treadmill, working harder and harder just to stay in the same place.

How is this possible? Why does earning more money not automatically translate to building real wealth?

The answer isn’t a lack of intelligence or willpower. The problem is a combination of modern psychology, hidden financial traps, and, most importantly, a complete mismatch between your 21st-century income and your 20th-century money management habits.

The good news? The solution is already in your pocket. This article will explore the psychology of spending money that traps high earners and reveal the specific fintech solutions to build real wealth. It’s time to stop looking rich and start being wealthy.

Why Am I Broke With a Good Job? Unmasking the High-Earner Trap

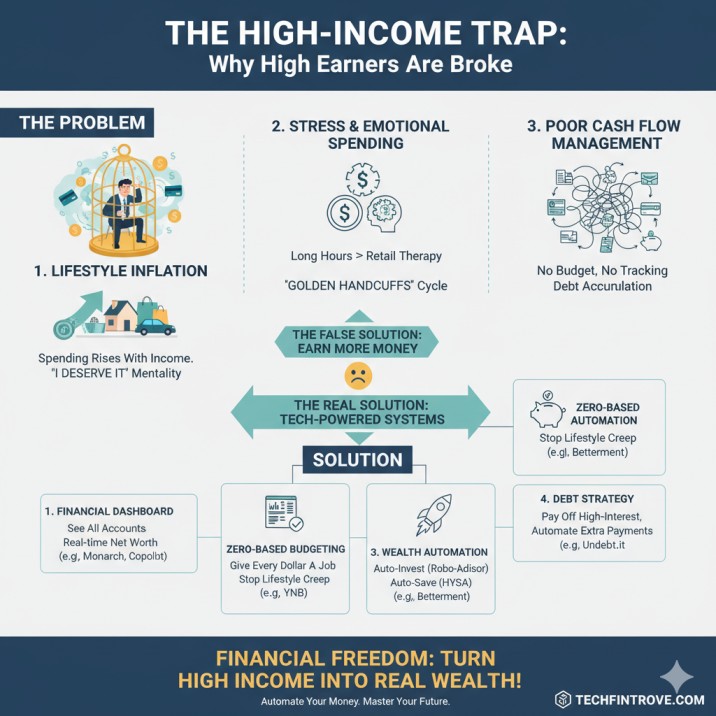

Before we can deploy the tech, we have to diagnose the problem. The paycheck to paycheck cycle for high-income professionals isn’t caused by one single thing, but a perfect storm of several powerful forces.

The #1 Culprit: What is Lifestyle Inflation and Why Is It So Dangerous?

This is the big one. Lifestyle inflation, often called lifestyle creep, is the habit of increasing your spending as your income grows.

When you got your first “real” job, a $50 dinner out felt like a luxury. Today, it’s a casual Tuesday. Your first apartment was a shoebox; now you have a mortgage for a house that “fits your status.” That car? It’s a lease payment that reflects your title.

Lifestyle creep is insidious because it feels earned. You deserve these things for your hard work, right? The problem is that your spending baseline rises in lockstep with your income, leaving no-to-little-gap for savings. You’re not saving more; you’re just living a more expensive life. This is the core reason six-figure earners are struggling—their outgoings have swollen to match their impressive income.

The “Golden Handcuffs”: How Your High-Stress Job Keeps You Spending

Many high-income jobs are also high-stress. Think 60-hour weeks, constant pressure, and being “on-call” 24/7. This creates a powerful high-stress job high-spending cycle.

Your brain starts to justify expensive purchases as a reward for your sacrifice.

- “I worked all weekend; I’m buying that $1,000 watch.”

- “This project was a nightmare; I’m booking a $5,000 vacation to decompress.”

- “I don’t have time to cook; I’ll just DoorDash every meal.”

These are not just purchases; they are emotional releases. Your high salary becomes fuel for emotional spending habits designed to compensate for an unsustainable work-life balance. These are the golden handcuffs explained: your job pays you just enough to afford the expensive lifestyle you need to survive the job.

The Pressure of “Optics”: The Keeping Up with the Joneses Syndrome

When you’re in a high-earning social circle, the pressure to maintain appearances is immense. Your colleagues, friends, and neighbors are all spending, and it creates a subconscious benchmark.

- Your friend just renovated their kitchen.

- Your boss just bought a vacation home.

- Your neighbor leased a new luxury SUV.

This keeping up with the Joneses syndrome means you’re not budgeting based on your own values, but on the perceived expectations of your peers. You’re spending to signal that you belong. This leads to high-income debt problems as you finance a life you can’t quite afford, all for the sake of “optics.”

The Silent Killers: High-Income Debt and Poor Cash Flow Management

Many high earners start the race from behind. Student loan debt for doctors and lawyers can easily be in the six-figure range. Add a large mortgage in a high cost of living area, two car payments, and a few credit cards, and your “high income” is pre-spent before it even hits your account.

But the biggest issue is a failure in cash flow management. You have a lot of money moving through your accounts, but you have no idea where it’s going. You’re not tracking monthly expenses because it feels tedious, or frankly, you’re afraid to look. You’re managing a $200,000/year household income with the same “check the balance” method you used in college. This is a recipe for disaster.

Breaking the Cycle: Using Technology to Manage Finances

Here’s the fundamental truth: You cannot out-earn poor financial habits. The key to building wealth is not (just) a bigger shovel; it’s plugging the leaks in your bucket.

Manually tracking receipts in a spreadsheet is a 1990s solution for a 2025 problem. It’s time-consuming, tedious, and you’ll give up by February. The only sustainable way to fix this is to use fintech solutions for financial management.

We’re going to build a “Tech Stack” for your personal finances. This combination of tools will automate your discipline, give you 100% clarity, and finally move you from “high earner” to “high net worth.”

Step 1: The Financial Diagnosis with Personal Finance Dashboards

You can’t fix what you can’t see. The first step is to get a complete, 100% accurate picture of your entire financial life. You need to know exactly how much you have, how much you owe, and where every single dollar is going.

- The Problem They Solve: You have 10-15 different accounts: checking, savings, 401(k), brokerage, crypto, credit cards, mortgage, student loans. It’s impossible to track manually.

- The Tech Solution: Use a personal finance dashboard or “aggregator” app. These are apps to track all your accounts in one place.

- How They Work: You securely link all your financial accounts, and the app pulls in your balances and transactions in real-time. In five minutes, you get a single, clean dashboard showing your real-time net worth tracking.

- Recommended Tools: Services like Monarch Money or Copilot Money are built for this. They automatically categorize your spending, track your investments, and show you your complete cash flow. This is the essential first step to understanding your cash flow.

Step 2: The “Pay Yourself First” 2.0 with Zero-Based Budgeting Apps

Once you know where your money is going, it’s time to tell it where to go. This is budgeting, but not the restrictive “no lattes” kind. For high earners, the best method is zero-based budgeting.

- The Problem They Solve: You get paid, you spend money, and you save whatever is left over (which is usually nothing).

- The Tech Solution: A zero-based budgeting app like YNAB (You Need A Budget).

- How They Work: The philosophy is simple: “Give every dollar a job.” Before you spend, you assign all the money in your account to a category (Mortgage, Groceries, Student Loans, Debt, Investments). When you spend, you’re not just “spending”; you’re taking money out of a specific category.

- Why It Works for High Earners: It forces you to make conscious trade-offs. You can absolutely have a $5,000 vacation, but you must plan for it by allocating funds. This single-handedly cures lifestyle creep. It’s the most powerful app to stop impulse spending because you can see exactly what you are giving up to make that impulse buy.

Step 3: Automate Your Wealth with AI-Powered Financial Planning

This is the most critical step. You must put your savings and investments on autopilot. You should not have to remember to build wealth; it should happen automatically, in the background.

- The Problem They Solve: You wait until the end of the month to save, or you try to “time the market” for investments, and end up doing nothing.

- The Tech Solution: A combination of automated savings tools for professionals and automated investment apps (robo-advisors).

- How They Work:

- Automated Savings: Set up an automatic transfer from your checking account to a high-yield savings account (HYSA) for the day after you get paid. This is the classic “Pay Yourself First” method.

- Robo-Advisors: Services like Betterment or Wealthfront act as AI-powered financial planning tools. You set a goal (e.g., “Retirement,” “House Down Payment”), and the platform automatically withdraws money from your bank account every month and invests it in a diversified, low-cost portfolio. This is how robo-advisors help build wealth—by enforcing consistency and removing emotion.

- Micro-Investing Apps: Tools like Acorns round up your purchases and automatically invest the spare change. It’s a simple way to start.

Step 4: Attack High-Income Debt with Smart Tech

You can’t build wealth while you’re servicing high-interest debt. Your high income is your greatest shovel—tech just helps you aim it.

- The Problem They Solve: You have multiple student loans, credit card balances, and a car note. You’re paying the minimums and getting nowhere.

- The Tech Solution: Fintech solutions for debt management and repayment calculators.

- How They Work:

- Debt Snowball/Avalanche Apps: Apps like Undebt.it help you organize all your debts and choose a payoff strategy. The “Debt Avalanche” (paying high-interest first) is mathematically best. These tools keep you motivated by showing you a “debt-free date.”

- Automated Bill Pay: Set up automatic extra principal payments on your loans. Even $100 extra per month on a mortgage or student loan can shave years off the term. Use your bank’s bill pay to automate this.

Your 5-Step Plan to Escape the Gilded Cage

Feeling overwhelmed? Don’t be. Here is a practical, step-by-step plan. This is how to stop living paycheck to paycheck on a high salary.

Step 1: The Brutal Financial Audit (This Weekend)

- Download a dashboard app (like Monarch).

- Link every single account.

- Look at the numbers. Don’t judge, just observe.

- Key Action: Identify your “Big 3” spending leaks. (Is it eating out? Subscriptions? Impulse Amazon buys?)

Step 2: Create Your First “Conscious Spending” Plan (This Weekend)

- Fire up a zero-based budgeting app (like YNAB).

- Fund your necessities first (Housing, Utilities, Debt).

- Fund your long-term financial goals second (this is crucial). Allocate at least 20% of your income to “Investing” and “High-Yield Savings.”

- Fund your discretionary spending last with what’s left.

Step 3: Build Your “Freedom Fund” (Next Paycheck)

- Open a high-yield savings account at a different bank than your checking account. This makes it harder to dip into.

- Set up an automatic transfer for 10% of your paycheck to go directly into this account. This is your emergency fund. Do not stop until you have 3-6 months of living expenses. This is your buffer against the six-figure earner no savings panic.

Step 4: Activate Your Wealth Automation (Next Paycheck)

- Open a robo-advisor account (like Betterment).

- Set up another automatic transfer for 10-15% of your paycheck.

- This is your “Pay Yourself First” 2.0. Your emergency fund (Step 3) makes you safe. This step makes you wealthy.

Step 5: Schedule Your “Money Date” (Monthly)

- Put a 30-minute meeting on your calendar for the first of every month.

- This is your “CEO of My Life” meeting.

- Open your dashboard (Monarch). Review your net worth. Did it go up?

- Open your budget (YNAB). Did you overspend anywhere? Adjust your plan for the next month.

- That’s it. 30 minutes. The tech does the other 99% of the work.

This is the mindset shift for building wealth: You use a short burst of intentional planning so the system can run on autopilot.

The Final Takeaway: It’s Not Your Salary, It’s Your System

Living paycheck to paycheck on a high income is a prison. It’s a gilded cage where your “reward” for success is just more stress, more spending, and the constant fear of losing it all.

You are not a bad person for being in this situation. You are simply a human whose natural psychological wiring (like lifestyle creep and emotional spending) has been exploited by modern culture.

Your intelligence and high income got you this far, but they won’t get you to the next level. Only a system can do that. By leveraging the smart money management techniques built into modern financial technology, you can automate your discipline.

You can plug the leaks, build your emergency fund, and finally start stacking wealth. You can turn your high income from a source of stress into a powerful engine for financial independence. The tech is ready. The only question is, are you?

Frequently Asked Questions (FAQ) About High-Income Financial Struggles

1. Why do I feel poor on a $100k+ salary?

This is a common feeling that stems from the paycheck to paycheck cycle for high-income professionals. Your expenses have likely risen to meet your income (lifestyle creep). When 100% of your salary is allocated to a mortgage, car payments, debt, and expensive habits, you have no “disposable” income or savings. You are poor in terms of cash flow, even with a high income.

2. What is the single best budgeting app for high-income earners?

While “best” is subjective, YNAB (You Need A Budget) is often cited as the most effective for high earners. It uses the zero-based budgeting method, which forces you to be intentional with your large income and actively prevents lifestyle inflation. It changes your behavior from “How much do I have left?” to “What did I plan to spend this on?”

3. I hate budgeting; isn’t there an easier way?

Yes. If you hate hands-on budgeting, the “anti-budget” is for you. Use a personal finance dashboard like Monarch to track your spending after the fact. The most important thing is to automate your savings and investments (Steps 3 and 4). Pay yourself first (at least 20% to savings/investments) the day you get paid. Then, you are free to spend whatever is left in your checking account, guilt-free.

4. What are the ‘golden handcuffs’ and how do I escape them?

The golden handcuffs are a high-paying job that provides a lifestyle so expensive that you can’t afford to quit. You’re trapped by your own income. The only way to escape is to aggressively lower your spending and build a “Freedom Fund” (a large emergency fund). This gives you the financial power to walk away, negotiate for better terms, or take a lower-paying job you actually enjoy.

5. How much should I have in savings if I earn $150,000?

A good baseline is to have an emergency fund of 3-6 months’ worth of your expenses (not income). If your monthly expenses are $8,000, you should have $24,000 – $48,000 in a high-yield savings account. On top of that, you should be saving at least 15-20% of your gross income for retirement and other long-term goals.

6. Are these fintech apps safe to link to my bank accounts?

This is a valid concern. Reputable fintech apps use bank-level security, encryption, and often read-only access. They connect via secure third-party platforms like Plaid. However, always do your research: use well-known apps (like the ones mentioned), set up two-factor authentication (2FA) on everything, and use strong, unique passwords. As Investopedia notes, these practices are essential for online financial safety.

7. How can I stop “lifestyle creep” for good?

You stop it by being intentional.

- Use a zero-based budget (YNAB): Give your new money a job before you spend it.

- Automate your raises: The next time you get a raise or bonus, immediately automate 50% of that new money to go directly to your investments or HYSA. You’ll enjoy the other 50% but won’t let your lifestyle inflate 1:1.

8. What’s the difference between a robo-advisor and a human financial advisor?

A robo-advisor (like Betterment) is an algorithm that automatically invests your money in a low-cost, diversified portfolio based on your goals and risk tolerance. It’s excellent for automated investment and is very low-cost. A human advisor is a person you hire for holistic AI-powered financial planning (or human-powered), including complex topics like taxes, estate planning, and insurance. Many high earners use a robo-advisor for their automated investing and a “fee-only” human advisor for an annual check-up.

9. What are the biggest financial mistakes high earners make?

- Lifestyle Inflation: Letting spending rise with income.

- Financing “Wants”: Taking out loans for things that depreciate (luxury cars, boats, vacations).

- Having No Emergency Fund: A six-figure earner with no savings is one layoff away from disaster.

- Ignoring Taxes: Underestimating taxes for high income can lead to a massive, unexpected bill in April.

10. How can I use tech to stop impulse spending?

- YNAB: The app will make you face the trade-off. “To buy this $200 item, I have to take money out of my ‘Vacation’ category.”

- Cooling-Off Periods: For any non-essential purchase over $100, put it in a digital cart and wait 48 hours. The emotional spending urge will often fade.

- Unsubscribe: Use tech for tracking subscriptions (like Rocket Money) to cancel unused services, and unsubscribe from all marketing emails that tempt you.

11. Is it better to pay off debt or invest my money?

This is the classic debate. The mathematical answer: If your investment can reliably earn a higher (after-tax) return than your debt’s interest rate, you should invest.

- High-Interest Debt (>7%): Pay this off aggressively. This includes credit cards.

- Low-Interest Debt (<5%): This includes many mortgages or federal student loans. It’s often better to pay the minimum and invest the rest.

- The Emotional Answer: If your debt (even if low-interest) is causing you stress, use a debt-payoff app and get rid of it. The peace of mind is worth it.

12. I feel ashamed of this problem. Where do I even start?

You start today, and you leave the shame behind. This is not a moral failing; it’s a systems failure. Your first step is simple and private: download a personal finance dashboard app. Just link your accounts. Don’t do anything else. Just get the data. Knowledge is power, and this is the first, most important step to taking back control.