(Disclaimer: This blog post is for educational and informational purposes only. It does not constitute financial advice. All investing involves risk, including the possible loss of principal. Before making any financial decisions, you should consult with a qualified financial advisor. The mention of specific features or platforms is for illustrative purposes and not an endorsement.)

Investing. For many, that word brings up images of Wall Street, complex charts, and needing thousands of dollars just to get in the door. It feels intimidating, exclusive, and completely out of reach for the average person. What if you only have $5, $20, or just the spare change from your morning coffee?

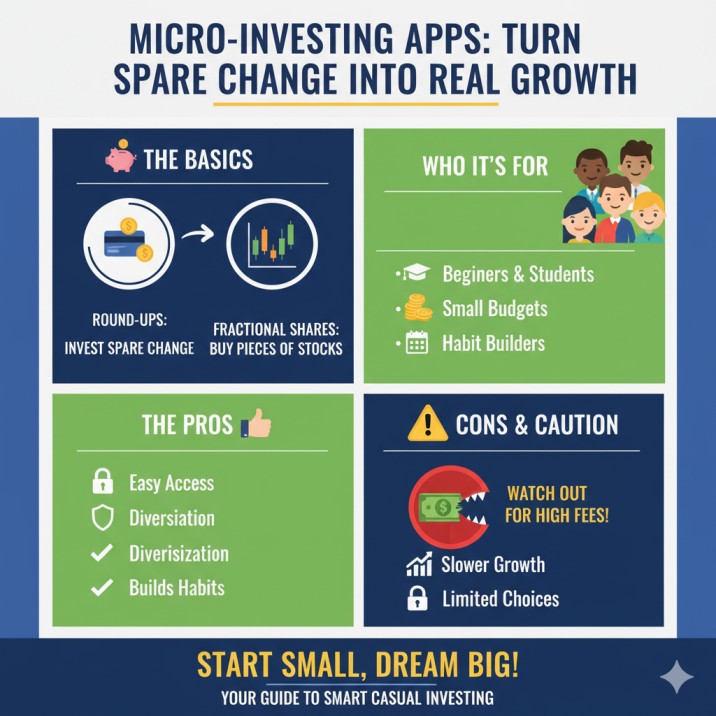

This feeling of being “locked out” is exactly why understanding micro-investing platforms and apps has become a game-changer for a new generation. These tools are designed to break down those old barriers, making investing accessible to everyone, regardless of their bank balance or experience level.

But are they too good to be true? Can you really build wealth by investing your pocket change?

This comprehensive guide will walk you through everything you need to know. We’ll explore how these apps work, the real pros and cons, the hidden fees to watch out for, and how you can start your investing journey with as little as $5. By the end, you’ll be able to confidently decide if a micro-investing app is the right first step for your financial goals.

What is Micro-Investing, Really? A Simple Explanation for Beginners

At its core, micro-investing is the practice of investing very small amounts of money on a regular basis. We’re not talking about saving up $1,000 to buy a share of a big company. We’re talking about amounts as small as $1, or even just 30 cents.

The entire micro-investing concept is built on simplicity and accessibility. It takes the scary, complex world of the stock market and shrinks it down into a user-friendly app on your phone.

Think of it like a digital piggy bank, but instead of your coins just sitting there, they get put to work in the stock market. These apps are designed to make investing a background habit, something you do automatically without even thinking about it. They achieve this through a few clever features that have completely changed the investing landscape.

The Core Features: How Do Micro-Investing Apps Actually Work?

You might be wondering how it’s even possible to invest 50 cents. Traditional brokerages were never set up for this. The magic lies in two key innovations: “round-ups” and “fractional shares.”

The Magic of “Round-Ups”: Your Spare Change Investing Guide

This is the most popular feature of many micro-investing platforms. Here’s how round-up investments work:

- You link your primary bank account or debit/credit card to the app.

- You go about your day, buying coffee, groceries, or gas.

- Let’s say you buy a coffee for $4.50. The app “rounds up” this purchase to the nearest dollar, which is $5.00.

- The difference, that $0.50 in spare change, is set aside.

- Once your “virtual spare change” hits a certain threshold (usually $5 or $10), the app automatically withdraws that amount from your bank account and invests it for you.

You’re essentially investing without feeling the pinch. It’s a powerful psychological trick that turns your daily spending habits into a saving and investing machine. This is what makes spare change investing apps so popular for people who struggle to save.

Fractional Shares: Owning a Piece of Big-Name Companies

In the old days, if you wanted to invest in a company like Amazon or Google, you might have needed over $1,000 to buy a single share. For most people, that’s a non-starter.

This is where fractional shares come in.

What are fractional shares investing? It’s exactly what it sounds like. Instead of needing to buy one whole, expensive share, the app lets you buy a tiny piece of it.

- Want to invest in Apple but don’t have $170 for a full share? No problem. You can invest **$10** and own approximately 0.058 shares.

- Got $5 from your round-ups? The app can split that $5 across hundreds of different companies, buying you $0.01 worth of this one, $0.03 of that one, and so on.

This feature is the engine that makes micro-investing possible. It allows you to buy partial shares of stocks and ETFs (Exchange-Traded Funds), meaning your $5 can be just as diversified as someone else’s $50,000. It’s the ultimate democratization of the stock market.

Automatic Investing: The “Set It and Forget It” Strategy

Beyond round-ups, the best automatic investment apps allow you to set up recurring deposits. This is perhaps the most powerful wealth-building habit you can develop.

You can tell the app: “Invest $5 for me every Friday,” or “$1 every single day,” or “$25 on the 1st of every month.”

This strategy is a simplified version of something called dollar-cost averaging. By investing small amounts consistently, you buy more shares when prices are low and fewer shares when prices are high. Over the long term, this can reduce your overall risk and smooth out your returns.

Setting up recurring investments on these apps takes the emotion and guesswork out of investing. You’re not trying to “time the market” (which even experts fail at). You’re just building your portfolio, bit by bit, automatically.

Who Are These Micro-Investing Platforms Built For?

While anyone can use them, these apps are specifically designed to solve problems for a few key groups of people.

The Absolute Beginner: Overcoming Investment Paralysis

If you’re reading an article about the best micro-investing apps for absolute beginners, you’re the primary audience. The biggest hurdle to investing isn’t always money; it’s fear and complexity.

- Fear of losing money.

- Fear of not knowing what to pick.

- Fear of making a “dumb” mistake.

Micro-investing apps solve this. They typically ask you a few simple questions about your goals and how much risk you’re comfortable with (your “risk tolerance”). Based on your answers, they recommend a pre-built portfolio, often a mix of stocks and bonds in an ETF. You don’t have to pick individual stocks. This easiest investing app to learn approach gets you in the game and helps you learn by doing, with real (but small) stakes.

Students and Young Adults: Building Habits Early

When you’re in college or just starting your career, you likely don’t have a large income. Finding the best investing app for college students can be a way to put the small amount of disposable income you do have to work.

More importantly, it builds the habit of investing. Learning to set aside a portion of your money—no matter how small—is a financial muscle. The earlier you build that muscle, the stronger it will be throughout your life. Starting to invest in your 20s, even with just $10 a month, gives you a massive head start thanks to the power of compound interest.

The Cautious Saver: Dipping a Toe into the Market

Maybe you’re a great saver. You’ve got an emergency fund, and you diligently put money into a savings account. But you know that with inflation, your savings are actually losing purchasing power over time.

You’re cautious about investing because it feels like gambling. A micro-investing app can be the perfect bridge. You can start with your round-ups, see how the market moves, and watch your $50 grow to $60, or dip to $45, without the panic of having your life savings on the line. It’s a low-risk way to get comfortable with the natural ups and downs of the market.

The Big Question: What are the Real Pros and Cons of Micro-Investing?

These apps are powerful tools, but they are not a magic solution.

The Advantages of Starting Small (The “Pros”)

- Extreme Accessibility: This is the #1 benefit. With no (or very low) account minimums, literally anyone with a smartphone and a bank account can start. This breaks down centuries-old socioeconomic barriers to wealth creation.

- Removes Psychological Barriers: It makes investing feel easy and manageable. The friendly interface and small amounts remove the “intimidation factor” that stops so many people from ever starting.

- Excellent for Habit-Building: The automation (round-ups and recurring deposits) is brilliant. The advantages of micro-investing platforms lie in their ability to make investing a passive, consistent habit, like brushing your teeth.

- Instant Diversification: Thanks to fractional shares of ETFs, your $10 investment can be spread across the entire U.S. stock market, international stocks, and bonds. This is a level of diversification that used to be impossible without thousands of dollars.

- Educational Sandbox: It’s a real-world learning tool. You get to see how your money is performing, read simple market commentary, and understand basic concepts like “dividends” and “risk” with real money, but in a low-stakes environment.

The Hidden Dangers and Downsides (The “Cons”)

This is the most important section of this article. Read it carefully.

- THE FEES! The Fees Can Be Extremely High.

This is the single biggest risk of using micro-investing apps. Many platforms don’t charge trading commissions. Instead, they charge a flat monthly subscription fee. This might be $1, $3, or $5 per month. A $3/month fee sounds tiny, right? Let’s do the math.- If you only have $100 in your account, a $3/month fee is **$36 per year**.

- That means you are paying a 36% annual fee!

- To break even, your investments would need to gain 36% in one year, which is highly unlikely (the S\&P 500 averages ~10%).

- Limited Investment Choices: These apps are simple on purpose. That’s their strength, but it’s also a weakness as you grow. You usually can’t buy individual stocks of your choice (though some are changing this), mutual funds, options, or crypto. You are often limited to a small menu of pre-built ETF portfolios.

- Slow Growth (It’s Not a Get-Rich-Quick Scheme): Let’s be honest. Investing 50 cents at a time is not going to make you a millionaire by next year. The limitations of micro-investing for wealth building are real. It’s a fantastic start, but it’s not a complete retirement plan.

- A False Sense of Accomplishment: This is a subtle psychological risk. You might think, “I’m investing!” and check that box, but if you’re only investing $15 a month, it’s not enough to secure your future. It can prevent you from taking the next, more significant steps, like opening a 401(k) or a Roth IRA.

Understanding the Costs: A Deep Dive into Micro-Investing Fees

Because fees are the biggest trap, let’s break them down even further. When you are comparing micro-investing app fees, you’ll generally find two models.

Model 1: Flat-Fee Monthly Subscriptions

This is the most common model for apps focused on round-ups.

- Tier 1 (e.g., $1-$3/month): Gives you a basic investment account.

- Tier 2 (e.g., $5/month): Adds an retirement account (IRA).

- Tier 3 (e.g., $9/month): Adds a checking account and other banking features.

As we discussed, this model is very expensive for small balances. You must find micro-investing apps with no hidden fees or, at least, understand that the fee is your biggest hurdle to overcome.

Model 2: Percentage-Based Fees (AUM)

Some platforms, particularly those that are “lite” versions of major brokerages, don’t charge a monthly fee. Instead, they charge an “Assets Under Management” (AUM) fee.

- This is a percentage of your total account balance, charged annually. A common fee might be 0.25% per year.

- On a $100 account, this is just $0.25 per year.

- On a $5,000 account, this is $12.50 per year.

For a beginner with a small balance, the AUM model is almost always cheaper than the flat-fee subscription model. Always do the math before you sign up.

Other “Hidden” Costs to Watch For

Read the fine print. Are there withdrawal fees? Inactivity fees? What about an ACAT transfer fee if you decide to move your investments to another brokerage? A trustworthy platform will be transparent about these costs.

How to Choose the Right Micro-Investing Platform for Your Goals

Okay, so you’ve weighed the pros and cons and decided you want to start. How do you pick the right app from the dozens available?

Step 1: Define Your “Why” (Your Investing Goal)

First, ask yourself why you’re doing this. Your goal will change which app is best.

- “I just want to learn and build a habit.” An app with round-ups and a simple interface is perfect.

- “I want to start my retirement fund.” You must choose an app that offers an IRA (Individual Retirement Account), like a Roth IRA, to get the tax advantages.

- “I want to save for a specific goal, like a vacation in 3 years.” Look for an app that lets you set specific goals and timelines.

Setting investing goals with micro-apps helps you stay motivated and choose the right account type.

Step 2: Compare Key Features and Investment Options

Now, look at what they offer.

- Do you want the round-up feature, or do you prefer to just set up a $20/week automatic deposit?

- Do you want a pre-built portfolio, or do you want to buy partial shares of your favorite stocks?

- What educational resources do they provide? Some apps have great articles and videos for beginners.

List the features to look for in a micro-investing app that matter most to you.

Step 3: Scrutinize the Fee Structure (Again!)

I will say it again because it’s that important. Which micro-investing app has the lowest fees for your starting amount?

If you’re starting with $50, an app with a $3/month fee is a bad deal. Look for one with a 0% or AUM-based fee until your balance is larger. Don’t let fees eat up your investment before it even has a chance to grow.

Step 4: Check for Security and Regulation (SIPC, FINRA)

This is non-negotiable. You are giving an app your bank information and your money.

- Is the app a registered member of FINRA (Financial Industry Regulatory Authority)? This is the self-regulatory body for brokerages. You can (and should) check any platform on FINRA’s BrokerCheck tool.

- Is your money protected by SIPC (Securities Investor Protection Corporation)? SIPC is not like FDIC for a bank. It doesn’t protect you from losing money if the market goes down. It does protect you (up to $500,000) if the brokerage firm itself fails or goes bankrupt.

Are micro-investing apps safe? If they are legitimate, registered members of FINRA and SIPC, your investments are protected against fraud or failure of the platform itself.

Your Step-by-Step Guide to Getting Started with Micro-Investing Today

Ready to take the plunge? Here’s a simple step-by-step guide to micro-investing. You can do this in less than 15 minutes.

- Choose Your App: Based on your research from the section above (fees, features, goals), pick one app and download it from the official Apple App Store or Google Play Store.

- Create Your Account: You’ll need to provide personal information. Because these are real financial accounts, you will be required by law to provide your Social Security number and a photo of your ID. This is a normal part of the “Know Your Customer” (KYC) rule to prevent fraud.

- Complete the Risk Profile: The app will ask you questions like “What would you do if your investment dropped 10%?” or “What is your main goal for this money?” Be honest. This helps them recommend a portfolio that matches your comfort level (e.g., “Conservative,” “Moderate,” or “Aggressive”).

- Link Your Bank Account: Securely link the checking account you want to use for funding. Most apps use services like Plaid to do this, which is a standard and secure technology.

- Fund Your Account & Set Up Automation: This is the fun part.

- Make your first deposit (even just $5).

- Turn on the “round-ups” feature if you want to use it.

- Set up a recurring investment (e.g., $10 every Monday).

That’s it. You are now officially an investor.

Micro-Investing vs. Traditional Investing: What’s the Difference?

It’s helpful to see how these new apps stack up against the “old” way of doing things. A micro-investing vs. traditional brokerage account comparison looks like this: Feature Micro-Investing PlatformsTraditional Brokerage (e.g., Vanguard, Fidelity)Account Minimum $0 or $5 Often $0, but some mutual funds require $1,000+ Primary User Absolute beginners, students DIY investors, long-term planners Key Feature Round-ups, automation, simplicity Full range of investment choices, research tools Investment Choices Limited (usually a few ETFs) Everything: stocks, bonds, ETFs, mutual funds, etc. Cost Structure Often flat monthly fee ($1-$9) Usually $0 commission, low AUM fees on funds Main Goal Build a habit, learn the ropes Build serious, long-term wealth

A spare change investing app is like the training wheels on a bicycle. It’s the perfect way to get started, gain confidence, and learn to balance. A traditional brokerage is the bicycle itself—faster, more powerful, and what you’ll need for the long journey.

The Real Talk: Can You Actually Build Wealth with Micro-Investing?

Yes… and no. It depends on your definition of “wealth.”

Can you get rich with micro-investing? If you are only investing your spare change, no. The math just doesn’t work. $20 a month, even with a great 10% annual return, will be worth about $7,600 after 20 years. That’s great, but it’s not “retire in a beach house” money.

But that’s not the point. The real wealth you build with micro-investing is the habit.

The power of compound interest—where your earnings start earning their own earnings—is the most powerful force in finance. But it needs two things: time and capital. Micro-investing gives you the time (by starting you early) and the habit (by automating it).

Here’s the path:

- You start with round-ups, investing $20/month.

- You get comfortable and add a $5/week recurring deposit ($40/month total).

- You get a raise and increase that to $100/month.

- You learn about a Roth IRA and open one (maybe on the same app or a different one) and start putting $200/month into it.

Your spare change didn’t make you rich. But the habit it built is now making you wealthy. A great resource to see this in action is the U.S. Securities and Exchange Commission (SEC) compound interest calculator. Plug in your own numbers and see the magic of consistency.

The Next Step: How to Graduate from Micro-Investing Platforms

There will come a time when you’re ready to take off the training wheels. How do you know when to stop using micro-investing apps?

The trigger is usually your account balance.

Remember our fee discussion? Once your account balance hits, say, $2,000, that $3/month ($36/year) subscription is a 1.8% fee. That’s still very high!

At that point, you could move your $2,000 to a traditional brokerage (like Fidelity, Vanguard, or Schwab) and invest it in a low-cost S&P 500 ETF with an expense ratio of 0.03%. That’s a fee of just **$0.60 per year** instead of $36.

Moving money from a micro-app to a brokerage is your “graduation day.” You’ve used the app for its intended purpose: to build a starting nest egg and, more importantly, the confidence and knowledge to take control of your financial future.

Conclusion: Is Micro-Investing the Right First Step for You?

So, is micro-investing worth it for beginners?

Absolutely, yes.

With the crucial caveat that you must pay attention to the fees.

A micro-investing platform is not a complete financial plan. But it is, without a doubt, the most effective, accessible, and least-intimidating tool ever created to get people to start. It transforms investing from a scary, elite activity into a simple, automated background task.

If you have been standing on the sidelines, paralyzed by jargon and high minimums, a micro-investing app is your invitation to the game. Use it to learn. Use it to build the habit. Use it to prove to yourself that you can be an investor.

Your future self will thank you for the pennies you started saving today.

Frequently Asked Questions (FAQ) About Micro-Investing Apps

1. Is micro-investing safe for beginners?

Yes, as long as you use a legitimate app. “Safe” means the app is a registered brokerage with FINRA and your account is protected by SIPC. This protects you from the company’s failure, but it does not protect you from normal market losses. All investing has risk.

2. Can I lose all my money with micro-investing apps?

It is highly unlikely you would lose all your money, especially if you are in a diversified ETF portfolio. However, all investments can go down in value. If you invest $100, it could drop to $90 in a bad month. That’s why it’s a tool for long-term goals, giving your money time to recover and grow. Never invest money you’ll need in the next 1-3 years.

3. How much money do I really need to start micro-investing?

Literally as little as $1 to $5. Many apps have no minimum deposit. You can start with just the first round-up you generate.

4. What is the best micro-investing app for a complete beginner?

The “best” one depends on its fees. The best app for you is one that has a $0 monthly fee or a percentage-based (AUM) fee. A flat $3/month fee is a very bad deal for a beginner with a $50 balance. For an excellent, unbiased definition of the concept, check out Investopedia’s article on micro-investing.

5. Do I have to pay taxes on micro-investing?

Yes. This is a real investment account. If you sell your investments for a profit, you will have to pay capital gains tax. You will also have to pay taxes on any dividends you receive (usually over $10). The app will send you a 1099 tax form at the end of the year if you meet the threshold.

6. Can I use a micro-investing app for my retirement?

Yes, many platforms now offer IRA accounts (like a Roth IRA or Traditional IRA). This is a fantastic way to start saving for retirement, as these accounts have powerful tax advantages.

7. How do micro-investing apps make money if they have low fees?

They make money in several ways:

- The flat monthly subscription fees ($1, $3, $5, etc.).

- Interest on the uninvested cash sitting in your account.

- Getting “payment for order flow” (a complex topic, but they get small rebates for sending your trades to a specific place).

- Charging AUM (Assets Under Management) fees.

8. What’s the difference between a micro-investing app and a high-yield savings account?

A high-yield savings account (HYSA) is for saving. Your money is FDIC-insured (you can’t lose it) and you earn a small, guaranteed interest rate. It’s perfect for your emergency fund. A micro-investing app is for investing. Your money is not guaranteed, it can go down, but it also has the potential to grow much, much faster over the long term.

9. How long should I keep my money in a micro-investing app?

You should plan to keep it invested for at least 3-5 years. The stock market is volatile in the short term. If you’re saving for a vacation next year, do not put that money in an investing app.

10. What happens if I stop putting money in?

Nothing bad. Your money will stay invested and will continue to go up and down with the market. However, if the app charges a monthly subscription fee, that fee will still be taken, and it will start to eat away at your investment balance.

11. Is micro-investing in stocks or ETFs better?

For 99% of beginners, investing in a diversified ETF (Exchange-Traded Fund) is better. An ETF is a bundle of hundreds or thousands of stocks in one. It’s automatically diversified. Buying individual stocks is much riskier and requires a lot more research.

12. When should I switch from a micro-investing app to a traditional brokerage?

You should switch when your account balance is large enough that the app’s flat monthly fee becomes more expensive than the AUM fee at a traditional broker. For most people, this “graduation point” is between $1,000 and $5,000.