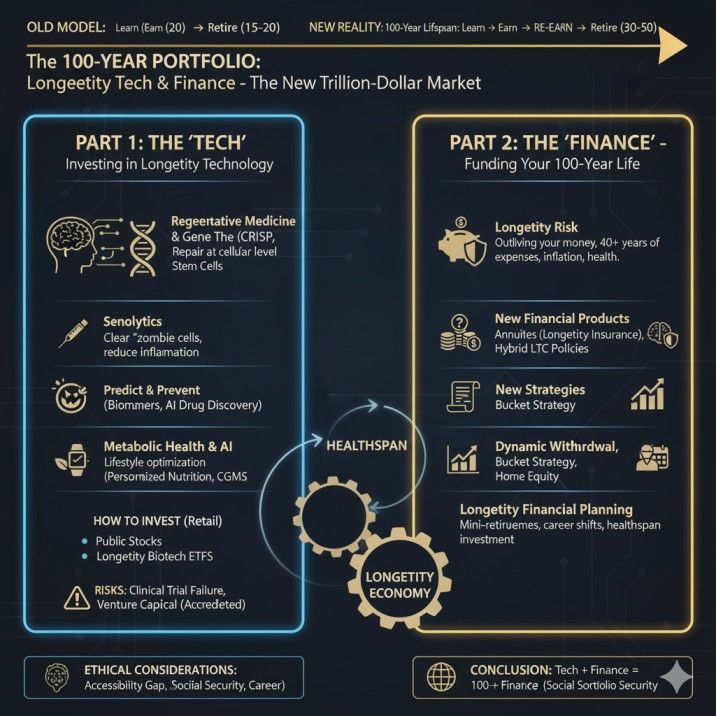

For our entire modern history, life has followed a predictable script: you learn, you earn, and then you retire. This three-stage model was built on the assumption that you’d work for 40 years and, if you were lucky, enjoy a 15 to 20-year retirement. But what happens when that final stage stretches to 30, 40, or even 50 years?

This isn’t science fiction. We are on the cusp of a revolution. The 100-year lifespan is moving from a statistical anomaly to a mainstream reality for many born today.

This demographic shift is creating the single greatest disruption—and opportunity—of our time. It’s sparking a two-sided boom, creating what is now known as the business of longevity.

- The “Tech”: A new industry, longevity technology (Longevity Tech), is racing to ensure those extra years are healthy and vital (known as healthspan), not just long (lifespan).

- The “Finance”: The entire financial services industry is scrambling to design new financial products for a 100-year lifespan to answer the terrifying question: “How do I pay for it all?”

This is not just another investment trend. It’s the emergence of a brand new longevity economy. Understanding how to invest in longevity tech and what longevity financial planning looks like is no longer optional; it’s essential for your future wealth and health.

What is the Longevity Economy? The New Trillion-Dollar Frontier

When you hear “aging population,” you might picture a drain on the economy. The longevity economy flips that script. It’s not just about “healthcare for the elderly”; it’s a vibrant, active, and wealthy economic ecosystem driven by the needs and desires of people living longer, healthier lives.

This economy encompasses everything from biotech and preventative medicine to finance, travel, housing, and education. It’s one of the largest and fastest-growing business opportunities in longevity.

Why Longevity is Now a Serious Asset Class

For decades, investing in longevity was seen as a niche, high-risk bet. Not anymore. Two major forces are converging:

- Demographic Tsunami: The “Silver Tsunami” of aging Baby Boomers controls a massive portion of global wealth and is willing to spend it on health and wellness.

- Technological Breakthroughs: For the first time, science is moving from treating age-related diseases (like heart disease) to treating aging itself as the root cause.

This shift has turned longevity as an asset class into a serious topic in boardrooms and at global forums. Analysts following longevity market trends now project its value in the trillions. The longevity industry growth is being supercharged by venture capital, with longevity venture capital funds pouring billions into startups. This isn’t a bubble; it’s the ground floor of a new economic era.

Part 1: The “Tech” — Investing in Longevity Technology

The goal of longevity tech is not immortality. It’s to extend healthspan—the number of years we live in good health, free from chronic disease. Investing in longevity technology is a bet on this future.

The longevity tech industry is complex, but it’s built on a few core pillars that every investor should understand.

Pillar 1: Regenerative Medicine and Gene Therapies (The “Repair” Crew)

This is about repairing the body at a cellular level. Instead of a pill to manage symptoms, these are therapies to reverse damage.

- Stem Cell Therapies: Using the body’s master cells to rebuild damaged tissues, from worn-out knees to damaged hearts. Investing in stem cell therapy has been a hot market for years.

- Gene Therapies (like CRISPR): This is the ultimate “bio-hack.” These technologies allow scientists to edit DNA to correct genetic faults that cause diseases like Huntington’s or even those that accelerate aging. Investing in gene therapy for aging and CRISPR investment opportunities are high-risk, high-reward plays.

Pillar 2: Senolytics (The “Zombie Cell” Cleaners)

As you age, your body accumulates “senescent cells”—cells that are damaged and refuse to die. They are like zombies, pumping out inflammatory signals that damage healthy cells around them.

Senolytics are a class of drugs designed to hunt down and eliminate these zombie cells. The theory is that by clearing them out, you can reduce inflammation and slow or even reverse many age-related conditions. Many senolytics companies to invest in are currently in clinical trials, making this one of the most-watched longevity market trends.

Pillar 3: Longevity Diagnostics and AI (The “Early Warning” System)

Why wait for a disease to show up? This pillar is all about prediction and prevention.

- AI in Longevity Research: Artificial intelligence is being used to sift through massive datasets to discover new anti-aging drug discovery targets far faster than humans ever could.

- Predictive Biomarkers: These are tests that go beyond your annual physical. They measure your “biological age” by looking at your epigenetics (how your lifestyle tells your genes to behave), your gut microbiome, or proteins in your blood. A longevity diagnostics investment is a bet that people will pay to know how they are aging and what to do about it.

Pillar 4: Metabolic Health and Epigenetics (The “Lifestyle” Tech)

This sector focuses on how we live. We now know that our diet, sleep, and exercise directly control how our genes are expressed (epigenetics).

- Personalized Nutrition: Companies are using your unique DNA and microbiome data to create personalized nutrition for longevity.

- Metabolic Health: This is a huge focus, with a surge in investing in metabolic health startups that offer continuous glucose monitors (CGMs) and other tools to help people manage their blood sugar and energy.

How to Invest in Longevity Tech: A Guide for Retail Investors

You don’t have to be a billionaire venture capitalist to get involved. Here’s how to invest in longevity tech today.

- Publicly Traded Longevity Tech Stocks: This is the most direct way. You can buy shares in established biotech longevity companies or pharmaceutical giants that have longevity divisions. This includes companies working on regenerative medicine stocks or those in the AI-driven drug discovery for aging space.

- Longevity Biotech ETFs: This is a much safer option. A longevity biotech ETF (Exchange-Traded Fund) bundles dozens of longevity-related stocks into a single, purchasable share. This diversifies your risk, so if one company’s clinical trial fails, your entire investment isn’t wiped out. This is one of the best longevity tech stocks for retail investors to get broad exposure.

- Venture Capital (for Accredited Investors): For those who qualify, longevity venture capital funds offer direct access to investing in longevity biotech startups. This is high-risk, as most startups fail, but the winners can deliver enormous returns.

It’s crucial to understand the risks of investing in longevity tech. This is a long-term play. Products can take a decade to get through clinical trials, and many will fail. This is a speculative part of your portfolio, not your retirement fund.

Part 2: The “Finance” — Funding Your 100-Year Life

The longevity technology startups might give us the health to live to 100, but the finance industry has to figure out how we pay for it. The traditional model of “retire at 65” is completely broken by a 100-year lifespan.

The Great Financial Mismatch: What is Longevity Risk?

Longevity risk is the simple, terrifying risk of outliving your money.

If you retire at 65 with $1 million and plan to live for 20 years, your plan looks very different than if you live for 40 years. The financial challenges of a 100-year lifespan are massive:

- Inflation erodes your savings over 40+ years.

- You face 40+ years of potential health issues and financing long-term care.

- A single market crash in the early years of such a long retirement can be catastrophic.

This is why we are seeing a boom in financial innovation for extended lifespans. Wealth management for centenarians (or future centenarians) is a new, specialized field.

The New Financial Products Being Designed for Longevity

Financial institutions are racing to create new financial products for a 100-year lifespan. Here’s what’s emerging.

1. The Reinvention of Annuities (Longevity Insurance)

Annuities got a bad rap for being complex and expensive. But the core idea is perfect for longevity. You pay a sum of money today in exchange for a guaranteed paycheck for the rest of your life, no matter how long that is.

- Deferred Income Annuities (DIAs): These are also called longevity insurance. You might pay $100,000 at age 60, and in return, you get a guaranteed $2,000-a-month check starting at age 85. This is a safety net to ensure you can’t outlive your income.

- New Annuity Products Designed for Longevity: We’re seeing new, more flexible annuities for extended lifespan that offer inflation protection and benefits for long-term care.

2. Long-Term Care (LTC) Insurance 2.0

The old LTC insurance market failed. Premiums skyrocketed, and companies went bust. The new model is different.

- Hybrid LTC Insurance Products: These are the new standard. A hybrid long-term care insurance policy combines a life insurance policy with an LTC benefit. If you don’t need the long-term care, your heirs get a death benefit. If you do need it, you can access that benefit to pay for home health aides or a nursing facility. This “use it or lose it” problem is solved.

- Financing Long-Term Care in Retirement: This is a critical piece of longevity financial planning. A 100-year life means a higher chance of needing care, which can cost over $100,000 a year.

3. New Wealth Management and Retirement Strategies

Your grandfather’s “4% rule” (withdrawing 4% of your portfolio each year) doesn’t work in a 40-year retirement.

- Dynamic Retirement Withdrawal Strategies: New models are emerging that are more flexible. You might withdraw 5% in a good market year but only 3% in a bad one.

- The “Bucket Strategy”: This is a popular financial strategy for living to 100. Your financial advisor splits your money into three “buckets”:

- Short-Term (1-3 years): Cash, for immediate living expenses.

- Mid-Term (4-10 years): Bonds and stable investments.

- Long-Term (10+ years): Stocks and growth assets (like your longevity tech ETFs).

- Using Home Equity: We are seeing more reverse mortgage alternatives for longevity and financial products that help retirees tap into their home equity for retirement income without having to sell their house.

4. The Rise of “Longevity Financial Planning”

A longevity financial advisor is a new type of specialist. They don’t just ask when you want to retire. They ask:

- How will you structure “mini-retirements” or sabbaticals?

- How will you fund a career change at age 50?

- How do we fund your “healthspan” investments (e.g., personalized nutrition, advanced diagnostics) now so you need less medical care later?

This is a holistic approach, blending wealth management for a longer life with investments in the very technology that makes it possible.

Navigating the Hype: The Risks and Ethics of the Longevity Business

It’s easy to get lost in the excitement, but E-E-A-T (Expertise, Authoritativeness, Trustworthiness) requires a clear-eyed look at the risks.

Financial and Regulatory Risks

- Biotech is Risky: The biggest risk of investing in longevity tech is clinical trial failure. A promising senolytics company can see its stock go to zero overnight if its Phase 3 trial fails. This is not a “get rich quick” scheme.

- Regulatory Challenges: How does the Food and Drug Administration (FDA) approve a drug for “aging”? It can’t—aging isn’t technically a disease. This regulatory challenge for longevity tech is a major hurdle. Companies must get drugs approved for specific age-related diseases first.

- Hype vs. Reality: The market is full of hype. You must separate science-backed companies from those selling “anti-aging” snake oil.

The Ethical Considerations of Longevity

This revolution also brings up profound ethical considerations of longevity.

- The Accessibility Gap: Will longevity treatments only be available to the wealthy? This could create a biological gap between the rich (who live to 120) and the poor (who don’t).

- Societal Impact: What does a 100-year life do to social security (which is already strained), or career progression (if people never retire)? These are questions society must answer.

Conclusion: The Twin Engines of Your Longer Future

The business of longevity is the most profound investment theme of our lifetime. It’s being driven by two powerful, interconnected engines.

The first engine is longevity technology—the science that is giving us the ability to live longer, healthier lives. Investing in longevity biotech is an opportunity to participate in one of the greatest technological advancements in human history.

The second engine is longevity finance—the creation of new financial products for a 100-year lifespan that give us the security to enjoy those extra decades without fear.

Understanding both is the key. You must become an investor in the technology that extends your healthspan while simultaneously adopting the financial strategies to extend your wealthspan. This is the new blueprint for a 100-year portfolio.

Frequently Asked Questions (FAQ) About Longevity Investing and Finance

1. What is the “longevity economy”?

The longevity economy is the total sum of all economic activity driven by the needs and wants of people living longer lives. It’s not just healthcare; it includes technology, financial services, housing, travel, and personalized wellness for people over 50.

2. What’s the difference between healthspan and lifespan?

Lifespan is the total number of years you are alive. Healthspan is the number of years you are alive in good health, free from chronic disease. The primary goal of longevity tech is to make healthspan equal lifespan.

3. Is longevity tech a good investment in 2025?

Investing in longevity tech is considered a high-growth but speculative investment. While the longevity industry growth is strong, individual stocks carry high risk due to clinical trial failures. For most people, a longevity biotech ETF is a safer way to gain exposure to this long-term trend.

4. What are senolytics and how do they work?

Senolytics are a class of drugs being researched to clear out “senescent” or “zombie” cells. These are damaged cells that refuse to die and instead create inflammation that damages nearby healthy tissue, contributing to aging.

5. How can a retail investor invest in longevity tech startups?

Directly investing in longevity biotech startups is difficult for most people as it’s usually reserved for longevity venture capital funds and accredited investors. The easiest way for a retail investor to get exposure is by buying stocks in publicly traded biotech longevity companies or, more simply, a longevity tech ETF.

6. What is “longevity risk” in financial planning?

Longevity risk is the personal financial risk of outliving your retirement savings. As people live longer, traditional retirement plans (like the 4% rule) may not be sufficient, requiring new financial strategies for living to 100.

7. How much money do I need to retire for a 100-year lifespan?

There is no single number, but managing finances for a longer life means your savings will need to last 35-40+ years in retirement, not 15-20. This requires a much larger nest egg, inflation protection, and a plan for financing long-term care. This is a core challenge of longevity financial planning.

8. What is longevity insurance?

Longevity insurance is another name for a deferred income annuity (DIA). You pay a lump sum to an insurance company when you are younger (e.g., 60s), and in exchange, you receive a guaranteed monthly paycheck that starts much later in life (e.g., 80 or 85) and lasts for as long as you live. It’s a powerful tool to prevent you from outliving your money.

9. What is a hybrid long-term care (LTC) insurance policy?

A hybrid long-term care insurance policy combines a life insurance policy (or an annuity) with a long-term care benefit. This is more popular than traditional LTC insurance because if you never need the long-term care, your heirs still receive a death benefit, so the money is not “wasted.”

10. What are the main sectors of the longevity tech industry?

The main investment sectors include:

- Regenerative Medicine (stem cells, gene therapy)

- Senolytics (clearing zombie cells)

- Longevity Diagnostics & AI (biomarkers, AI drug discovery)

- Metabolic Health & Epigenetics (personalized nutrition, lifestyle tech)

11. What is the role of AI in longevity research?

AI in longevity research is critical. It is used to analyze massive biological datasets to discover new drug targets, identify predictive biomarkers of aging, and personalize treatments far faster than human scientists ever could.

12. What are the biggest risks of investing in longevity technology?

The risks of investing in longevity tech are high. The biggest is clinical trial failure, where a promising drug fails to prove effective, which can make a company’s stock worthless. Other risks include regulatory challenges from agencies like the FDA and intense market competition.

13. What is a “biological age” test?

A biological age test is a type of longevity diagnostic that measures your age at a cellular or molecular level, which can be different from your chronological (calendar) age. These tests, often based on epigenetics, aim to show you how fast your body is actually aging.

14. How does the 100-year lifespan affect the economy?

The impact of a 100-year lifespan on the economy is complex. It creates the massive longevity economy (a positive) but also strains social safety nets like Social Security and Medicare (a challenge). It also forces a rethink of career paths and retirement.

15. Where can I find reliable information on longevity investing?

For financial information, look to reputable financial regulators like the SEC’s investor education site for general advice on investing in speculative sectors. For scientific information, resources like the National Institute on Aging (NIA) provide credible research on the science of aging.