Choosing the right payment processor can make or break your business in 2025. Whether you’re launching an online store, freelancing across borders, or scaling a SaaS company, Stripe vs PayPal for small businesses 2025 is a hot topic. Both platforms are powerhouses, but they cater to different needs. In this post, we’ll dive into the best payment processor Stripe or PayPal for ecommerce, compare fees, integrations, and more—all in plain English. Let’s find the perfect fit for your business!

Why Compare Stripe and PayPal in 2025?

Imagine you’re a freelancer juggling global clients or running a subscription service. You’ve probably wondered, which is better Stripe or PayPal for online stores? Stripe, born in 2011, is a developer’s dream with endless customization. PayPal, a veteran since 1998, wins hearts with its trusted name and simplicity. With ecommerce exploding, understanding Stripe vs PayPal international payments pros and cons is key to staying ahead. Let’s break it down.

Stripe vs PayPal Fees Comparison 2025

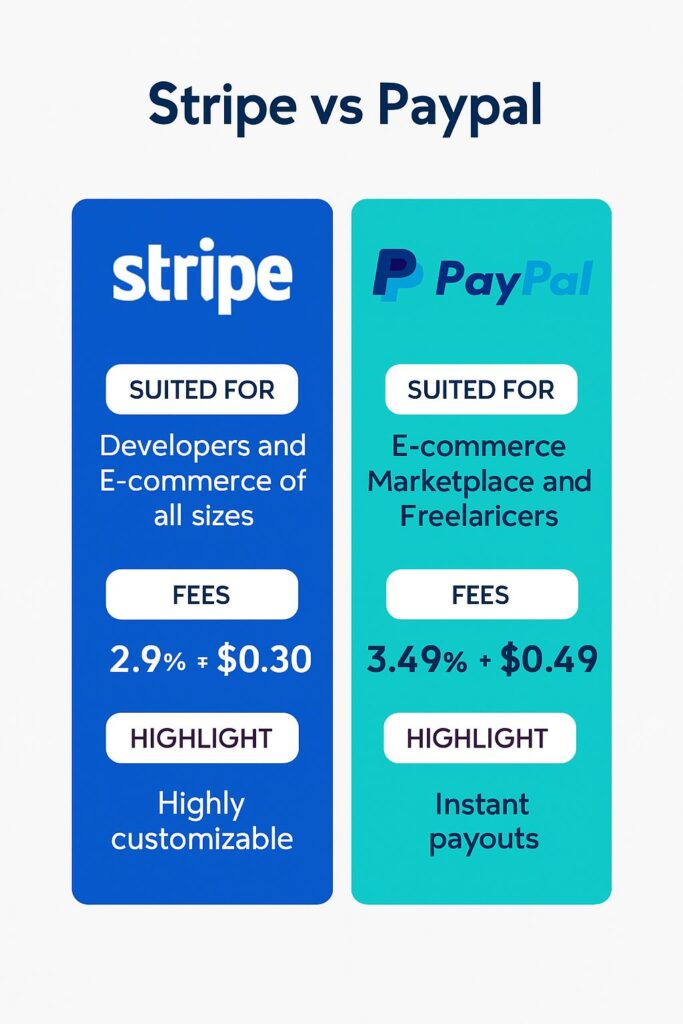

Fees can sneak up on your profits, so let’s tackle Stripe vs PayPal transaction fees for high volume. Both offer pay-as-you-go pricing—no monthly fees unless you opt for premium features.

For domestic online card payments:

- Stripe: 2.9% + $0.30 per transaction.

- PayPal: 2.89% + $0.29 for some plans, but 2.99% + $0.49 for standard checkout.

Going global? PayPal vs Stripe for international currency conversion gets spicy. Stripe charges 1.5% for cross-border cards plus 1% for currency conversion. PayPal adds 1.5% per transaction, but its fixed fees hit harder on smaller sales.

Which is cheaper Stripe or PayPal for online transactions? Stripe often wins for high-volume or global businesses with lower add-ons. For tiny transactions, Stripe vs PayPal micropayments fees explained shows PayPal’s special rates can save you cash.

Here’s a quick fees breakdown: Feature Stripe PayPal Domestic Card Fee 2.9% + $0.30 2.89% + $0.29 International Add-On 1.5% + 1% conversion 1.5% per transaction Chargeback Fee $15 $20 Recurring Billing Built-in, no extra Available, varies

Pro tip: For high-risk merchants, explore Stripe vs PayPal alternatives for high risk businesses 2025.

Integrations: PayPal vs Stripe for Shopify 2025

Seamless integration is a game-changer. Stripe vs PayPal integration with WooCommerce explained? Stripe’s API is a developer’s playground, perfect for custom checkouts on Shopify, WooCommerce, BigCommerce, or WordPress. PayPal vs Stripe for BigCommerce integration? Stripe’s flexibility shines.

PayPal, on the other hand, is plug-and-play—ideal for beginners. Best choice between Stripe and PayPal for SaaS businesses leans toward Stripe for its robust Stripe vs PayPal for subscription billing services. For Amazon or Etsy sellers, Stripe vs PayPal for Amazon sellers comparison and PayPal vs Stripe for Etsy sellers 2025 guide highlight PayPal’s edge due to buyer trust.

International and Mobile Features

Freelancers, this one’s for you: Best for international freelancers Stripe or PayPal 2025? Stripe supports 135+ currencies across 195 countries with lower conversion fees. PayPal covers 200+ markets but charges more for cross-border transactions.

For mobile users, Stripe vs PayPal mobile app features comparison shows PayPal’s app is more intuitive for peer-to-peer payments. In-person sales? Stripe vs PayPal POS systems for brick and mortar—Stripe’s Terminal starts at $59, PayPal’s readers at $29.

Payout speed? Compare Stripe and PayPal payout times 2025: Stripe typically takes 2 business days, while PayPal offers instant payouts for a fee.

Security and Fraud Protection

Nobody wants fraud drama. Stripe vs PayPal security features side by side: Both are PCI DSS Level 1 compliant, using encryption and AI to spot risks. PayPal vs Stripe fraud prevention tools 2025? Stripe’s Radar (costs $0.02-$0.07 per transaction) blocks billions in fraud annually. PayPal’s Seller Protection covers eligible disputes.

For chargebacks, Stripe vs PayPal chargeback protection explained: Stripe’s $15 fee is refundable if you win; PayPal’s $20 isn’t. Stripe feels a tad more proactive here.

Customer Support and Scalability

Stripe vs PayPal customer support differences 2025: Stripe offers 24/7 chat and email for paid users, but its techy vibe can overwhelm newbies. PayPal provides phone support (business hours) and forums, better for beginners.

For growth, Stripe vs PayPal scalability for growing businesses favors Stripe’s custom APIs and enterprise solutions. PayPal suits PayPal vs Stripe for low volume ecommerce sites.

Who Wins for Your Niche?

- Startups: Which processor Stripe or PayPal for startups 2025? PayPal’s simplicity for newbies.

- Ecommerce: Best payment gateway Stripe or PayPal for Shopify 2025? Stripe for customization.

- Freelancers: PayPal vs Stripe for freelancers and solopreneurs—PayPal for fast invoicing.

- SaaS: Stripe vs PayPal for subscription-based services—Stripe’s billing tools dominate.

- Nonprofits: Which payment gateway Stripe or PayPal for nonprofits? Stripe’s lower fees win.

- Events: PayPal vs Stripe for event booking platforms—Stripe for recurring events.

User feedback? PayPal vs Stripe user reviews and ratings 2025 give Stripe 4.7/5 for features, PayPal 4.5/5 for trust.

Pros and Cons Snapshot

Stripe Pros: Dev-friendly, lower international fees, killer analytics.

Cons: Steeper learning curve.

PayPal Pros: Easy setup, trusted brand, buyer protection.

Cons: Higher fees for extras, more disputes.

Your Next Step: Choose Wisely!

So, Stripe vs PayPal for ecommerce startups 2025? Go Stripe if you’re tech-savvy and global. Pick PayPal for simple setups and buyer trust. Both offer free trials—test them out!