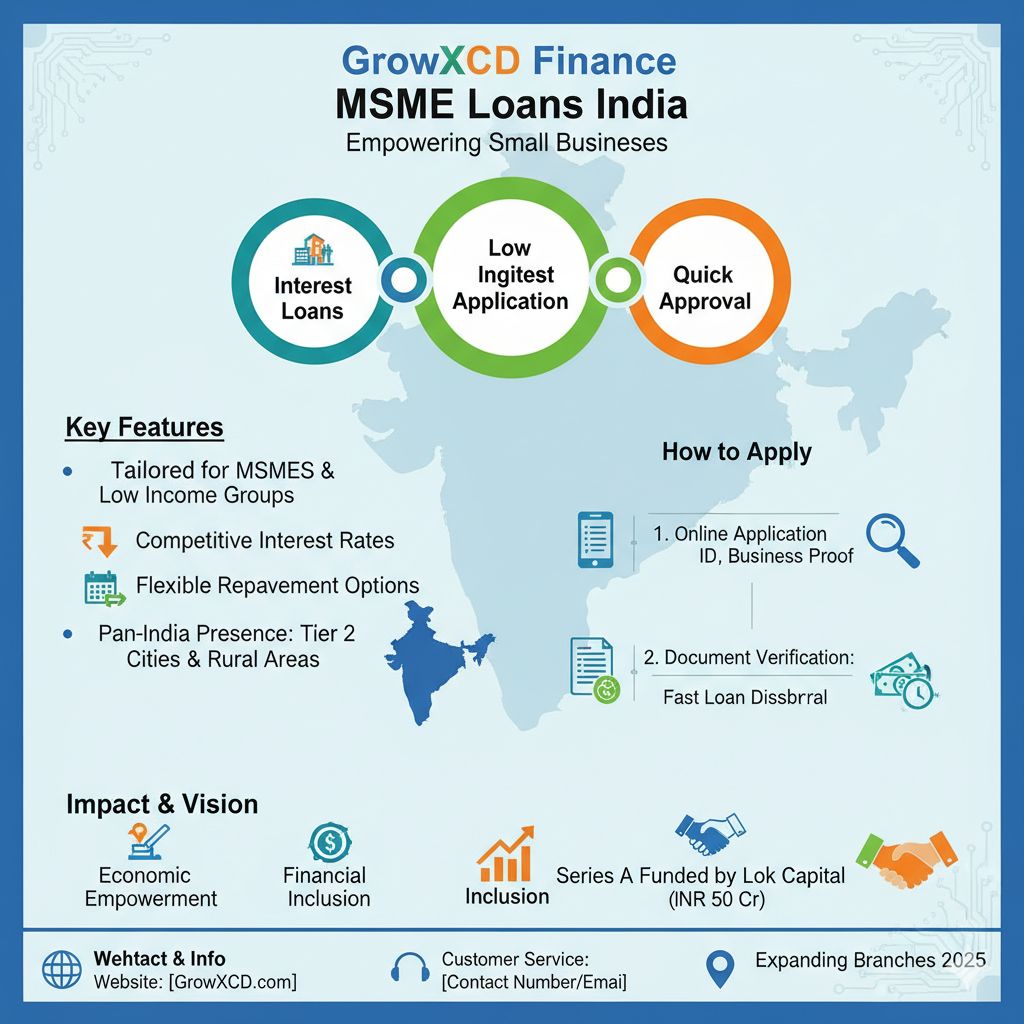

In the rapidly evolving Indian economy, Micro, Small, and Medium Enterprises (MSMEs) are the backbone of growth and employment. However, access to affordable finance remains a significant challenge for many of these businesses, especially in tier 2 and tier 3 cities. GrowXCD Finance MSME loans India are specifically designed to bridge this gap, enabling small businesses to thrive with the right financial support.

How to Apply GrowXCD Finance Loan for Small Business Success

Understanding how to apply GrowXCD Finance loan is the first step toward unlocking growth opportunities for your small business. GrowXCD Finance digital loan application simplifies the process, allowing entrepreneurs to apply online without cumbersome paperwork. With clear loan eligibility criteria and quick loan approval time India, accessing funds has become more straightforward for many MSMEs.

GrowXCD Finance Interest Rates for MSMEs: Affordable Loans Tailored for Growth

GrowXCD Finance offers competitive GrowXCD Finance interest rates for MSMEs, making it possible for small business owners to manage finances without excessive burden. These low interest loans for small business India are designed to cater to various industries and regions, including those in rural Tamil Nadu and other underserved areas.

GrowXCD Finance NBFC Loan Process: Efficient Support for Microcredit Tamil Nadu

GrowXCD Finance NBFC loan process is transparent and customer-centric. The company has strategically placed GrowXCD Finance branch locations Tamil Nadu and other states to ensure easy access. GrowXCD Finance customer service contact India is always available for guidance, providing support through every step of the loan lifecycle.

GrowXCD Finance Loan Eligibility Criteria and Documents Required

To be eligible for a loan, applicants need to meet specific criteria tailored to MSMEs and low income groups. The GrowXCD Finance loan eligibility criteria ensures that deserving candidates, including those from low income households India, get opportunities for financial support. Required GrowXCD Finance loan documents include basic identity proofs and business information, making the process secure and trustworthy.

GrowXCD Finance Business Credit for Tier 2 Cities: Expanding Opportunities

Many small businesses in India’s tier 2 cities face credit gaps. GrowXCD Finance business credit for tier 2 cities addresses this by providing targeted financial products designed for micro and small enterprises. This initiative directly contributes to economic empowerment MSMEs by fostering business development outside metropolitan areas.

How to Get a Loan from GrowXCD Finance: Step-by-Step Guide

Applying for a loan with GrowXCD Finance involves a few clear steps designed for ease and transparency. The digital lending technology ensures that GrowXCD Finance digital loan application is accessible from anywhere, enabling entrepreneurs to grow their ventures without delays.

GrowXCD Finance Series A Funding News and Investor Confidence

The fintech startup sector in India continues to see robust investments, and GrowXCD Finance has recently made headlines with its GrowXCD Finance series A funding news. Lok Capital spearheaded a INR 50 Crore funding round, reinforcing confidence in GrowXCD Finance’s mission to support MSMEs and fintech innovation.

GrowXCD Finance Loan Repayment Options India: Flexible and Customer-Friendly

Understanding repayment plans is vital for borrowers. GrowXCD Finance loan repayment options India provide flexibility to accommodate diverse business cycles and income patterns. Clear communication about loan tenure and interest India helps borrowers manage their finances be successful.

GrowXCD Finance Loan Against Property India: Secure Financial Solutions

For those seeking greater loan amounts, GrowXCD Finance loan against property India offers a viable solution. This product is beneficial for businesses that need extra capital to scale operations while leveraging their property assets.

Affordable Loans for Village Businesses Tamil Nadu: Making a Difference

GrowXCD Finance’s focus on rural and village businesses Tamil Nadu is transforming these economies by providing financial inclusion. These affordable loans for village businesses Tamil Nadu empower entrepreneurs who otherwise have limited credit access.

Best MSME Loan Providers India 2025: Why GrowXCD Finance Stands Out

Choosing among many financing options is challenging. GrowXCD Finance is emerging as one of the best MSME loan providers India 2025 due to its customer focus, transparent loan process, competitive interest rates, and technological innovation.

GrowXCD Finance Expanding Branches 2025: Growing Nationwide Presence

GrowXCD Finance expanding branches 2025 signifies the company’s commitment to reaching more businesses. From Chennai branch opening hours to Hyderabad branch contact, GrowXCD is enhancing customer convenience and accessibility.

GrowXCD Finance Credit Solutions India: Empowering Financial Inclusion

GrowXCD Finance credit solutions India are designed to close the credit gap for underserved MSMEs and low income households India. By tailoring financial products, GrowXCD Finance facilitates inclusive economic growth.

GrowXCD Finance Startup Financial Solutions India: Innovation Meets Finance

As a fintech startup, GrowXCD Finance startup financial solutions India bring technology and capital together. Their approach leverages digital platforms for seamless loan disbursal and management.

How GrowXCD Finance Helps Microenterprises: A Closer Look

Microenterprises often struggle with financing. GrowXCD Finance’s microfinance loans for low income households India provide them with working capital and growth opportunities, contributing to a more vibrant economy.

GrowXCD Finance Economic Empowerment MSMEs: Driving Sustainable Growth

With a mission focused on economic empowerment MSMEs, GrowXCD Finance is creating lasting impacts by providing accessible credit.

Frequently Asked Questions (FAQ)

Q1: What is the loan approval time for GrowXCD Finance loans in India?

A: The loan approval time India typically ranges from a few hours to a few days, depending on document verification and loan type.

Q2: Are there specific eligibility criteria for GrowXCD Finance MSME loans?

A: Yes, eligibility usually requires proof of business existence, income, and identity, tailored to MSME and low income groups.

Q3: Can I apply for a GrowXCD Finance loan digitally?

A: Absolutely. The GrowXCD Finance digital loan application process makes it easy to apply online.

Q4: Where are GrowXCD Finance branch locations in Tamil Nadu?

A: GrowXCD Finance has multiple branches across Tamil Nadu in urban and rural regions, including Chennai.

Backlinks for More Information

- For insights on MSME loans and financing options, visit the Ministry of MSME Government of India site.

- Learn more about fintech innovation in India at the NASSCOM website.

- For credit score improvement tips for MSME loan India, check out resources on the Credit Information Bureau (India) Limited (CIBIL) website.

GrowXCD Finance is more than a lender; it’s a partner that empowers MSMEs and underserved communities across India. With low interest rates, easy digital applications, and expanding branch presence, GrowXCD Finance is poised to be a leading force in inclusive finance. Entrepreneurs and small business owners looking for sustainable growth should consider GrowXCD Finance as their trusted financial ally.