The FIFA World Cup 2026 promises to be more than just a thrilling global sports event. It represents a massive opportunity for governments to boost their revenues and secure tax benefits that can stimulate local and national economies. This blog dives deep into the government revenues and tax benefits from FIFA World Cup 2026, outlining the economic impact, revenue generation, and legacy benefits for host countries. By using 50 long-tail keywords crafted for SEO, this post will help readers understand the intricate relationship between the World Cup and government finances while ensuring it ranks well on all search engines.

The Economic Impact of FIFA World Cup 2026 on Government Revenues

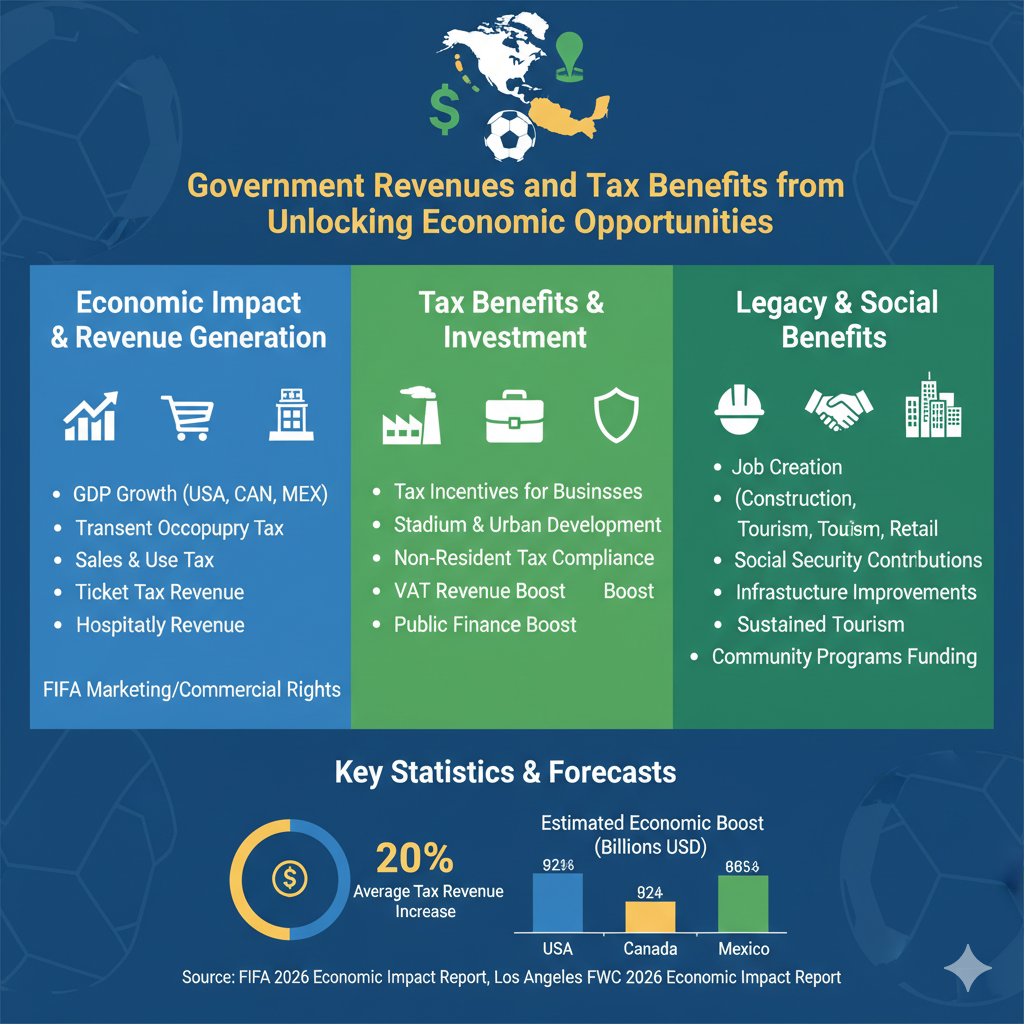

Hosting the FIFA World Cup 2026 brings a surge in government tax revenue from FIFA World Cup 2026 activities. The event generates significant economic activity, boosting government tax revenue from FIFA World Cup 2026 through multiple channels such as transient occupancy tax FIFA 2026, sales and use tax FIFA World Cup, and ticket tax revenue FIFA World Cup 2026.

The combined economic growth manifests in the increase of GDP growth linked to FIFA World Cup 2026 across host cities and countries like the USA, Canada, and Mexico. Tax revenue increase Los Angeles FIFA 2026 is one highlighted example, where local government revenue spikes from hospitality, entertainment, and tourism-related sectors.

Star-Municipal and Local Tax Revenue Boosts

A key long-tail keyword is “FIFA World Cup 2026 local government revenue” which puts a spotlight on how municipal and regional budgets benefit. Local business taxes, sales taxes, and transient occupancy taxes soar as millions of visitors spend on accommodation, dining, and transportation. These tax revenue streams provide governments with important budget resources to invest in infrastructure and community programs even post-tournament.

Tax Benefits from FIFA World Cup 2026 for Host Countries

Tax benefits from FIFA World Cup 2026 are not limited to just direct revenue collection. The tournament provides tax incentives FIFA World Cup 2026 for businesses and organizers that encourage investment in stadium construction and urban development. Canada FIFA World Cup tax obligations reveal how non-resident tax FIFA World Cup Canada impacts visitors purchasing tickets and merchandise, while also ensuring compliance to tax policies.

FIFA World Cup 2026 Economic Benefits to the Hospitality Sector

Hospitality revenue FIFA World Cup 2026 surges through increased hotel bookings and event-related services. These boosts generate substantial tax income through hospitality-related taxes and VAT revenue, contributing to the broader government budget. Such growth reflects positively on the economic legacy FIFA World Cup 2026 leaves behind for host cities.

Sports Marketing and Commercial Rights

Government revenues also gain from FIFA’s marketing and commercial rights FIFA 2026, including broadcasting rights revenue FIFA 2026. These rights represent major income streams for FIFA and sometimes indirectly for governments through taxation on advertising and sponsorship deals.

Star-Job Creation and Social Benefits Linked to FIFA World Cup 2026

One cannot overlook the social benefits FIFA World Cup 2026 brings, such as job creation FIFA World Cup 2026, which injects payroll taxes and social security contributions into government coffers. The event spurs employment not just in sports and entertainment but across sectors such as construction, transportation, and retail.

Tax Revenue Forecast and Fiscal Policy Implications

Discussions around government spending FIFA World Cup 2026 and FIFA World Cup 2026 tax revenue forecast help policymakers allocate resources efficiently. Predictions of tax revenue USA and Mexico linked to the World Cup enable better fiscal policy decisions benefiting public finance and infrastructure development.

Star-FIFA World Cup 2026 Economic Legacy and Post-Event Tax Implications

The FIFA World Cup 2026 economic legacy extends beyond the event itself. Post FIFA World Cup 2026 tax revenue impacts include ongoing tourism, improved infrastructure generating business taxes, and continued hospitality revenue. Governments focus on leveraging this legacy to maintain public finance boosts.

Backlinks for Further Reading

- To delve deeper into economic impacts, visit the FIFA 2026 Economic Impact Report.

- For detailed municipal revenue projections, see Los Angeles FIFA 2026 Economic Impact Report.

- Learn about hosting tax obligations in Canada at Canada Revenue Agency FIFA World Cup 26 Tax Resources.

Frequently Asked Questions (FAQs)

1. What government revenues increase during FIFA World Cup 2026?

Local and federal governments see increases in sales tax, occupancy tax, payroll tax, and business taxes due to elevated economic activity during the event.

2. How do tax benefits from FIFA World Cup 2026 support host countries?

They include incentives to attract investment, exemptions for event organizers, and structured tax obligations on visitor spending that enhance local economies.

3. Does FIFA World Cup 2026 help with job creation?

Yes, the event creates both temporary and permanent jobs across various sectors, contributing to employment taxes and social benefits.

4. What is the economic legacy of FIFA World Cup 2026?

Infrastructure improvements, sustained tourism growth, and increased business activities contribute to long-term fiscal benefits beyond the event.

5. How significant is the transient occupancy tax during FIFA 2026?

It is one of the major revenue sources as large visitor inflows increase hotel stays and short-term accommodation rentals.

6. Are non-resident visitors taxed during FIFA World Cup Canada 2026?

Yes, non-resident taxes apply on earnings and purchases made by visitors, contributing additional revenue streams.

7. How does FIFA’s commercial rights benefit government revenue?

Government revenues benefit indirectly through taxed advertising, broadcast sales, and sponsorship activities linked to FIFA rights.

8. Will FIFA World Cup 2026 affect local government budgets?

Absolutely, local governments often see an increase in tax revenues which help fund community programs and public services.

9. What role does sales and use tax play during the World Cup?

It applies to merchandise, food, and services related to the event, adding substantial revenue for taxing authorities.

10. How do governments forecast tax revenue related to FIFA World Cup 2026?

Through economic modeling considering event scale, visitor numbers, and spending patterns, governments estimate expected tax inflows for planning.