Have you ever booked a flight and, with a single click, added travel insurance to your purchase? Or bought a new laptop online and been offered a two-year protection plan right before you paid? If so, you’ve already experienced the biggest shift in the insurance industry in a generation: embedded insurance.

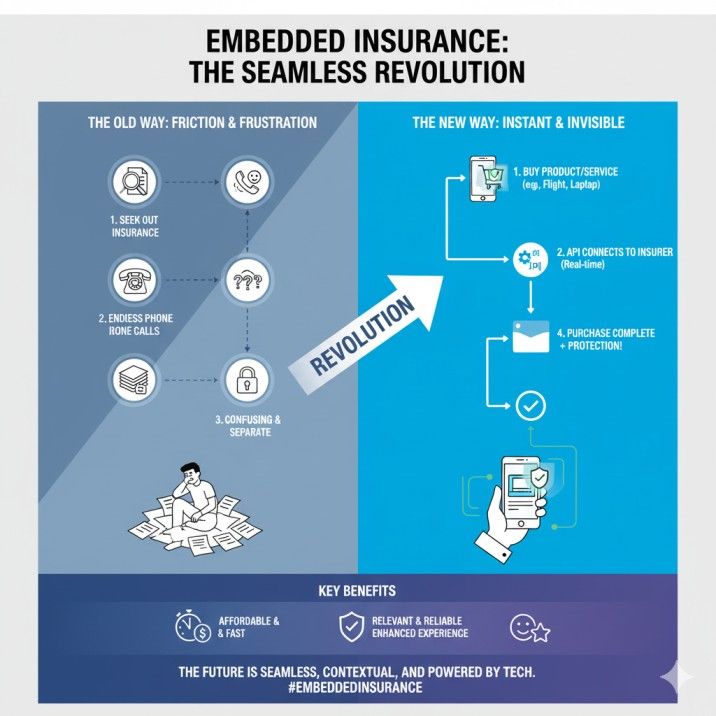

This isn’t just another tech buzzword. It’s a quiet revolution that’s changing the entire landscape of how we buy and interact with insurance. For decades, getting insured meant seeking out an agent, filling out lengthy forms, and buying a policy completely separate from the product or service you wanted to protect. That era is quickly fading.

The new model is simple, seamless, and customer-centric. It works by bundling insurance at the point of sale, making protection an effortless, integrated part of the purchases you already make. It’s about getting the right coverage, at the right moment, for the right price—all without having to think about it.

This in-depth guide will unpack the world of embedded insurance. We’ll explore how this contextual insurance offering at checkout is cutting out the middleman, why your favorite brands are embracing it, and what it means for you as a consumer.

What is Embedded Insurance, Really? A Simple Explanation

At its heart, embedded insurance is the process of integrating insurance coverage directly into the purchase of a product or service. The insurance isn’t an afterthought; it’s part of the core offering.

Think of it like this:

- The Old Way: You buy a new car from a dealership. A week later, you call an insurance broker, compare quotes from five different companies, fill out a mountain of paperwork, and finally get a policy. The car purchase and the insurance purchase are two completely separate, often frustrating, experiences.

- The Embedded Way: You buy a new Tesla. During the digital checkout process within the Tesla app, you are offered a comprehensive auto insurance policy based on the car’s data. With one tap, you’re insured the moment you drive away. The product and the protection are one.

This seamless experience is made possible by technology, specifically through APIs (Application Programming Interfaces) that allow different software systems to talk to each other. A retailer’s website can “talk” to an insurer’s system in real-time to generate a personalized insurance offer right at the point of sale. This is the magic of API-driven embedded insurance platforms.

The goal is to make insurance invisible yet always available, offering you protection when you need it most, without the friction of a traditional sales process.

How Companies are Bundling Insurance at the Point of Sale: A Look Behind the Curtain

The magic of embedding insurance at checkout isn’t actually magic—it’s a sophisticated technological dance happening in milliseconds. Understanding this process reveals why it’s such a powerful model for both businesses and consumers.

The Step-by-Step Process of an Embedded Insurance Offer:

- The Customer Journey Begins: You’re on an e-commerce website buying a new, expensive camera. You add it to your cart and proceed to checkout.

- Context is Key: The website’s platform knows what you’re buying (a camera), its value ($2,000), and potentially some information about you (your location). This is the “context” that makes the insurance offer relevant.

- The API Call: At the checkout page, the retailer’s system sends this data via a secure API to an insurance partner. This is a real-time request for an insurance quote. The insurer could be a large, established company or a modern “Insurtech” startup that specializes in these products.

- Instantaneous Underwriting: The insurer’s platform uses algorithms to instantly assess the risk and calculate a premium. For a camera, this might involve factoring in the model’s fragility, theft rates in your area, and the cost of repairs. This real-time insurance quoting at e-commerce checkout is a core component.

- The Offer is Presented: The insurer sends the personalized quote back to the e-commerce site. You see a simple, easy-to-understand offer on your screen: “Protect your new camera for 2 years against accidental damage and theft for just $99. Add to cart?”

- One-Click Acceptance: You click “Yes.” The cost is added to your total purchase price.

- Seamless Policy Creation: Once you complete the payment, the retailer confirms the purchase with the insurer. Your policy documents are automatically generated and emailed to you. You are now protected.

This entire process happens in less time than it takes to enter your credit card details. There are no forms, no agents, and no hassle. This is the essence of providing a frictionless insurance purchase experience for online shoppers.

Why Embedded Insurance is a Game-Changer: The Benefits for You and Your Favorite Brands

This model isn’t just growing because it’s technologically clever; it’s growing because it creates a powerful win-win situation. Both consumers and the businesses they buy from see significant advantages.

Benefits of Embedded Insurance Solutions for Consumers:

- Unbeatable Convenience: This is the most obvious benefit. You get coverage at the exact moment you need it, eliminating the need to shop for it separately. The convenience of adding insurance during online purchase is a primary driver of adoption.

- Increased Affordability: By cutting out the traditional distribution channels and agent commissions, embedded insurance can often be more affordable. The focus is on smaller, specific “micro-policies” that cover one item, making the cost manageable. This leads to more affordable product protection plans at the point of sale.

- Contextual Relevance: You’re offered insurance that is directly relevant to what you’re doing. You don’t get an offer for pet insurance when you’re buying a plane ticket. This relevance makes the value proposition clear and easy to understand.

- Simplicity and Transparency: Embedded offers are typically presented in simple, plain language. Instead of pages of jargon, you get a clear statement: “If your flight is canceled, you get $500.” This removes the confusion often associated with buying insurance.

How Businesses Benefit from Offering Embedded Insurance:

- Creation of New Revenue Streams: For retailers, airlines, and other businesses, offering insurance becomes a high-margin source of ancillary revenue. This is a key reason for the growth of embedded insurance in the retail sector.

- Enhanced Customer Experience and Loyalty: By offering a valuable service that protects a customer’s purchase, a business can significantly improve the overall customer experience. A smooth claims process, in particular, can turn a negative event (like a broken product) into a positive brand interaction, building immense loyalty. For more on the importance of customer experience, leading business publications like Harvard Business Review often explore this topic in depth.

- Increased Conversion Rates: Knowing that a valuable purchase can be easily protected can actually encourage customers to complete the sale. It reduces purchase anxiety, especially for high-ticket items.

- Access to Valuable Data: The data generated from insurance offers and claims can provide businesses with deeper insights into customer behavior, product reliability, and risk, helping them improve their core products and services.

Cutting Out the Middleman: How Embedded Insurance is Disrupting Traditional Models

For over a century, the insurance industry has relied heavily on intermediaries—agents and brokers—to sell policies. These professionals played a crucial role in advising clients and navigating complex products. However, the embedded model challenges this traditional structure directly.

By integrating insurance at the point of need, the non-insurance brand (the airline, the retailer, the car manufacturer) becomes the new distribution channel. This has several profound implications:

- Reduced Distribution Costs: The largest expense for many insurance companies is customer acquisition and sales commissions. The embedded insurance distribution model dramatically lowers these costs, allowing for more competitive pricing.

- The Changing Role of the Agent: This doesn’t mean insurance agents will disappear overnight. However, their role is evolving. Instead of selling simple, transactional policies, agents will increasingly focus on providing advice for complex, high-value needs, such as financial planning or commercial business insurance.

- Power to the Platform: The companies that own the customer relationship—the big e-commerce platforms, the auto manufacturers, the travel booking sites—are now in the driver’s seat. They can partner with insurers to create customized insurance products that are exclusive to their platform, giving them a competitive edge. This is a key aspect of the platform economy’s impact on the insurance industry.

This disruption is a core reason why companies like Tesla, Amazon, and Uber are making significant moves in the insurance space. They already have millions of customers and a deep understanding of their behavior, making them ideal platforms for offering embedded protection.

Real-World Examples: Where You Can Find Embedded Insurance Today

Embedded insurance isn’t a theoretical concept; it’s already integrated into many of the services you use. Here are some of the most common applications:

Embedded Insurance for E-commerce and Retail:

This is one of the fastest-growing areas. When you buy electronics, furniture, or appliances online, you’re often presented with an offer for an extended warranty or an accidental damage protection plan. Companies like Clyde and Extend are leaders in providing these e-commerce product protection solutions at checkout, partnering with hundreds of online brands.

Embedded Travel Insurance Solutions:

This is perhaps the most familiar example. Airlines, travel agencies, and booking websites have been offering point-of-sale travel insurance for flight cancellations and medical emergencies for years. The process has become incredibly streamlined, allowing you to add comprehensive coverage with a single click when you buy your ticket.

The Revolution in Auto Insurance:

The automotive sector is undergoing a massive transformation. Electric vehicle manufacturers like Tesla and Rivian are now offering their own insurance products, using data directly from the car’s sensors (telematics) to price the policy. This is the ultimate example of embedded auto insurance for new vehicle purchases. You’re not just buying a car; you’re buying a complete mobility solution with insurance built-in.

Embedded Insurance for the Gig Economy:

Platforms like Uber and Airbnb have integrated insurance directly into their services. When you take an Uber ride, you are automatically covered by a commercial auto policy. When you book a stay on Airbnb, the host is protected by their Host Guarantee program. This provides on-demand insurance for gig economy workers and peace of mind for users.

Other Innovative Examples:

- Banking and FinTech: Neobanks are starting to embed things like phone insurance and travel coverage into their premium account offerings.

- Ticketing: When you buy concert or event tickets, you can often add insurance that protects you if you’re unable to attend.

- Shipping and Logistics: Small businesses can instantly add shipping insurance to their packages through platforms like Shippo or Shopify.

Navigating the Challenges: What to Watch Out For

While the embedded model offers incredible benefits, it’s not without its challenges and considerations. Both regulators and consumers need to be aware of potential pitfalls.

- Transparency is Non-Negotiable: It must be absolutely clear to the customer that they are buying an insurance product. The terms, coverage details, and costs should be presented simply and transparently, not hidden in the fine print.

- The Regulatory Landscape: Insurance is a highly regulated industry. Companies that are not traditional insurers (like retailers or tech companies) must navigate a complex web of licensing and compliance rules to offer these products legally. This is a significant hurdle for startups offering embedded insurance APIs.

- Avoiding Coercion: The offer should always be optional. Customers should not feel pressured into buying coverage or be tricked into it through pre-checked boxes or confusing website design.

- The Claims Experience: The seamless buying experience needs to be matched by an equally seamless claims experience. A difficult or slow claims process can damage the reputation of both the insurer and the brand partner. Many Insurtechs are focusing heavily on automating the insurance claims process for embedded products to solve this.

Industry bodies like the National Association of Insurance Commissioners (NAIC) are actively working to understand and adapt regulations for these new distribution models to ensure consumer protection remains paramount.

Frequently Asked Questions (FAQ)

1. Is embedded insurance the same as an extended warranty?

They are very similar, but often different. An extended warranty is typically a service contract offered by the manufacturer or retailer that covers defects. An embedded insurance product is an actual insurance policy underwritten by a licensed insurer that can cover additional perils like accidental damage, theft, or loss.

2. How do I file a claim on an embedded insurance policy?

The claims process is usually initiated through a digital portal. When you purchase the policy, you’ll receive an email with a link to your policy documents and instructions on how to start a claim. The goal is to make it as simple and digital as the purchase process was.

3. Am I forced to buy the insurance offered at checkout?

No, never. Embedded insurance should always be an optional add-on. You always have the right to decline the offer and seek insurance elsewhere or go without it.

4. Is embedded insurance more expensive?

Generally, no. Because it cuts out many of the traditional costs of selling insurance (like agent commissions), it can often be more affordable than buying a standalone policy. However, you should always compare the coverage and price to make sure it’s the right value for you.

5. Who is the actual insurance provider?

The brand you’re buying from (e.g., the airline or retailer) is the distributor, not the insurer. The policy is underwritten by a separate, licensed insurance company that partners with the brand. Your policy documents will clearly state the name of the underwriting insurer.

6. What happens if the company I bought from goes out of business?

Your insurance policy is a contract with the underwriting insurance company, not the retailer. Therefore, your coverage remains valid for the full term of the policy even if the original retailer is no longer operating.

7. Can I cancel an embedded insurance policy?

Yes. Just like any insurance policy, there is typically a “free look” period (e.g., 10-30 days) during which you can cancel for a full refund. Cancellation policies after that period will vary, so you should check the terms and conditions.

8. What kind of data is used to create an embedded insurance offer?

It’s primarily contextual data about the transaction: what you’re buying, its value, the duration of your trip, etc. It does not typically involve a deep dive into your personal data. The process is designed to be fast and privacy-conscious.

9. Why are tech companies like Apple and Amazon getting into insurance?

Tech giants have two massive advantages: a huge customer base and vast amounts of data. They see embedded insurance as a natural extension of their ecosystem, allowing them to offer more value to their customers and create powerful new revenue streams.

10. Is this the end of the insurance agent?

It’s not the end, but it is a major evolution. The role of the agent will shift from selling simple, transactional products (which are perfect for the embedded model) to providing expert advice on more complex financial and life planning needs.

11. What is an “Insurtech” company?

“Insurtech” is a blend of “insurance” and “technology.” It refers to startups and tech companies that are using new technologies (like AI, APIs, and big data) to innovate and disrupt the traditional insurance industry. Many of these companies provide the underlying platforms for embedded insurance.

12. Can I get embedded life or health insurance?

This is still an emerging area. While simple property and travel insurance are common, more complex products like life and health insurance are more difficult to embed due to underwriting complexity. However, some innovative companies are starting to offer simplified versions through fintech apps and other platforms.

13. How does regulation affect embedded insurance?

Regulation is a major factor. Insurance is regulated at the state or national level, and companies offering embedded products must ensure they comply with all licensing and consumer protection laws. This is one of the biggest challenges for the industry’s growth.

14. What is the difference between “embedded” and “integrated” insurance?

The terms are often used interchangeably. “Embedded” typically implies that the insurance is an almost invisible, one-click part of the core product purchase. “Integrated” can be a slightly broader term, which might include an offer that is presented alongside the main purchase but might require a few more steps to complete.

15. Is my data safe when I buy an embedded policy?

Reputable companies use secure APIs and follow strict data privacy regulations to protect your information. The data shared is typically limited to only what is necessary to generate the quote. However, as with any online transaction, it’s always wise to be aware of the privacy policy of the brand and its insurance partner.

Conclusion: The Future of Insurance is Seamless and Everywhere

Embedded insurance is more than just a new distribution channel; it’s a fundamental rethinking of the role insurance plays in our lives. It transforms insurance from a product we have to grudgingly seek out into a simple, valuable service that meets us wherever we are.

By putting customer needs and convenience first, this model is breaking down the barriers that have made the insurance industry seem slow and complicated for decades. The future of insurance isn’t in a filing cabinet or a stack of paperwork. It’s in a single click at checkout, an automatic feature of your new car, and an invisible layer of protection that powers the platforms and services you use every day. The revolution won’t be televised—it will be embedded.