Buy Now, Pay Later: The Ultimate Guide to Instant Loans and Their Hidden Dangers

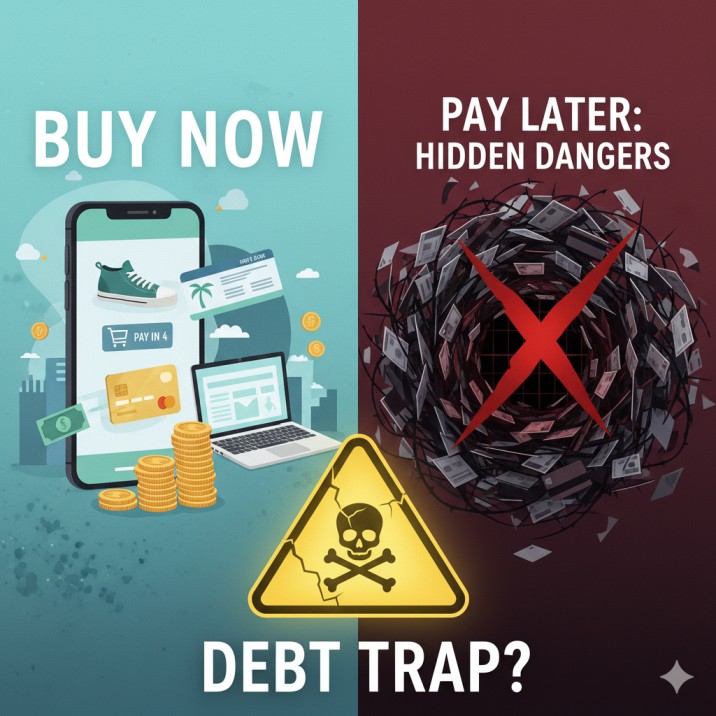

Tempted by “Pay in 4 interest-free installments”? Buy Now, Pay Later (BNPL) services like Klarna and Afterpay have revolutionized shopping, offering instant approval without a hard credit check. They make big purchases feel small.

However, this convenience hides risks. By breaking a $200 item into four “easy” payments, BNPL encourages overspending and “loan stacking,” which can quickly overwhelm your budget. While 0% interest is the hook, missed payments trigger hefty late fees and can seriously damage your credit score. Understand the dangers: BNPL is a debt trap in disguise if used irresponsibly.

Buy Now, Pay Later: The Ultimate Guide to Instant Loans and Their Hidden Dangers Read More »