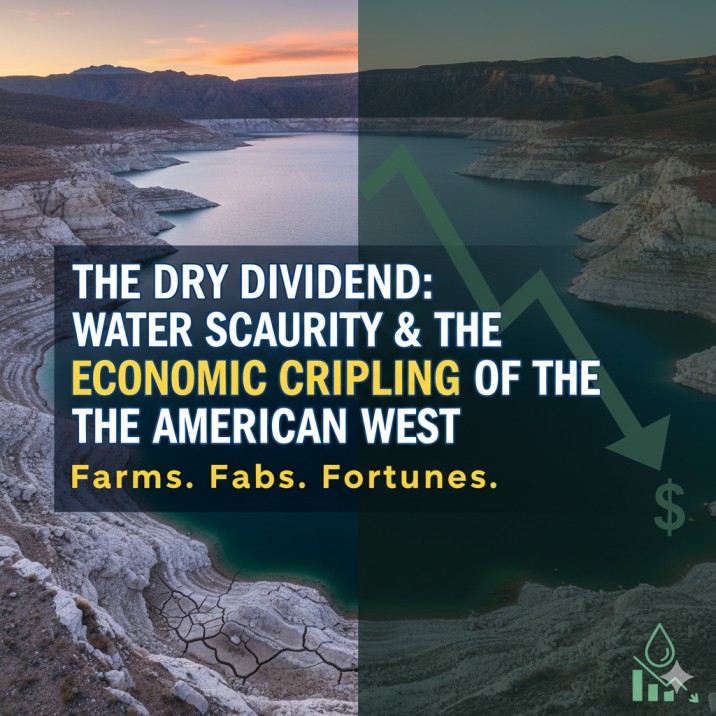

The Dry Dividend: Navigating the Economic Consequences of Water Scarcity in the American West

The iconic “bathtub ring” around Lake Mead isn’t just an environmental disaster; it’s a massive economic risk to the American West’s multi-trillion-dollar economy.

The decades-long promise of cheap, abundant water is broken, forcing a reckoning across key industries. Agriculture faces billions in losses and fallowed fields. Tech giants in Phoenix and Las Vegas confront rising costs and regulatory scrutiny for water-intensive cooling. Real estate growth is stalling due to water moratoriums.

The financial shockwaves are here. Proactive water stewardship is no longer an option—it’s the new economic necessity for survival and success in the arid future.