For generations, buying insurance felt like a trip to the dentist. You knew it was necessary, but you dreaded the process. It involved endless phone calls, confusing jargon, stacks of paperwork, and a nagging feeling that you might not be getting the best deal. The power was firmly in the hands of the insurance carriers and their agents, who dictated the terms and controlled the flow of information.

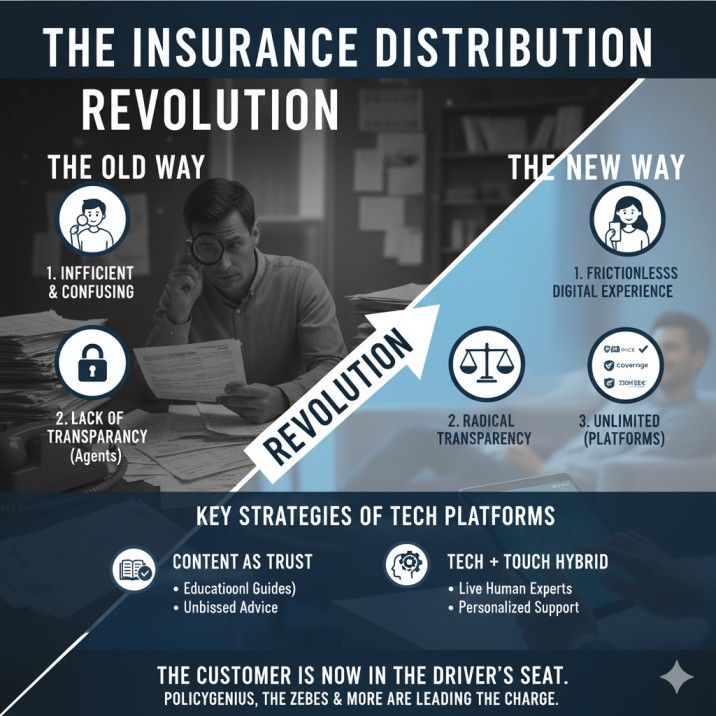

That world is vanishing. A quiet but powerful revolution is underway, a distribution revolution that is fundamentally shifting the balance of power from the insurer to you, the customer. At the forefront of this change are innovative tech platforms—digital marketplaces and comparison engines—that have completely reimagined the insurance buying experience.

Companies like Policygenius and The Zebra aren’t insurance companies. They are tech companies that have dissected every frustrating part of the old model and rebuilt it from the ground up with the customer at the center. They are winning the insurance-customer relationship not by inventing a new type of policy, but by creating a vastly superior way to find, compare, and buy the one that’s right for you.

This deep-dive analysis will explore how these digital disruptors are succeeding. We’ll break down their winning strategies, from radical transparency to a masterful blend of technology and human touch, and examine what this means for the future of the entire insurance industry.

The Old Way: Why Traditional Insurance Distribution Was Ripe for Disruption

To appreciate the revolution, we first need to understand the old system these platforms are replacing. Traditionally, if you needed insurance, you had two main paths:

- The Captive Agent: You’d go to an agent who works for a single company, like State Farm or Allstate. They know their company’s products inside and out, but they can’t offer you options from any other carrier. Your choice is limited to their menu.

- The Independent Agent/Broker: You’d work with an agent who represents multiple insurance companies. This gives you more choice than a captive agent, but you’re still limited to the specific carriers they have partnerships with. Their recommendations can also sometimes be influenced by which company pays a higher commission.

For the modern consumer, who is used to the unlimited choice and instant gratification of Amazon and Netflix, this model presented several glaring problems:

- It was Inefficient: The process was slow, manual, and required you to repeat your information over and over again.

- It Lacked Transparency: It was incredibly difficult to do a true “apples-to-apples” comparison of policies. Pricing was a black box, and understanding the fine print of coverage felt impossible without an expert.

- It Was Opaque: You never knew if you were truly getting the best price or if there was a better policy out there that your agent simply didn’t have access to or wasn’t incentivized to sell.

This friction and lack of customer control created a massive opportunity for a new model—one built on technology, transparency, and choice.

The New Champions: How Online Insurance Marketplaces Are Changing the Game

Enter the digital insurance marketplace. These platforms, often called “aggregators,” are not insurers. They are intermediaries that use technology to connect consumers with a wide array of insurance carriers, all in one place. They function like an Expedia or Kayak for insurance.

You enter your information once, and their powerful technology instantly scours the market, pulling real-time quotes from dozens of insurance companies. Suddenly, a process that used to take days of phone calls can be done in minutes.

Two of the most prominent leaders in this space are Policygenius and The Zebra, each with a slightly different focus but a shared mission to empower the consumer.

- Policygenius: Often called the best online marketplace for life and disability insurance, Policygenius has built a reputation on its blend of a sleek digital interface and access to live, human experts. They excel at helping consumers navigate more complex insurance needs, like finding the right life insurance coverage for families or bundling home and auto policies for maximum savings.

- The Zebra: Known as the “Kayak for Auto Insurance,” The Zebra has focused intensely on creating the most comprehensive car insurance comparison tool on the market. Their platform allows users to compare dozens of quotes in real-time and provides exceptional educational content to help drivers understand the nuances of their policies.

These platforms, and others like Insurify and Jerry, are winning because they have systematically addressed every pain point of the traditional model.

The Winning Playbook: An Analysis of the Tech Platforms’ Key Strategies

How did these companies so effectively capture the customer relationship? It wasn’t one single innovation but a combination of powerful, customer-focused strategies that legacy insurers were too slow to adopt.

1. Radical Transparency: Using Technology to Compare Insurance Policies, Not Just Prices

The single most powerful weapon in the disruptors’ arsenal is transparency. For the first time, consumers can easily see a side-by-side comparison of quotes from a huge range of national and regional carriers.

But it goes deeper than just price. The best online insurance comparison websites provide tools to compare policies based on crucial factors that used to be buried in fine print:

- Coverage Limits: You can easily see if one policy offers $100,000 in liability while another offers $300,000.

- Deductibles: You can toggle different deductible amounts to see how it immediately impacts your premium.

- Customer Service Ratings: Platforms like The Zebra integrate third-party ratings (like J.D. Power scores) for each carrier, so you’re not just comparing price but also the quality of the company you’ll be dealing with.

- Policy Features: Does this homeowner’s policy include water backup coverage? Does that auto policy have new car replacement? This information is surfaced and made easy to understand.

This transparent insurance pricing and coverage analysis demystifies the product. It gives you the confidence that you’re not just getting a cheap policy, but the right policy.

2. A Frictionless Digital Experience: The Importance of User-Centric Design

Legacy insurance websites have historically been clunky, confusing, and designed more for the company’s internal processes than for the user. The new tech platforms have obsessed over creating a seamless and intuitive user experience (UX) for buying insurance online.

What does this look like in practice?

- Simplified Forms: Instead of asking 100 questions in a long, intimidating form, they break the process into small, manageable steps. They use plain language and provide helpful tips along the way.

- Speed and Efficiency: Their technology works in the background to pre-fill information where possible and deliver quotes in minutes, not days. The entire process of getting an online insurance quote without talking to an agent is optimized for speed.

- Omnichannel Accessibility: These platforms work flawlessly whether you’re on a desktop, tablet, or smartphone, meeting you wherever you are.

By removing the friction, they make the process of shopping for insurance feel less like a chore and more like the modern, digital experiences consumers have come to expect.

3. Content as a Cornerstone: Building Trust Through Education

This is perhaps the most underrated, yet most crucial, part of their strategy. These companies have invested heavily in becoming the most trusted educational resources for insurance information online.

Their websites are filled with vast libraries of high-quality, easy-to-understand articles, guides, and glossaries that answer every possible question a consumer might have:

- What are the different types of life insurance?

- How much liability coverage do I actually need?

- What factors affect my car insurance rates?

- A guide to understanding your homeowners insurance declaration page.

This content does two things. First, it empowers consumers to make smarter decisions. Second, and more importantly, it builds immense trust. By providing this value for free, they are not just trying to sell you a policy; they are positioning themselves as an unbiased, expert advisor. This is a core tenet of Google’s E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness) guidelines, which is why their content ranks so well on search engines. When it comes time to buy, you’re far more likely to trust the company that educated you than one that simply gave you a price.

4. The “Tech + Touch” Hybrid Model: Blending Digital Efficiency with Human Expertise

While these platforms champion a digital-first approach, the smartest ones recognize that insurance can still be complicated and personal. A purely digital tool can fall short when a customer has a unique situation or simply wants the reassurance of talking to a real person.

This is where the hybrid “tech + touch” approach to insurance sales becomes a key differentiator. Platforms like Policygenius have an in-house team of licensed, salaried (not commissioned) agents available via phone, email, or chat.

This model offers the best of both worlds:

- For the DIY Customer: They can complete the entire process online without ever speaking to a human.

- For the Customer Who Needs Help: They can get free, unbiased advice from a licensed expert who isn’t trying to push a specific product.

This blend of digital insurance platforms with human agent support is incredibly powerful. It caters to all consumer preferences and provides a safety net of expertise that a purely automated system cannot. It proves that the goal isn’t to eliminate humans, but to empower them with better technology.

The Ripple Effect: How Digital Aggregators Are Forcing the Entire Industry to Evolve

The success of these platforms has sent shockwaves through the traditional insurance world. Legacy carriers and independent agents can no longer rely on the old ways of doing business. They are being forced to adapt or risk becoming obsolete.

- Pressure on Legacy Insurers: Large, established insurance companies are now under immense pressure to improve their own digital capabilities. They are investing billions in upgrading their websites, creating mobile apps, and streamlining their underwriting processes to compete with the speed and ease of the aggregators. Many have also chosen to partner with these platforms, recognizing them as a vital new channel for customer acquisition.

- The Evolving Role of the Insurance Agent: The future of independent insurance agents in the digital age is a hot topic. The role is not disappearing, but it is changing. Agents can no longer compete on price and convenience alone—the aggregators will almost always win there. Instead, agents must evolve into specialized advisors, focusing on complex, high-value needs like commercial insurance, high-net-worth clients, or intricate financial planning. Their value is shifting from being a gatekeeper of information to being a trusted counselor.

This distribution revolution is ultimately creating a more competitive, innovative, and customer-centric insurance market for everyone. For deeper insights into the Insurtech landscape, industry reports from firms like Deloitte offer excellent analysis.

How to Choose the Best Online Insurance Platform for You

With more choices than ever, finding the right platform can seem daunting. Here’s a simple guide to help you select the best online tool for comparing insurance rates.

1. Know What You Need:

- For Auto Insurance: Platforms like The Zebra and Insurify have the most extensive carrier networks and the most sophisticated comparison tools specifically for auto insurance.

- For Life, Disability, or Homeowners Insurance: Policygenius is a top contender due to its educational resources and the availability of expert human advisors to guide you through these more complex decisions.

- For Bundling Home and Auto: Most major platforms can help with this, as it’s one of the most common ways to save money.

2. Decide on Your Desired Experience:

- Do you want a 100% digital, DIY experience? Or do you value the option to speak with a licensed professional if you have questions? Choose a platform that aligns with your comfort level.

3. Check Their Reputation:

- Look at reviews on independent sites like Trustpilot. See what other customers are saying about the ease of the process, the quality of customer service, and the accuracy of the quotes. The most reputable online insurance marketplaces will have a long history of positive customer feedback.

4. Understand Their Business Model:

- Remember that these platforms are brokers. They get paid a commission by the insurance company you choose to buy from. This is a standard industry practice, and the good news for you is that this cost is already built into the insurance premium. Your rate will not be higher for using a comparison site; in fact, you are far more likely to find a lower rate due to the increased competition.

Frequently Asked Questions (FAQ)

1. Are the quotes on insurance comparison websites accurate?

Yes, for the most part. These platforms use APIs to pull real-time quotes directly from the insurance carriers. The initial quotes are very accurate based on the information you provide. The final price might change slightly after the insurer runs your official driving record and credit history (with your permission), but the initial comparison is a highly reliable tool.

2. How do platforms like The Zebra and Policygenius make money?

They are licensed insurance brokers. When you use their platform to purchase a policy from a carrier (like Progressive or Prudential), that carrier pays them a commission. This doesn’t cost you anything extra; it’s a standard customer acquisition cost for the insurer.

3. Is it safe and legitimate to buy insurance through an online marketplace?

Absolutely. Reputable platforms like the ones mentioned are licensed in all the states they operate in and use high levels of encryption to protect your personal data. They are legitimate businesses that are simply providing a modern way to shop for a traditional product.

4. Will my insurance rates be higher if I use a comparison site?

No. This is a common myth. Your rate is determined by the insurance carrier based on your risk profile. The comparison site has no influence on the final price. You will pay the exact same price for the same policy whether you buy it through a marketplace or directly from the carrier. The marketplace just makes it easier to find the carrier with the best price.

5. Can I manage my insurance policy through these platforms?

Generally, no. The marketplace is the “store” where you buy the policy. Once the purchase is complete, your policy is held and serviced by the actual insurance carrier (e.g., State Farm, Geico, etc.). You will work directly with the carrier to make payments, file claims, or make changes to your policy.

6. What is the biggest advantage of using an online insurance marketplace?

Choice and transparency. It’s the ability to see dozens of options in one place and make an informed decision based on both price and coverage, putting the power squarely in your hands.

7. Do I need to talk to an agent when using these sites?

It’s up to you. Most platforms allow you to complete the entire purchase online. However, the best ones also offer the option to speak with a licensed, non-commissioned agent if you need help or advice, offering a “best of both worlds” approach.

8. How are these platforms different from a local independent agent?

The main difference is scale and technology. A local agent has relationships with a handful of carriers. A digital marketplace has relationships with dozens, sometimes over 100, carriers. Their technology allows them to compare all of them instantly, a task that would be impossible for a human agent to do in real-time.

9. Can these platforms help me find insurance for unique situations, like a DUI or bad credit?

Yes. Because they work with so many different carriers, including non-standard ones, they are often an excellent resource for finding high-risk auto insurance online. They can quickly identify which companies are willing to offer a policy for your specific situation.

10. What information do I need to get a quote on an insurance comparison site?

For auto insurance, you’ll need basic personal information, your address, details about your vehicle (make, model, year), and information about the drivers in your household (name, date of birth, driving history). For life insurance, you’ll need personal information and will be asked health and lifestyle questions.

11. How long does it take to get a quote?

For auto insurance, you can often see multiple real-time quotes in as little as 5-10 minutes. For life insurance, the initial quotes are also fast, but the full application and approval process (called underwriting) takes longer.

12. Does checking my rates on a comparison site affect my credit score?

No. When you get insurance quotes, carriers typically use a “soft pull” on your credit history, which does not impact your credit score. A “hard pull” is only done if you officially apply for certain financial products, but this is not the case for initial insurance shopping.

13. Which company is better: Policygenius or The Zebra?

They are both excellent but specialize in different areas. The Zebra is arguably the leader for auto insurance comparison. Policygenius is a top choice for life, disability, and bundling home & auto, largely due to its strong educational content and human agent support for these more complex products.

14. Are there any downsides to using an online insurance marketplace?

The main potential downside is the lack of a long-term, personal relationship with a single agent. While this is becoming less important for many consumers, some people still value having a local agent they can meet with face-to-face. Additionally, once you buy the policy, you will be dealing with the insurance carrier directly for service, not the marketplace.

15. Is this digital trend happening in other types of insurance?

Yes. While most visible in personal lines (auto, home, life), a similar revolution is happening in health insurance, small business insurance, and even pet insurance, with new tech platforms emerging to simplify the buying process across the board. The principles of transparency, choice, and user experience are universal.

Conclusion: The Customer is Now in the Driver’s Seat

The distribution revolution in insurance is more than just a technological shift; it’s a philosophical one. It represents the transfer of power from large, slow-moving institutions to the individual consumer. Platforms like Policygenius and The Zebra have proven that the key to winning the modern customer’s loyalty isn’t a bigger advertising budget or a longer history; it’s a relentless focus on solving customer pain points.

They have demonstrated that by providing transparency, building trust through education, and delivering a world-class digital experience, you can transform a product people hate buying into an empowering experience. This revolution is still in its early stages, but one thing is clear: the future of insurance is digital, transparent, and built entirely around you. The customer is finally in the driver’s seat, and there’s no looking back.